Kuwait Syringes Market Overview

- The Kuwait Syringes Market is valued at USD 20 million, based on a five-year historical analysis. This market growth is primarily driven by the increasing demand for healthcare services, particularly in response to the COVID-19 pandemic, which heightened the need for vaccination and medical treatments. The rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, and the expansion of healthcare infrastructure have also contributed significantly to the market's growth. The adoption of disposable syringes has accelerated due to concerns over infection control and patient safety, further supporting market expansion .

- Kuwait City remains the dominant hub in the Kuwait Syringes Market due to its advanced healthcare facilities and high population density. The city benefits from a well-established healthcare system, attracting investments in medical technologies and supplies. The presence of major hospitals and clinics, coupled with ongoing medical campaigns and awareness programs, further solidifies Kuwait City's position as a leader in the market .

- In 2023, the Kuwaiti government implemented the “Ministerial Resolution No. 92 of 2023 on Safety Medical Devices” issued by the Ministry of Health, mandating the use of safety syringes in all healthcare facilities to minimize the risk of needle-stick injuries. This regulation requires healthcare providers to procure and utilize syringes with integrated safety features, ensuring compliance with international standards for patient and healthcare worker safety. The regulation covers all public and private hospitals, clinics, and laboratories, and mandates regular audits for adherence to safety device protocols .

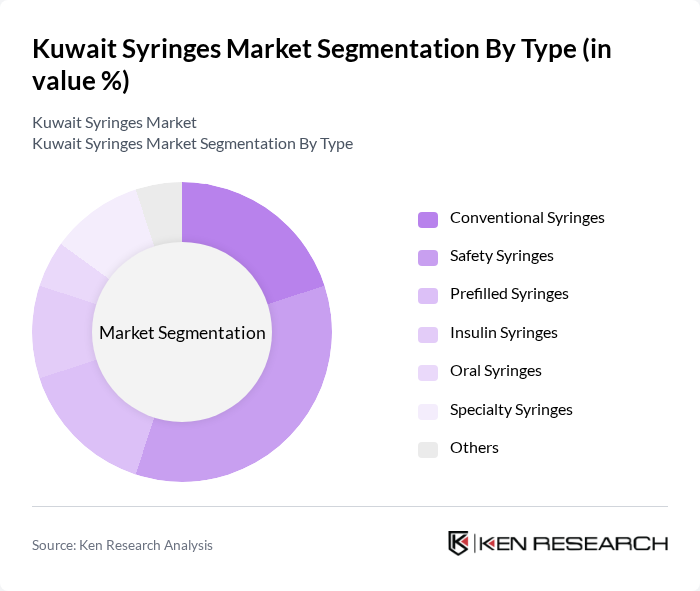

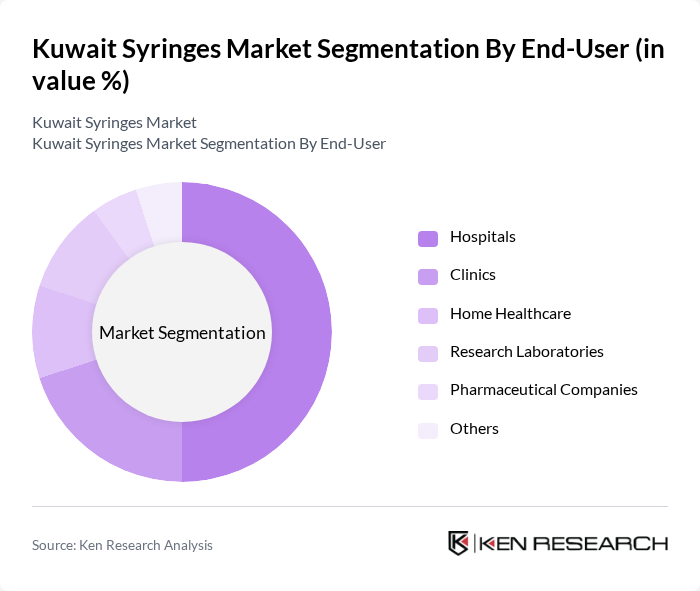

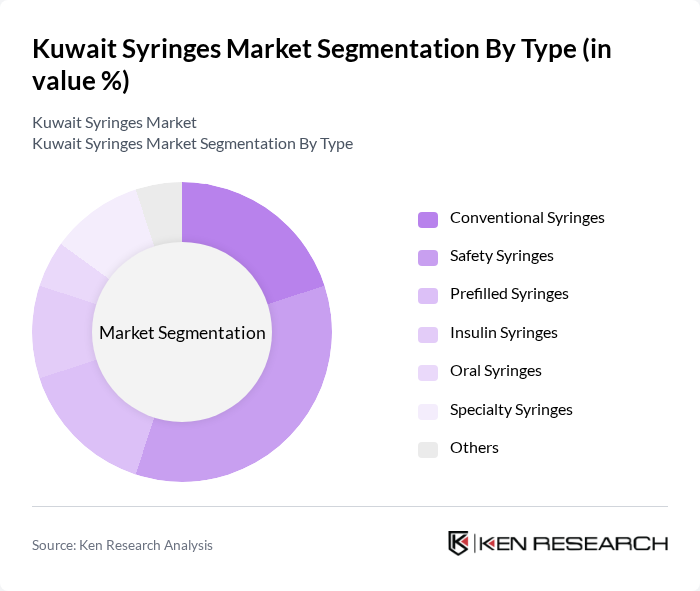

Kuwait Syringes Market Segmentation

By Type:The syringes market in Kuwait is segmented into Conventional Syringes, Safety Syringes, Prefilled Syringes, Insulin Syringes, Oral Syringes, Specialty Syringes, and Others. Safety Syringes are gaining significant traction due to their ability to prevent needle-stick injuries, which remains a critical concern in healthcare settings. The increasing awareness of infection control protocols, regulatory mandates, and the shift toward single-use devices are driving demand for safety syringes, making them the leading sub-segment. Prefilled syringes are also experiencing notable growth, supported by the rising prevalence of chronic diseases and the demand for self-administration solutions .

By End-User:The market is segmented by end-users into Hospitals, Clinics, Home Healthcare, Research Laboratories, Pharmaceutical Companies, and Others. Hospitals are the leading end-user segment, driven by the high volume of procedures requiring syringes, such as vaccinations, chronic disease management, and blood sampling. The increasing number of hospitals and healthcare facilities, along with government-led vaccination and screening campaigns, is further propelling demand for syringes in this segment. Clinics and home healthcare are also seeing rising adoption due to the shift toward outpatient and self-care models .

Kuwait Syringes Market Competitive Landscape

The Kuwait Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company, Terumo Corporation, Smiths Medical, Nipro Corporation, Medtronic plc, Fresenius Kabi AG, B. Braun Melsungen AG, Gerresheimer AG, Baxter International Inc., HMD (Hindustan Syringes & Medical Devices Ltd.), Amsino International, Inc., Retractable Technologies, Inc., Shanghai Kindly Enterprise Development Group Co., Ltd., UltiMed, Inc., Henke-Sass, Wolf GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Syringes Market Industry Analysis

Growth Drivers

- Increasing Healthcare Expenditure:Kuwait's healthcare expenditure is projected to reach approximately KWD 2.2 billion, reflecting a significant increase from KWD 2.0 billion. This rise is driven by government initiatives to enhance healthcare services and infrastructure. The increased funding allows for the procurement of advanced medical supplies, including syringes, thereby boosting market demand. As healthcare spending continues to grow, the syringe market is expected to benefit from improved access to medical services and technologies.

- Rising Prevalence of Chronic Diseases:The prevalence of chronic diseases in Kuwait is on the rise, with diabetes affecting approximately 15% of the adult population. This trend is expected to increase the demand for syringes, particularly for insulin administration. The World Health Organization reports that chronic diseases account for about 73% of all deaths in the region, emphasizing the need for effective management solutions. Consequently, the growing patient population will drive the demand for syringes in healthcare settings.

- Growing Demand for Vaccination:Kuwait's vaccination program has expanded significantly, with over 90% of the population receiving essential vaccines. The government's commitment to immunization, especially in response to global health challenges, has led to increased syringe usage. The Ministry of Health's initiatives to promote vaccination against diseases like influenza and COVID-19 further contribute to this demand. As vaccination efforts intensify, the syringe market is poised for substantial growth in the coming years.

Market Challenges

- Stringent Regulatory Requirements:The Kuwaiti healthcare sector is governed by strict regulatory frameworks, including compliance with ISO standards and local health regulations. Manufacturers must navigate complex approval processes for medical devices, which can delay product launches and increase operational costs. The Ministry of Health's rigorous guidelines ensure safety and efficacy but can pose significant challenges for new entrants and existing players in the syringe market, impacting overall growth.

- High Competition Among Manufacturers:The Kuwait syringes market is characterized by intense competition, with numerous local and international manufacturers vying for market share. This competitive landscape leads to price wars and increased marketing expenditures, which can erode profit margins. As companies strive to differentiate their products, the pressure to innovate and maintain quality standards becomes paramount. This challenge necessitates strategic investments in research and development to stay ahead in the market.

Kuwait Syringes Market Future Outlook

The future of the Kuwait syringes market appears promising, driven by advancements in technology and increasing healthcare demands. The shift towards safety-engineered syringes and the rise in home healthcare services are expected to shape market dynamics. Additionally, the growing focus on preventive healthcare will likely enhance the adoption of innovative syringe solutions. As the healthcare infrastructure expands, the market is set to witness significant transformations, fostering opportunities for manufacturers to innovate and capture emerging trends.

Market Opportunities

- Expansion of Healthcare Infrastructure:The Kuwaiti government is investing heavily in healthcare infrastructure, with plans to allocate KWD 1 billion for new hospitals and clinics. This expansion will create a higher demand for syringes and related medical supplies, presenting a lucrative opportunity for manufacturers to establish partnerships and supply agreements with healthcare facilities.

- Development of Eco-Friendly Syringes:As environmental concerns grow, there is a rising demand for eco-friendly medical products. The market for biodegradable syringes is expected to expand, driven by consumer preferences for sustainable options. Manufacturers who invest in the development of eco-friendly syringes can tap into this emerging market segment, aligning with global sustainability trends and enhancing their brand reputation.