Region:Europe

Author(s):Geetanshi

Product Code:KRAB2770

Pages:88

Published On:October 2025

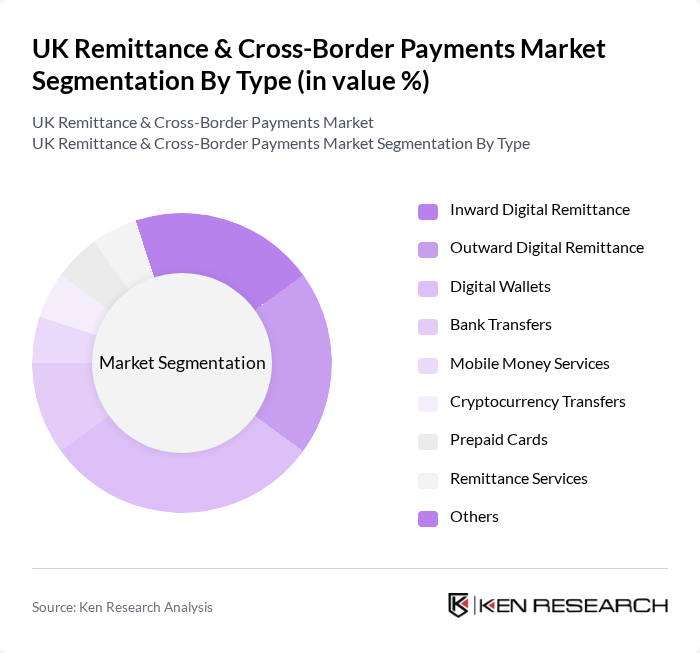

By Type:

The market is segmented into Inward Digital Remittance, Outward Digital Remittance, Digital Wallets, Bank Transfers, Mobile Money Services, Cryptocurrency Transfers, Prepaid Cards, Remittance Services, and Others. Among these, Digital Wallets have emerged as the leading sub-segment, propelled by the rapid adoption of mobile payment solutions and the convenience they offer. Consumers increasingly prefer digital wallets for their speed, ease of use, and integration with other financial services, resulting in a strong migration away from traditional banking channels toward innovative digital solutions .

By End-User:

The end-user segmentation comprises Individual Consumers, Migrant Labor Workforce, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). The Migrant Labor Workforce remains the dominant sub-segment, as a substantial share of remittances is sent by migrant workers to support families abroad. This group depends heavily on remittance services for financial support, making it a pivotal driver of market expansion .

The UK Remittance & Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wise (formerly TransferWise), Western Union, PayPal, MoneyGram, Revolut, WorldRemit, Remitly, Azimo, Skrill, OFX, Xoom, Ria Money Transfer, Payoneer, Cashplus Bank, Curve contribute to innovation, geographic expansion, and service delivery in this space.

The UK remittance and cross-border payments market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance transaction security and customer experience. Additionally, the increasing adoption of blockchain technology could streamline processes, reduce costs, and improve transparency. As e-commerce continues to expand, the demand for efficient cross-border payment solutions will likely rise, creating new avenues for market participants to explore.

| Segment | Sub-Segments |

|---|---|

| By Type | Inward Digital Remittance Outward Digital Remittance Digital Wallets Bank Transfers Mobile Money Services Cryptocurrency Transfers Prepaid Cards Remittance Services Others |

| By End-User | Individual Consumers Migrant Labor Workforce Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Services Prepaid Cards Cryptocurrency Transfers |

| By Transaction Size | Low-Value Transactions Medium-Value Transactions High-Value Transactions |

| By Frequency of Transactions | One-Time Transfers Recurring Transfers |

| By Geographic Focus | Domestic Transfers International Transfers |

| By Customer Segment | Expatriates Students Abroad Migrant Workers Small Businesses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Services | 100 | Individuals using remittance services, Age 18-65 |

| Small Business Cross-Border Payments | 60 | Small business owners, Finance Managers |

| Fintech Innovations in Payments | 50 | Product Managers, Technology Officers |

| Regulatory Compliance Insights | 40 | Compliance Officers, Legal Advisors |

| Market Trends and Consumer Behavior | 60 | Market Analysts, Consumer Insights Managers |

The UK Remittance & Cross-Border Payments Market is valued at approximately USD 24 billion, driven by factors such as increasing migration, the rise of digital payment solutions, and the growth of fintech platforms that facilitate faster and more cost-effective transactions.