Region:Middle East

Author(s):Shubham

Product Code:KRAC4293

Pages:86

Published On:October 2025

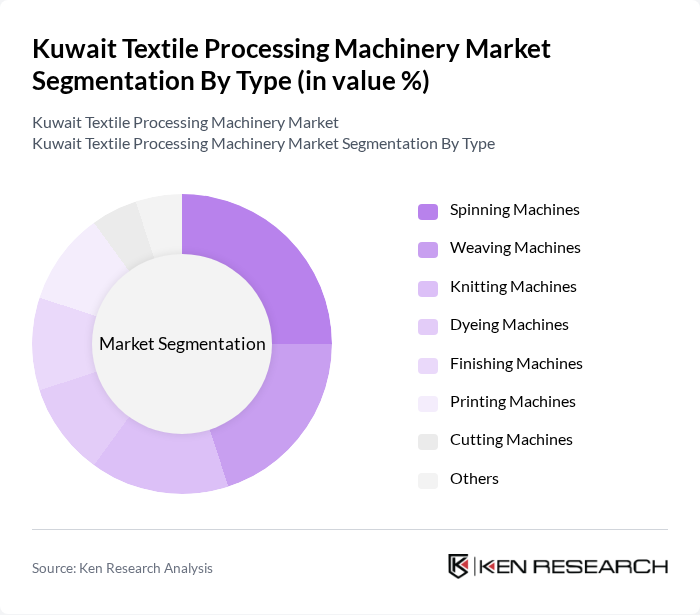

By Type:The market is segmented into various types of machinery used in textile processing. The key subsegments include Spinning Machines, Weaving Machines, Knitting Machines, Dyeing Machines, Finishing Machines, Printing Machines, Cutting Machines, and Others. Each of these types is essential for different stages of textile manufacturing, supporting diverse production needs and enabling manufacturers to meet evolving consumer and industry requirements.

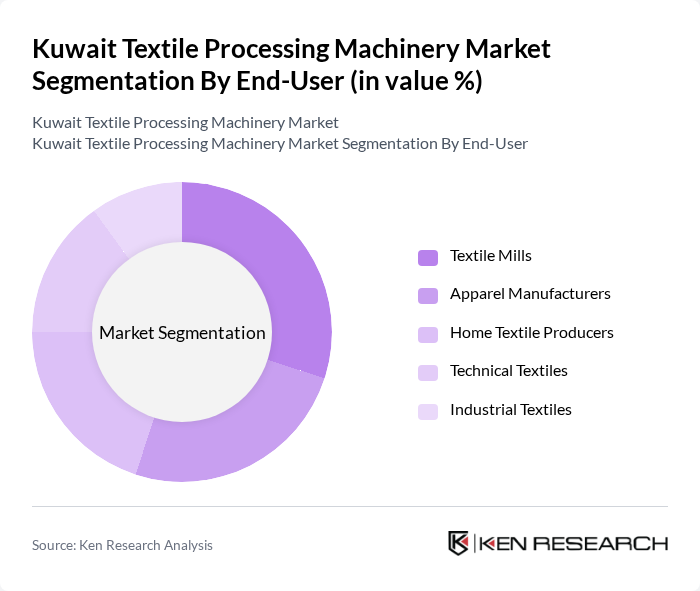

By End-User:The end-user segmentation includes Textile Mills, Apparel Manufacturers, Home Textile Producers, Technical Textiles, and Industrial Textiles. Each segment utilizes specific textile processing machinery tailored to their production requirements, with technical and industrial textiles showing increased adoption of advanced machinery for specialized applications.

The Kuwait Textile Processing Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mufeed Trading Co., Gulf Textile Machinery Co., Al-Ahli Group, Al-Hazm Group, Al-Mansour International Co., Al-Salam Textile Machinery, Al-Fahad Trading Co., Al-Majed Group, Al-Qabas Machinery Co., Al-Shaheen Group, Al-Mansour Al-Kuwait Co., Al-Jazeera Machinery Co., Al-Mutawa Group, Al-Saeed Trading Co., Al-Mahfouz Group, Rieter (Switzerland, via local distributors), Toyota Industries Corporation (Japan, via local distributors), SHIMA SEIKI MFG., LTD. (Japan, via local distributors), Trützschler Group (Germany, via local distributors), and Itema Group (Italy, via local distributors) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait textile processing machinery market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt automation and eco-friendly practices, the market is expected to evolve significantly. Additionally, the government's support for local manufacturing initiatives will likely enhance competitiveness. The integration of Industry 4.0 practices will further streamline operations, positioning Kuwait as a key player in the regional textile industry in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Spinning Machines Weaving Machines Knitting Machines Dyeing Machines Finishing Machines Printing Machines Cutting Machines Others |

| By End-User | Textile Mills Apparel Manufacturers Home Textile Producers Technical Textiles Industrial Textiles |

| By Application | Garment Production Upholstery Industrial Textiles Fashion Accessories |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Local Brands International Brands |

| By Technology | Conventional Machinery Automated Machinery Smart Machinery |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Manufacturing Firms | 100 | Production Managers, Operations Directors |

| Textile Machinery Suppliers | 70 | Sales Managers, Product Development Heads |

| Industry Experts and Consultants | 40 | Market Analysts, Industry Advisors |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Officers |

| Textile Trade Associations | 40 | Association Leaders, Membership Coordinators |

The Kuwait Textile Processing Machinery Market is valued at approximately USD 110 million, reflecting a consistent growth trend driven by increased demand for textile products and advancements in manufacturing technologies.