Region:Global

Author(s):Dev

Product Code:KRAA2538

Pages:80

Published On:August 2025

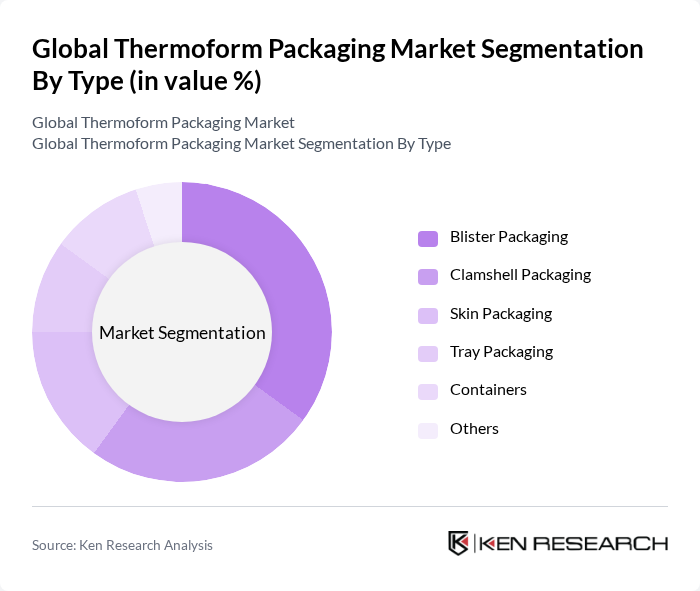

By Type:The thermoform packaging market is segmented into various types, including blister packaging, clamshell packaging, skin packaging, tray packaging, containers, and others. Among these, blister packaging is particularly dominant due to its widespread use in the pharmaceutical, food, and consumer goods sectors, where product visibility, tamper resistance, and protection are crucial. Clamshell and skin packaging are also gaining traction, driven by the demand for attractive, functional, and secure packaging solutions for electronics, personal care, and retail products .

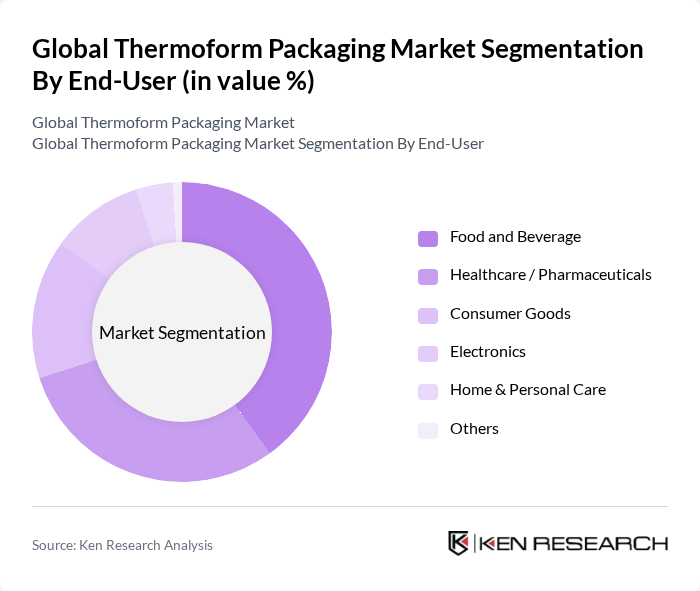

By End-User:The end-user segmentation includes food and beverage, healthcare/pharmaceuticals, consumer goods, electronics, home & personal care, and others. The food and beverage sector is the largest consumer of thermoform packaging, driven by the increasing demand for ready-to-eat meals, convenience foods, and shelf-stable packaging. The healthcare and pharmaceutical sector also significantly contributes to market growth, as packaging plays a vital role in ensuring product safety, compliance with regulatory standards, and tamper evidence. Electronics and personal care are growing segments due to the need for protective and visually appealing packaging .

The Global Thermoform Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Sonoco Products Company, Berry Global, Inc., Constantia Flexibles Group GmbH, Placon Corporation, Winpak Ltd., Coveris Holdings S.A., Pactiv LLC, Klöckner Pentaplast Group, Greiner Packaging International GmbH, Dart Container Corporation, ProAmpac LLC, Tray-Pak Corporation, Display Pack Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermoform packaging market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in biodegradable materials and smart packaging technologies are expected to reshape the industry landscape. Furthermore, as e-commerce continues to expand, the demand for customized and efficient packaging solutions will rise, creating new avenues for growth. Companies that invest in sustainable practices and automation will likely gain a competitive edge in this evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | Blister Packaging Clamshell Packaging Skin Packaging Tray Packaging Containers Others |

| By End-User | Food and Beverage Healthcare / Pharmaceuticals Consumer Goods Electronics Home & Personal Care Others |

| By Material | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) PET (Polyethylene Terephthalate) Paper & Paperboard Aluminum Others |

| By Application | Packaging for Fresh Produce Packaging for Processed Foods Packaging for Medical Devices Packaging for Electronics Packaging for Personal Care Products Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Solutions | 120 | Product Managers, Quality Assurance Specialists |

| Pharmaceutical Packaging Innovations | 90 | Regulatory Affairs Managers, R&D Directors |

| Consumer Goods Packaging Trends | 70 | Marketing Managers, Supply Chain Analysts |

| Environmental Impact Assessments | 60 | Sustainability Managers, Compliance Officers |

| Market Entry Strategies for New Products | 50 | Business Development Managers, Strategic Planners |

The Global Thermoform Packaging Market is valued at approximately USD 51 billion, driven by the demand for sustainable packaging solutions, the growth of e-commerce, and consumer preferences for convenience foods.