Region:Asia

Author(s):Geetanshi

Product Code:KRAB2759

Pages:84

Published On:October 2025

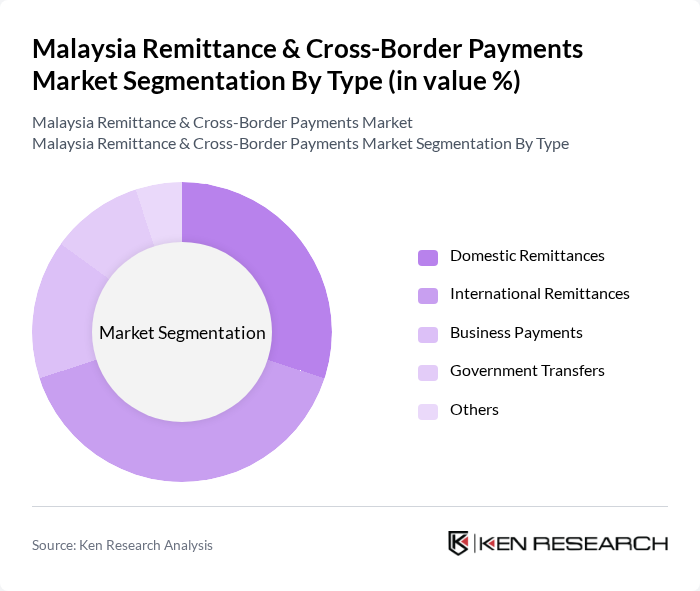

By Type:The market can be segmented into various types, including Domestic Remittances, International Remittances, Business Payments, Government Transfers, and Others. Each of these segments plays a crucial role in the overall market dynamics, with specific trends and consumer behaviors influencing their growth. Domestic and international transfers are particularly prominent, driven by the demand for efficient, real-time, and low-cost money transfer solutions, especially among migrant workers and expatriates. Business payments and government transfers are also significant, reflecting the needs of SMEs, corporations, and public sector disbursements .

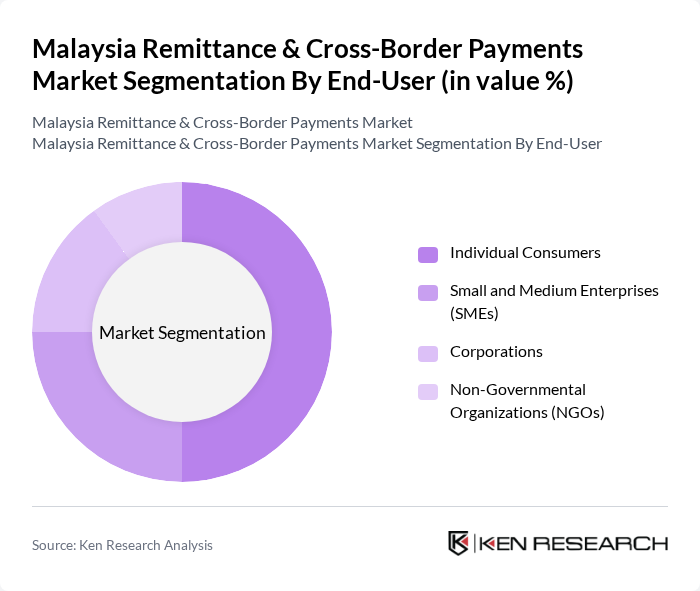

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporations, and Non-Governmental Organizations (NGOs). Each of these user groups has distinct needs and preferences that shape their engagement with remittance and cross-border payment services. Individual consumers, particularly migrant workers and expatriates, are the dominant segment, while SMEs and corporations increasingly leverage digital platforms for business payments and cross-border trade .

The Malaysia Remittance & Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Razer Fintech, Wise (formerly TransferWise), PayPal, GrabPay, CIMB Bank, Maybank, Public Bank Berhad, Hong Leong Bank, Bank Islam Malaysia Berhad, AEON Credit Service, DuitNow, Alipay, WeChat Pay, TrueMoney Malaysia, Valyou, WorldRemit, Remitly, and Instarem contribute to innovation, geographic expansion, and service delivery in this space. These providers are increasingly focusing on digital transformation, mobile-first solutions, and partnerships to enhance customer experience and expand their reach in Malaysia’s evolving payments landscape .

The future of the Malaysia remittance and cross-border payments market appears promising, driven by technological advancements and increasing consumer demand for efficient services. The integration of blockchain technology is expected to enhance transaction security and reduce costs. Additionally, as the government continues to promote financial inclusion, more individuals will gain access to digital payment solutions, further expanding the market. The focus on customer experience will also play a crucial role in shaping service offerings in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Remittances International Remittances Business Payments Government Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Wallets Money Transfer Operators (MTOs) Cash Pickup Services Others |

| By Transaction Size | Small Transactions (Below RM5,000) Medium Transactions (RM5,000–RM50,000) Large Transactions (Above RM50,000) |

| By Frequency of Transactions | One-time Transactions Recurring Transactions (Daily/Weekly/Monthly) |

| By Geographic Origin/Destination | Southeast Asia Middle East Europe North America Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Usage | 120 | Expatriates, Migrant Workers |

| Business Cross-Border Payments | 70 | SME Owners, Finance Managers |

| Digital Payment Adoption | 60 | Tech-savvy Consumers, Young Professionals |

| Regulatory Impact Assessment | 40 | Compliance Officers, Financial Analysts |

| Service Provider Satisfaction | 50 | Frequent Users, Customer Service Representatives |

The Malaysia Remittance & Cross-Border Payments Market is valued at approximately USD 10 billion, driven by the increasing number of migrant workers and the adoption of digital payment solutions, enhancing transaction efficiency and accessibility.