Region:Europe

Author(s):Shubham

Product Code:KRAB6561

Pages:89

Published On:October 2025

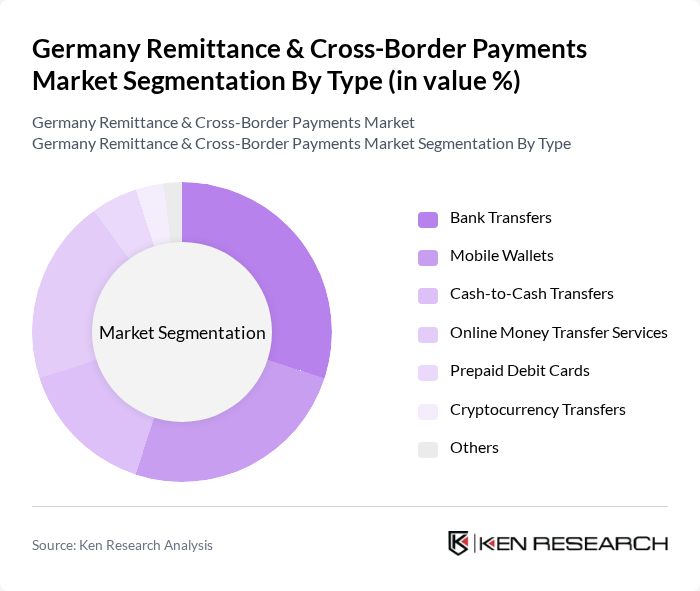

By Type:The market can be segmented into various types, including Bank Transfers, Mobile Wallets, Cash-to-Cash Transfers, Online Money Transfer Services, Prepaid Debit Cards, Cryptocurrency Transfers, and Others. Each of these segments caters to different consumer needs and preferences, with varying levels of adoption and usage across demographics.

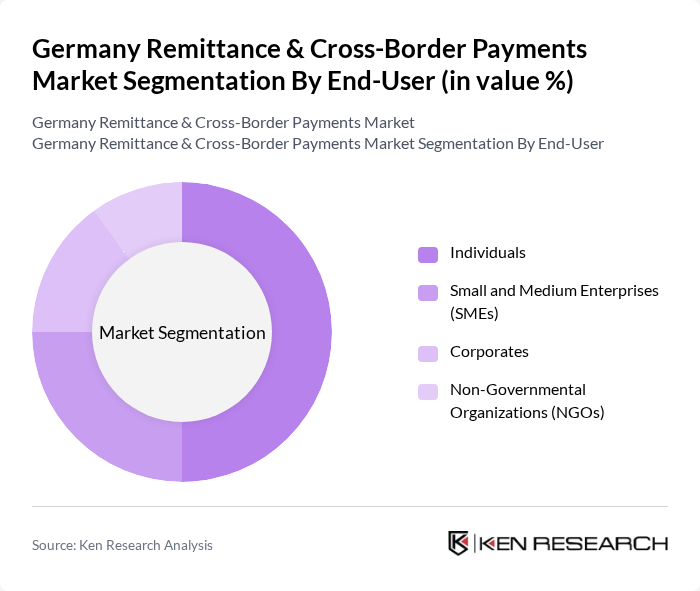

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, and Non-Governmental Organizations (NGOs). Each segment has distinct requirements and transaction patterns, influencing the overall dynamics of the remittance and cross-border payments market.

The Germany Remittance & Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Bank AG, TransferWise Ltd., Western Union Company, PayPal Holdings, Inc., Revolut Ltd., MoneyGram International, Inc., N26 GmbH, Skrill Limited, WorldRemit Ltd., Remitly, Inc., Azimo Ltd., OFX Group Ltd., Xoom Corporation, Wise Payments Ltd., Pangea Money Transfer, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the remittance and cross-border payments market in Germany appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning in payment systems is expected to enhance fraud detection and streamline transaction processes. Additionally, the growing acceptance of cryptocurrencies and blockchain technology may revolutionize cross-border payments, offering faster and more cost-effective solutions for consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Bank Transfers Mobile Wallets Cash-to-Cash Transfers Online Money Transfer Services Prepaid Debit Cards Cryptocurrency Transfers Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Non-Governmental Organizations (NGOs) |

| By Payment Method | Credit/Debit Cards Bank Transfers Cash Payments Digital Wallets |

| By Transaction Size | Low-Value Transactions Medium-Value Transactions High-Value Transactions |

| By Frequency of Transactions | One-Time Transfers Recurring Transfers Seasonal Transfers |

| By Geographic Reach | Domestic Transfers International Transfers |

| By Customer Segment | Expatriates Students Migrant Workers Tourists |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Services | 150 | Individuals using remittance services, Financial Advisors |

| Small Business Cross-Border Payments | 100 | Small Business Owners, Financial Managers |

| Digital Payment Solutions | 80 | Fintech Executives, Product Managers |

| Regulatory Compliance in Payments | 60 | Compliance Officers, Legal Advisors |

| Market Trends in Remittance | 90 | Market Analysts, Economic Researchers |

The Germany Remittance & Cross-Border Payments Market is valued at approximately USD 30 billion, reflecting a significant growth driven by the increasing number of expatriates and the demand for efficient money transfer solutions.