Region:Middle East

Author(s):Shubham

Product Code:KRAC4279

Pages:86

Published On:October 2025

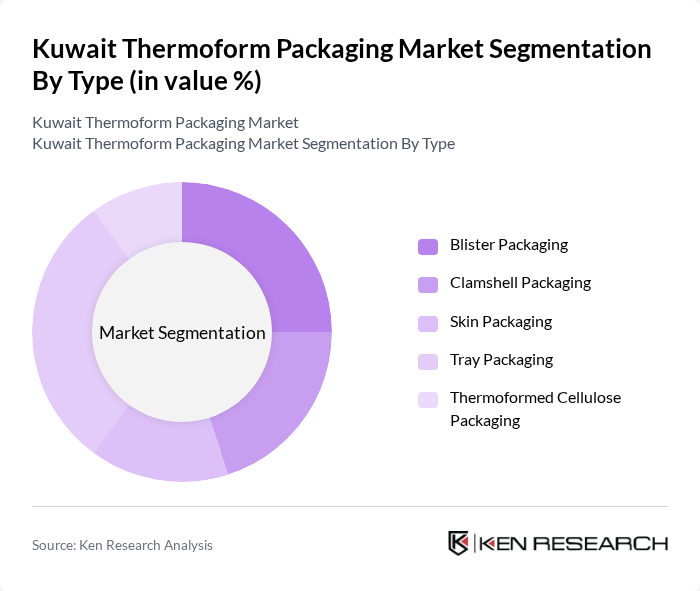

By Type:The thermoform packaging market can be segmented into various types, including blister packaging, clamshell packaging, skin packaging, tray packaging, and thermoformed cellulose packaging. Each type serves distinct purposes across different industries, with specific applications that cater to consumer needs.

The tray packaging segment is currently dominating the market due to its versatility and effectiveness in protecting products during transportation and storage. This type of packaging is widely used in the food industry, where maintaining product integrity is crucial. The growing trend towards convenience and ready-to-eat meals has further propelled the demand for tray packaging, making it a preferred choice among manufacturers.

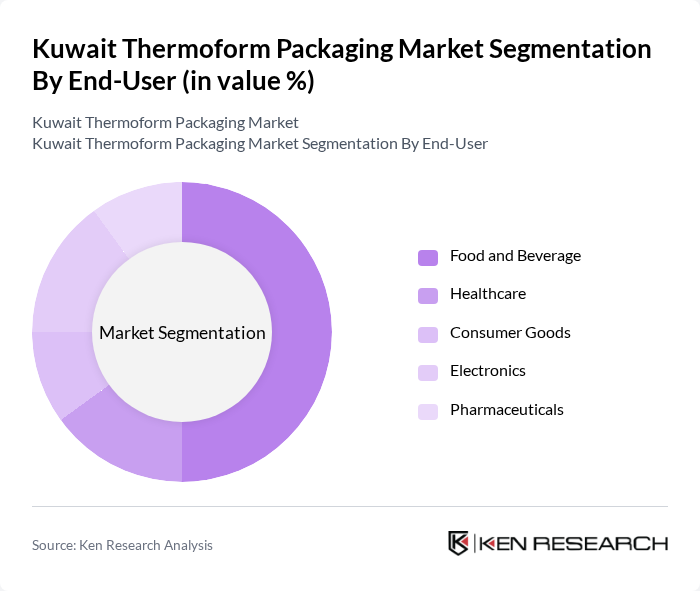

By End-User:The end-user segmentation includes food and beverage, healthcare, consumer goods, electronics, and pharmaceuticals. Each sector has unique requirements for packaging, influencing the choice of thermoform solutions.

The food and beverage sector is the leading end-user of thermoform packaging, accounting for a significant portion of the market. This dominance is attributed to the increasing demand for packaged food products, driven by changing consumer lifestyles and preferences for convenience. The need for effective preservation and presentation of food items has made thermoform packaging an essential component in this industry.

The Kuwait Thermoform Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Plastic Industries Co., Al Kifah Holding Company, Al Khorayef Group, Al Khatib Group, Al Mufeed Group, Al Mulla Group, Al Shaya Group, Al Zamil Group, Gulf Packaging Industries, National Plastic Company, Packaging Industries Company, United Gulf Manufacturing Company, Al-Fahad Group, Al-Hokair Group, Amcor (for international comparison) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermoform packaging market in Kuwait appears promising, driven by increasing consumer awareness of sustainability and the ongoing growth of the food and beverage sector. As companies invest in innovative technologies and sustainable practices, the market is likely to witness a shift towards more eco-friendly packaging solutions. Additionally, the expansion of e-commerce and online food delivery services will further enhance demand for convenient and efficient packaging options, positioning the industry for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Blister Packaging Clamshell Packaging Skin Packaging Tray Packaging Thermoformed Cellulose Packaging |

| By End-User | Food and Beverage Healthcare Consumer Goods Electronics Pharmaceuticals |

| By Material | Polyethylene (PE) Polyvinyl Chloride (PVC) Polypropylene (PP) Polystyrene (PS) Cellulose-based Materials |

| By Application | Food Packaging Medical Packaging Retail Packaging Industrial Packaging Protective Packaging |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Wholesale Markets |

| By Price Range | Economy Mid-Range Premium |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Eastern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 100 | Packaging Managers, Product Development Heads |

| Pharmaceutical Packaging Solutions | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Consumer Goods Packaging | 80 | Brand Managers, Supply Chain Coordinators |

| Industrial Packaging Applications | 50 | Operations Managers, Procurement Specialists |

| Sustainable Packaging Initiatives | 40 | Sustainability Officers, Marketing Directors |

The Kuwait Thermoform Packaging Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is largely driven by the increasing demand for sustainable packaging solutions and heightened consumer awareness regarding environmental issues.