Region:Global

Author(s):Geetanshi

Product Code:KRAA3371

Pages:89

Published On:January 2026

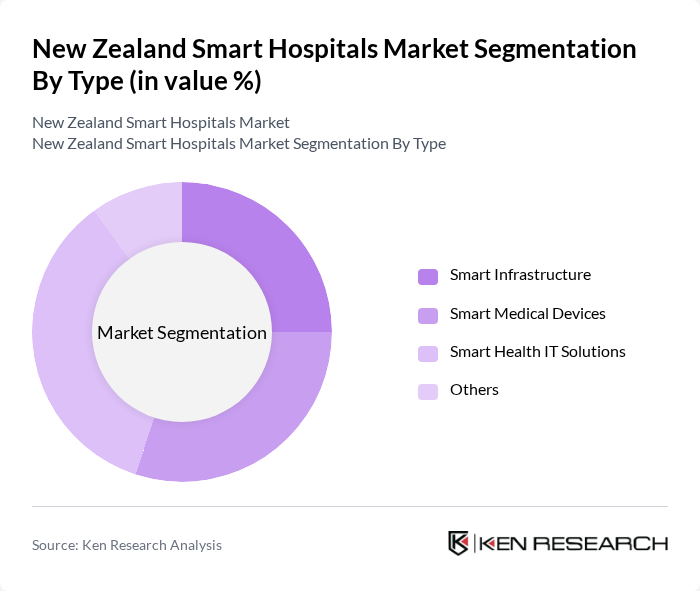

By Type:The market is segmented into Smart Infrastructure, Smart Medical Devices, Smart Health IT Solutions, and Others. Among these, Smart Health IT Solutions is the leading sub-segment, driven by the increasing demand for integrated healthcare systems and data management solutions. The rise of telemedicine and remote patient monitoring has further accelerated the adoption of these technologies, making them essential for modern healthcare delivery. Software and systems segments dominate the global smart hospitals market, accounting for approximately 42-45% of market share, reflecting the critical importance of digital infrastructure in hospital operations.

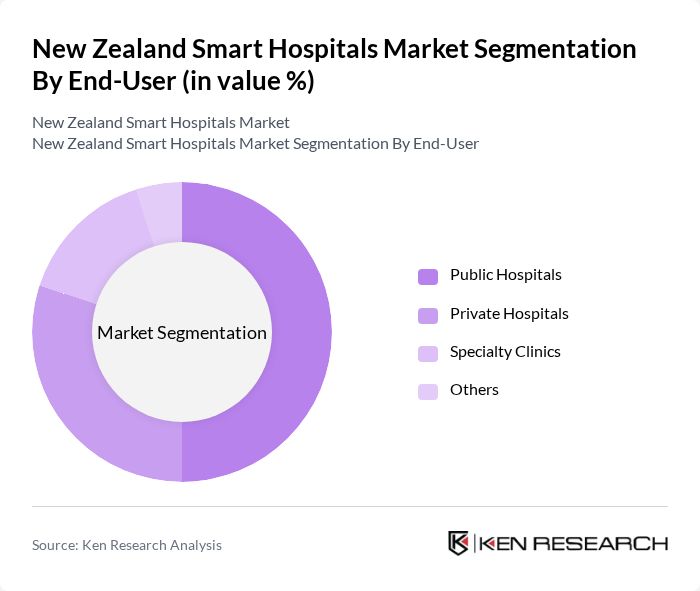

By End-User:The market is categorized into Public Hospitals, Private Hospitals, Specialty Clinics, and Others. Public Hospitals dominate the market due to their larger patient base and government funding, which facilitates the adoption of smart technologies. The increasing focus on improving healthcare services and patient outcomes in public healthcare systems drives the demand for smart hospital solutions.

The New Zealand Smart Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fisher & Paykel Healthcare, Orion Health, HealthLink, Datacom, ProCare Health, Southern Cross Healthcare, Medtech Global, Ryman Healthcare, Auckland District Health Board, Waikato District Health Board, Canterbury District Health Board, Capital & Coast District Health Board, Bay of Plenty District Health Board, Hutt Valley District Health Board, Northland District Health Board contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand smart hospitals market is poised for significant transformation, driven by technological advancements and evolving patient expectations. As healthcare providers increasingly adopt IoT and AI technologies, operational efficiencies are expected to improve, leading to enhanced patient outcomes. Furthermore, the shift towards value-based care will encourage hospitals to invest in smart solutions that prioritize patient-centric models, ultimately reshaping the healthcare landscape in New Zealand in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Infrastructure Smart Medical Devices Smart Health IT Solutions Others |

| By End-User | Public Hospitals Private Hospitals Specialty Clinics Others |

| By Service Type | Telemedicine Services Remote Patient Monitoring Health Information Management Others |

| By Technology | Cloud Computing Artificial Intelligence Big Data Analytics Others |

| By Application | Patient Management Operational Management Financial Management Others |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Administrators | 120 | Chief Executive Officers, Operations Managers |

| Private Healthcare Providers | 100 | IT Directors, Clinical Technology Managers |

| Healthcare Technology Vendors | 80 | Sales Executives, Product Development Managers |

| Healthcare Policy Makers | 50 | Government Officials, Health Policy Analysts |

| Healthcare Professionals (Doctors/Nurses) | 90 | Clinical Staff, Nurse Managers |

The New Zealand Smart Hospitals Market is valued at approximately USD 309 million. This growth is driven by the increasing adoption of advanced healthcare technologies and the need for efficient hospital management systems.