Region:North America

Author(s):Shubham

Product Code:KRAC8979

Pages:92

Published On:November 2025

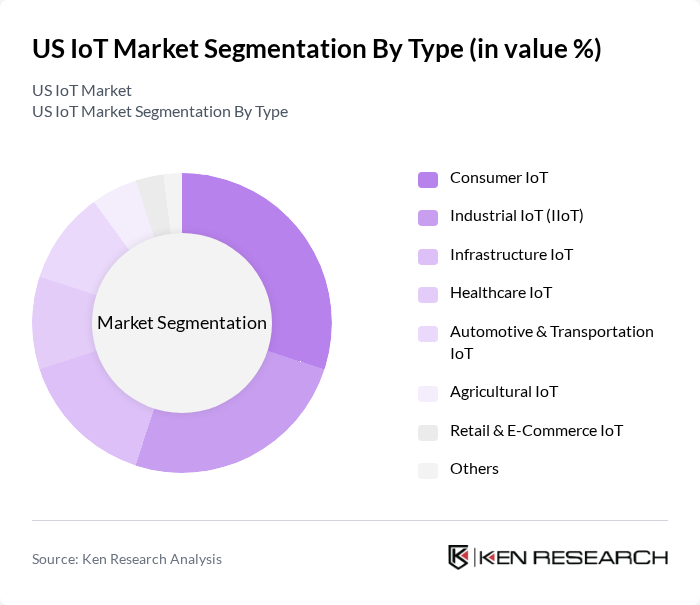

By Type:The IoT market can be segmented into Consumer IoT, Industrial IoT (IIoT), Infrastructure IoT, Healthcare IoT, Automotive & Transportation IoT, Agricultural IoT, Retail & E-Commerce IoT, and Others. Each of these segments is shaped by distinct drivers: Consumer IoT is propelled by smart home adoption and wearable devices; Industrial IoT benefits from automation and predictive maintenance; Infrastructure IoT is driven by smart city and utility applications; Healthcare IoT leverages remote monitoring and telemedicine; Automotive & Transportation IoT is advanced by connected vehicles and fleet management; Agricultural IoT focuses on precision farming; Retail & E-Commerce IoT is enabled by inventory and supply chain automation .

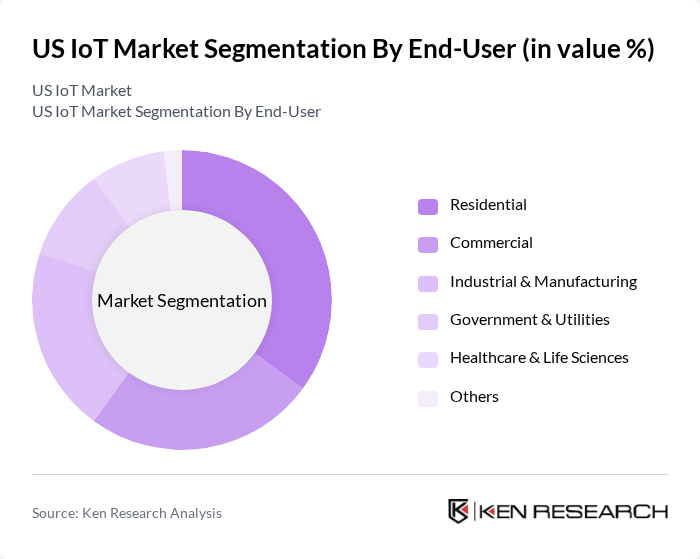

By End-User:The end-user segmentation of the IoT market includes Residential, Commercial, Industrial & Manufacturing, Government & Utilities, Healthcare & Life Sciences, and Others. The Residential segment is driven by smart home devices and personal wearables; Commercial applications include building automation and retail analytics; Industrial & Manufacturing is focused on process automation and asset tracking; Government & Utilities leverage IoT for smart grids and infrastructure monitoring; Healthcare & Life Sciences utilize IoT for patient monitoring and connected medical devices .

The US IoT market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc. (AWS), Google LLC (Google Cloud), Siemens AG, GE Digital (General Electric Company), Intel Corporation, PTC Inc., Oracle Corporation, Honeywell International Inc., Schneider Electric SE, SAP SE, Arm Holdings plc, Verizon Communications Inc., AT&T Inc., Dell Technologies Inc., Texas Instruments Incorporated, Celona, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US IoT market is poised for transformative growth, driven by technological advancements and increasing integration across sectors. As industries embrace digital transformation, the demand for IoT solutions will rise, particularly in healthcare and smart cities. The convergence of AI and IoT will enhance data analytics capabilities, enabling more informed decision-making. Furthermore, as regulatory frameworks evolve, businesses will adapt to new compliance requirements, fostering innovation while addressing security and privacy concerns in the IoT landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Consumer IoT Industrial IoT (IIoT) Infrastructure IoT Healthcare IoT Automotive & Transportation IoT Agricultural IoT Retail & E-Commerce IoT Others |

| By End-User | Residential Commercial Industrial & Manufacturing Government & Utilities Healthcare & Life Sciences Others |

| By Application | Smart Home Applications Smart Grid Applications Wearable Technology Smart Transportation & Mobility Industrial Automation Asset Tracking & Logistics Others |

| By Connectivity Technology | Cellular (3G/4G/5G) Wi-Fi Bluetooth & BLE Zigbee LPWAN (LoRa, NB-IoT, Sigfox) Z-Wave Others |

| By Industry Vertical | Manufacturing Healthcare Retail & E-Commerce Transportation & Logistics Energy & Utilities BFSI (Banking, Financial Services & Insurance) IT & Telecom Government & Defense Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Edge Others |

| By Service Type | Managed Services Professional Services System Design & Integration Services Device & Platform Management Services Application Management Services Network Management Services Testing & Support Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Home Technology Adoption | 120 | Homeowners, Smart Device Users |

| Industrial IoT Implementations | 90 | Operations Managers, IT Managers |

| Healthcare IoT Solutions | 60 | Healthcare Administrators, IT Specialists |

| Smart City Initiatives | 50 | City Planners, Urban Development Officials |

| IoT Security Concerns | 70 | Cybersecurity Experts, IT Security Managers |

The US IoT market is valued at approximately USD 169 billion, driven by the increasing adoption of smart devices, the expansion of 5G networks, and the integration of IoT with artificial intelligence and machine learning across various industries.