Region:Asia

Author(s):Geetanshi

Product Code:KRAE2213

Pages:80

Published On:February 2026

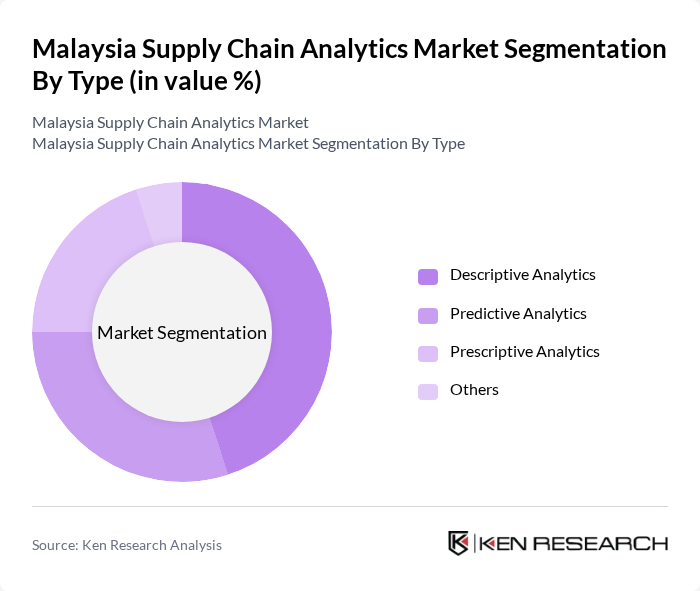

By Type:The market is segmented into various types, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Others. Descriptive Analytics is currently leading the market due to its ability to provide insights into historical data, helping businesses understand past performance and make informed decisions. Predictive Analytics is also gaining traction as companies seek to forecast future trends and optimize their supply chain operations. The demand for Prescriptive Analytics is growing as organizations look for actionable recommendations to enhance efficiency.

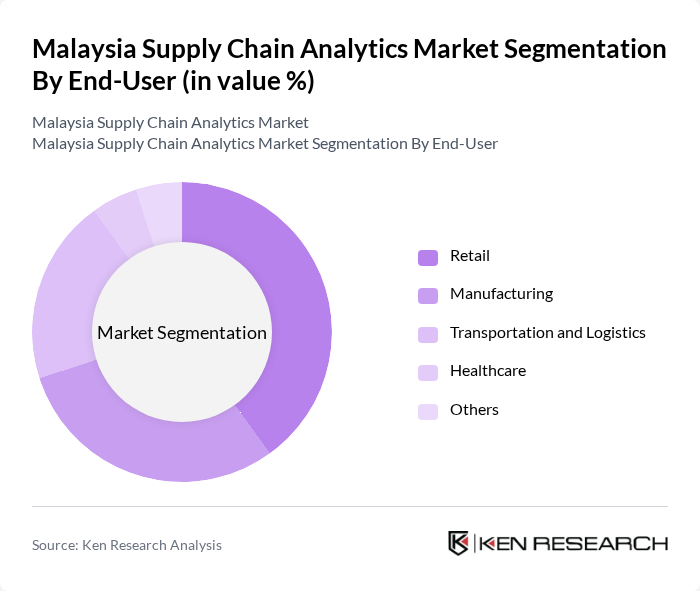

By End-User:The end-user segmentation includes Retail, Manufacturing, Transportation and Logistics, Healthcare, and Others. The Retail sector is the dominant segment, driven by the need for inventory optimization and demand forecasting. Manufacturing follows closely, as companies leverage analytics to streamline production processes and reduce costs. The Transportation and Logistics sector is also significant, focusing on route optimization and supply chain visibility to enhance operational efficiency.

The Malaysia Supply Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Malaysia, IBM Malaysia, Oracle Malaysia, Microsoft Malaysia, SAS Institute Malaysia, QlikTech Malaysia, Tableau Software Malaysia, Infor Malaysia, TIBCO Software Malaysia, MicroStrategy Malaysia, Sisense Malaysia, Domo Malaysia, Zoho Analytics Malaysia, Looker Malaysia, Alteryx Malaysia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian supply chain analytics market appears promising, driven by technological advancements and increasing digital transformation initiatives. As businesses continue to embrace data-driven decision-making, the integration of artificial intelligence and machine learning will enhance predictive capabilities. Furthermore, the government's commitment to fostering a digital economy will likely lead to increased investments in analytics infrastructure, enabling companies to optimize their supply chains and improve operational efficiency significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Others |

| By End-User | Retail Manufacturing Transportation and Logistics Healthcare Others |

| By Industry Vertical | Automotive Consumer Goods Pharmaceuticals Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Analytics Type | Real-Time Analytics Batch Analytics |

| By Geographic Region | Central Region Northern Region Southern Region Eastern Region |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Analytics | 100 | Supply Chain Managers, Operations Directors |

| Retail Analytics Solutions | 80 | Retail Managers, Data Analysts |

| E-commerce Logistics Optimization | 90 | eCommerce Operations Managers, IT Specialists |

| Transportation Management Systems | 70 | Logistics Coordinators, Fleet Managers |

| Warehouse Management Analytics | 60 | Warehouse Managers, Inventory Control Specialists |

The Malaysia Supply Chain Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advanced analytics technologies and the increasing demand for data-driven decision-making across various industries.