Region:Europe

Author(s):Geetanshi

Product Code:KRAB2745

Pages:85

Published On:October 2025

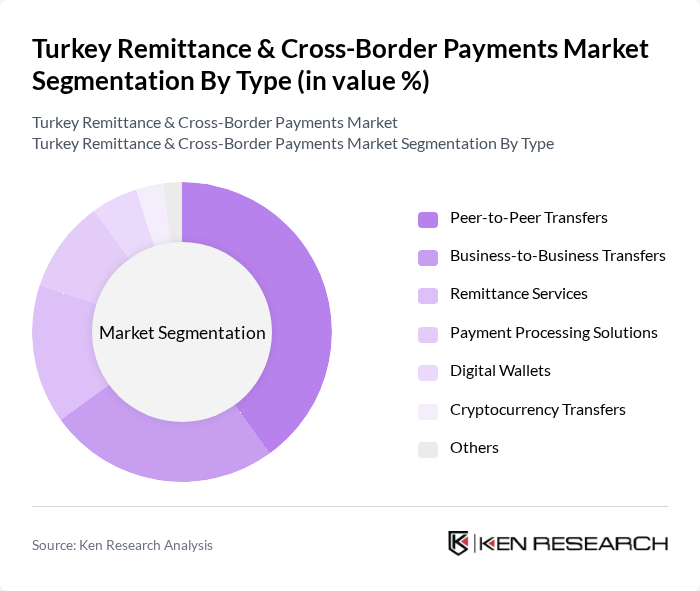

By Type:The segmentation by type includes various methods of transferring money across borders. The subsegments are Peer-to-Peer Transfers, Business-to-Business Transfers, Remittance Services, Payment Processing Solutions, Digital Wallets, Cryptocurrency Transfers, and Others. Each of these subsegments caters to different consumer needs and preferences, with Peer-to-Peer Transfers being particularly popular due to their convenience and low fees, driven by user-friendly interfaces and lower transaction costs that appeal to individual consumers and small businesses alike.

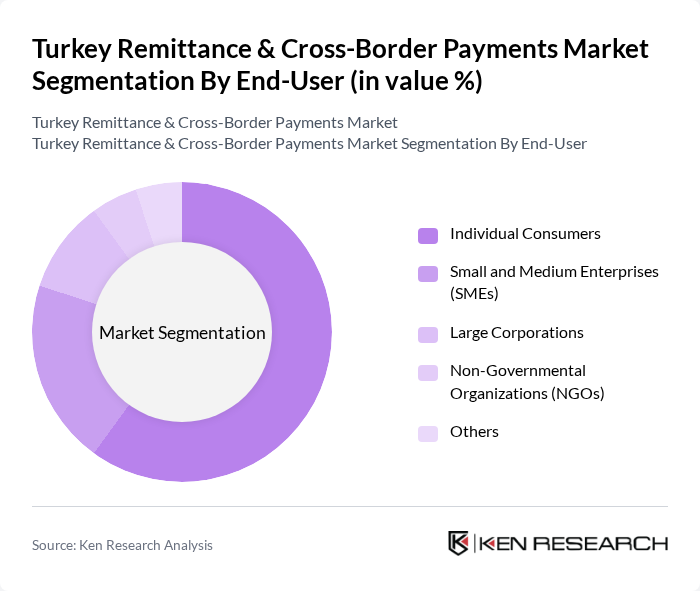

By End-User:The segmentation by end-user includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Non-Governmental Organizations (NGOs), and Others. Individual Consumers dominate the market as they frequently send remittances to family and friends, driven by the increasing number of people utilizing digital remittance services for personal transactions such as sending money to family and friends abroad. The convenience and accessibility of these services have made them the preferred choice for many consumers.

The Turkey Remittance & Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Wise (formerly TransferWise), PayPal, Remitly, WorldRemit, Ziraat Bankas?, ?? Bankas?, Garanti BBVA, Yap? Kredi, PTT, Papara, DenizBank, QNB Finansbank, Turkcell, Payoneer, N26, Revolut, TEB (Türk Ekonomi Bankas?) contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey remittance and cross-border payments market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The increasing adoption of blockchain technology is expected to enhance transaction security and reduce costs, while the shift towards cashless transactions will further streamline payment processes. Additionally, the growing demand for cross-border e-commerce will create new avenues for remittance services, fostering innovation and competition in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-Peer Transfers Business-to-Business Transfers Remittance Services Payment Processing Solutions Digital Wallets Cryptocurrency Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) Others |

| By Payment Method | Bank Transfers Credit/Debit Cards Mobile Payments Cash Payments Online Payment Platforms Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions Others |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions Others |

| By Source of Funds | Salaries Business Profits Gifts and Support Others |

| By Destination | Domestic Transfers International Transfers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Remittance Service Users | 120 | Individuals aged 18-65 who regularly send money abroad |

| Financial Institutions | 80 | Banking executives and product managers in remittance services |

| Fintech Startups | 60 | Founders and CTOs of companies offering cross-border payment solutions |

| Regulatory Bodies | 40 | Officials from the Banking Regulation and Supervision Agency |

| Consumer Advocacy Groups | 40 | Representatives from organizations focused on financial literacy and consumer rights |

The Turkey Remittance & Cross-Border Payments Market is valued at approximately USD 8 billion, driven by the increasing number of Turkish expatriates abroad and the growing adoption of digital payment solutions.