Region:Asia

Author(s):Geetanshi

Product Code:KRAE2214

Pages:90

Published On:February 2026

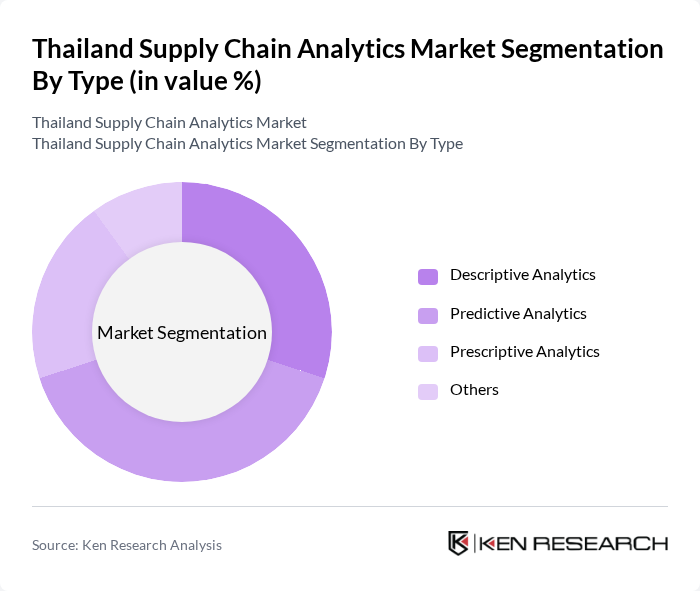

By Type:The market is segmented into Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Others. Descriptive Analytics is primarily used for reporting and understanding historical data, while Predictive Analytics focuses on forecasting future trends based on historical data. Prescriptive Analytics provides recommendations for optimal decision-making, and the Others category includes various niche analytics solutions.

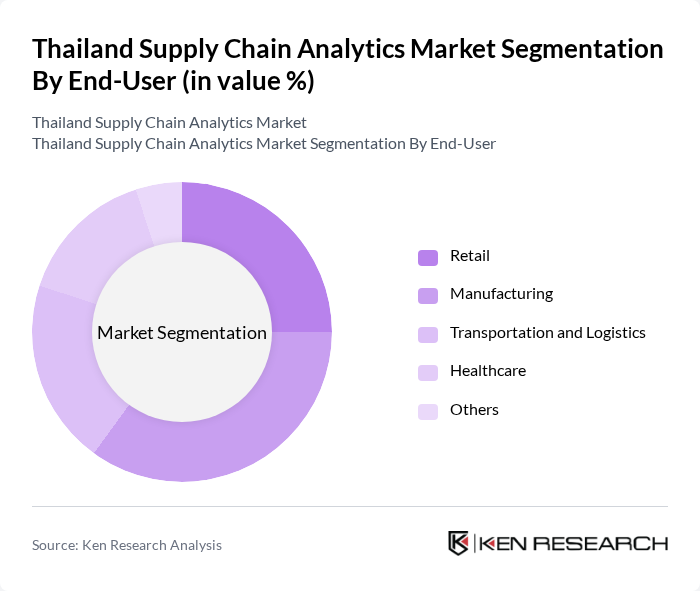

By End-User:The end-user segmentation includes Retail, Manufacturing, Transportation and Logistics, Healthcare, and Others. Retail utilizes analytics for inventory management and customer insights, while Manufacturing focuses on optimizing production processes. Transportation and Logistics leverage analytics for route optimization, and Healthcare uses it for patient management and operational efficiency. The Others category encompasses various sectors that benefit from supply chain analytics.

The Thailand Supply Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SCG Logistics, Kuehne + Nagel, DHL Supply Chain Thailand, JWD Group, Thai Airways International, Yusen Logistics, DB Schenker, Agility Logistics, CEVA Logistics, T Logistics, Kintetsu World Express, Nippon Express, Panalpina, XPO Logistics, Geodis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand supply chain analytics market appears promising, driven by technological advancements and increasing digitalization. As companies prioritize efficiency and responsiveness, the integration of IoT and AI technologies will become more prevalent. Additionally, the focus on sustainability will shape supply chain strategies, with businesses seeking to minimize their environmental impact. This evolving landscape will likely foster innovation and collaboration among stakeholders, paving the way for enhanced operational capabilities and competitive advantages.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Others |

| By End-User | Retail Manufacturing Transportation and Logistics Healthcare Others |

| By Industry Vertical | Automotive Consumer Goods Pharmaceuticals Electronics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Analytics Type | Supply Chain Optimization Demand Forecasting Inventory Management Others |

| By Geographic Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Analytics Adoption | 100 | Supply Chain Managers, IT Directors |

| Retail Supply Chain Optimization | 80 | Logistics Coordinators, Operations Managers |

| Food and Beverage Supply Chain Analytics | 70 | Procurement Managers, Quality Assurance Heads |

| Pharmaceutical Supply Chain Management | 60 | Regulatory Affairs Managers, Supply Chain Analysts |

| E-commerce Supply Chain Strategies | 90 | eCommerce Directors, Fulfillment Managers |

The Thailand Supply Chain Analytics Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the adoption of advanced analytics technologies and the demand for data-driven decision-making across various industries.