Region:Asia

Author(s):Shubham

Product Code:KRAB6617

Pages:91

Published On:October 2025

By Type:

The segmentation by type includes various subsegments such as Person-to-Person Transfers, Business Payments, Remittance Services, Digital Wallets, Cross-Border E-commerce Payments, Mobile Money Transfers, and Others. Among these, Person-to-Person Transfers is the leading subsegment, driven by the increasing number of individuals sending money to family and friends abroad. The convenience and speed of these transfers, often facilitated by mobile apps, have made them the preferred choice for many consumers. Business Payments also show significant growth, particularly as companies expand their operations internationally and require efficient payment solutions.

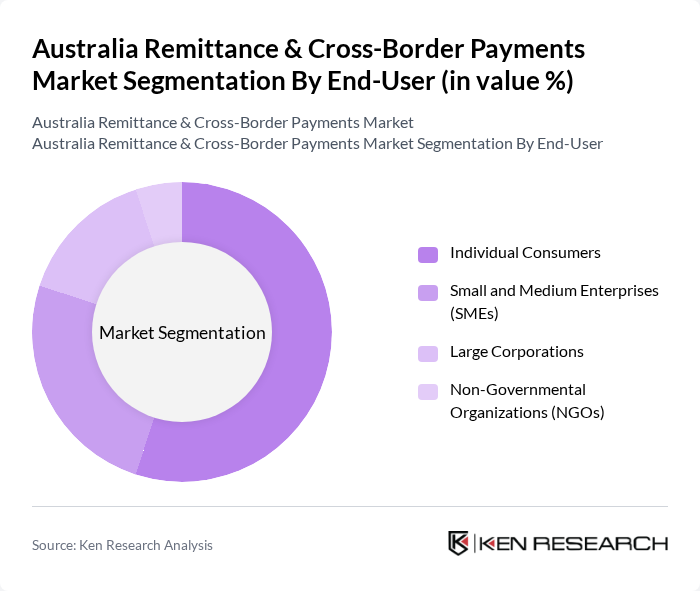

By End-User:

This segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers dominate this market segment, as they frequently engage in remittances to support family members or for personal transactions. The rise of digital platforms has made it easier for individuals to send money internationally, contributing to the growth of this segment. SMEs are also increasingly utilizing cross-border payment solutions to expand their market reach, while NGOs rely on remittances for funding and support.

The Australia Remittance & Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal, OFX, Wise (formerly TransferWise), WorldRemit, Remitly, Revolut, Xoom, Azimo, Skrill, Ria Money Transfer, Payoneer, Alipay, WeChat Pay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia remittance and cross-border payments market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in payment processing is expected to enhance security and efficiency, while the growing acceptance of cryptocurrencies may offer alternative remittance options. Additionally, as e-commerce continues to expand, the demand for seamless cross-border payment solutions will likely increase, creating new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business Payments Remittance Services Digital Wallets Cross-Border E-commerce Payments Mobile Money Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Credit/Debit Cards Cash Pickup Mobile Payments |

| By Currency | AUD USD EUR Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | One-time Transfers Recurring Transfers |

| By Service Provider | Banks Fintech Companies Money Transfer Operators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Users | 150 | Individuals aged 18-65, using remittance services |

| Small Business Owners | 100 | Owners of businesses engaged in international trade |

| Banking Sector Executives | 80 | Senior management from banks offering cross-border payment solutions |

| Fintech Innovators | 70 | Founders and executives from fintech companies in the remittance space |

| Regulatory Authorities | 50 | Officials from Australian financial regulatory bodies |

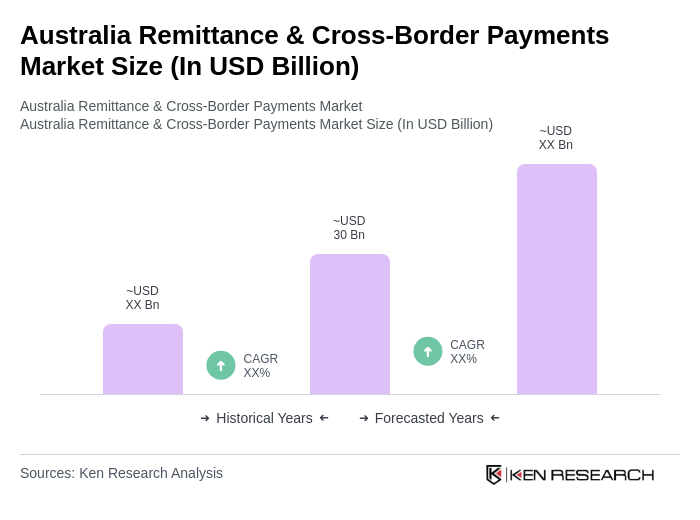

The Australia Remittance & Cross-Border Payments Market is valued at approximately USD 30 billion, reflecting significant growth driven by increasing international migration, digital payment solutions, and the demand for efficient cross-border transactions.