Region:Middle East

Author(s):Rebecca

Product Code:KRAB8379

Pages:94

Published On:October 2025

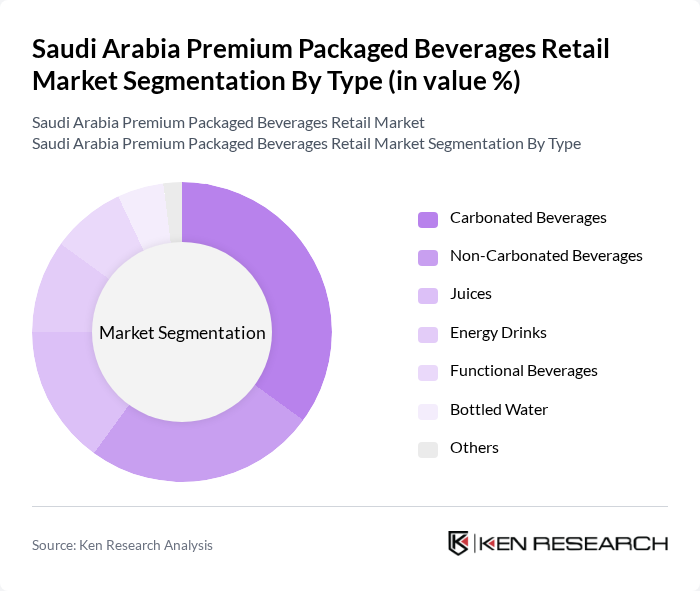

By Type:The market is segmented into various types of beverages, including Carbonated Beverages, Non-Carbonated Beverages, Juices, Energy Drinks, Functional Beverages, Bottled Water, and Others. Among these, Carbonated Beverages have traditionally dominated the market due to their popularity and extensive marketing. However, there is a noticeable shift towards Non-Carbonated Beverages and Functional Beverages as consumers become more health-conscious and seek alternatives that offer added benefits.

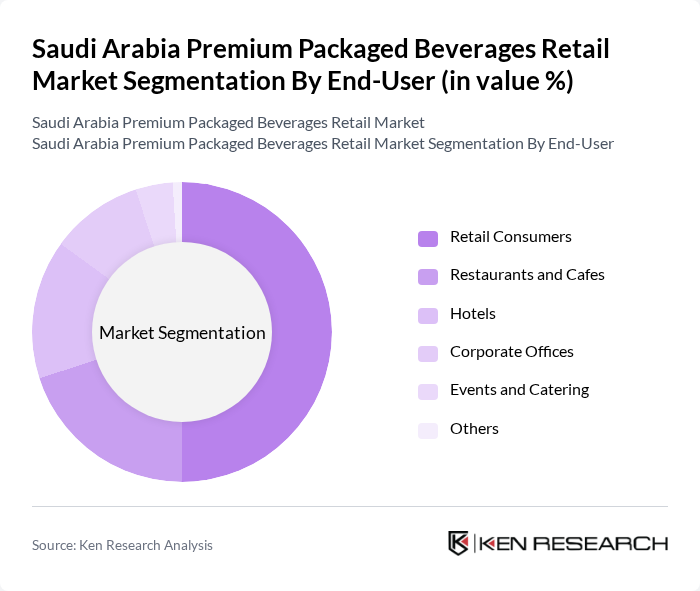

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Cafes, Hotels, Corporate Offices, Events and Catering, and Others. Retail Consumers represent the largest segment, driven by the increasing trend of on-the-go consumption and the growing number of retail outlets. Restaurants and Cafes also play a significant role, as they often serve premium beverages to enhance customer experience and satisfaction.

The Saudi Arabia Premium Packaged Beverages Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, PepsiCo, Inc., The Coca-Cola Company, National Beverage Company, Al Ain Water, Al Safi Danone, Al Waha Beverages, Al Jomaih Bottling Plants, Al Rabie Saudi Foods Co., Al-Hokair Group, Al-Faisaliah Group, Al-Muhaidib Group, Al-Baik Food Systems, Al-Mansour Group, Al-Safi Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia premium packaged beverages market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with functional beverages that cater to specific health needs. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement, fostering loyalty. The market is expected to adapt to these trends, ensuring sustained growth and resilience against challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Beverages Non-Carbonated Beverages Juices Energy Drinks Functional Beverages Bottled Water Others |

| By End-User | Retail Consumers Restaurants and Cafes Hotels Corporate Offices Events and Catering Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores Vending Machines Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Packaging Type | Glass Bottles Plastic Bottles Cans Tetra Packs Others |

| By Flavor Profile | Citrus Berry Tropical Herbal Others |

| By Occasion | Everyday Consumption Special Events Fitness and Sports Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Beverage Outlets | 150 | Store Managers, Beverage Category Managers |

| Consumer Preferences in Packaged Beverages | 200 | General Consumers, Health-Conscious Shoppers |

| Distribution Channels Analysis | 100 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 80 | Product Development Managers, Marketing Executives |

| Impact of Pricing Strategies | 120 | Pricing Analysts, Retail Strategists |

The Saudi Arabia Premium Packaged Beverages Retail Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by increasing consumer demand for high-quality and healthier beverage options.