Region:Middle East

Author(s):Rebecca

Product Code:KRAD1574

Pages:87

Published On:November 2025

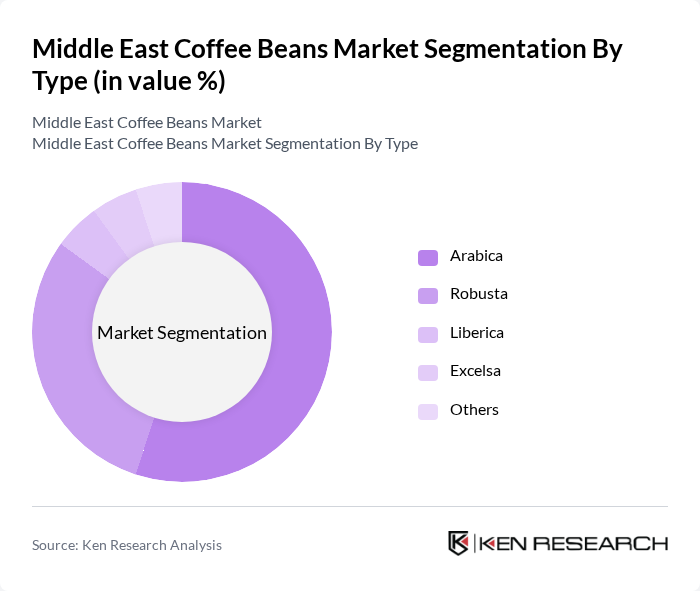

By Type:The coffee beans market can be segmented into various types, including Arabica, Robusta, Liberica, Excelsa, and others. Among these, Arabica coffee is the most popular due to its smooth flavor and aromatic qualities, making it a preferred choice for consumers. Robusta, known for its strong and bitter taste, is also gaining traction, especially in the instant coffee segment. The demand for specialty coffee types like Liberica and Excelsa is growing, driven by consumer interest in unique flavors and origins. The market is witnessing increased demand for single-origin and traceable coffee beans, particularly among younger and urban consumers .

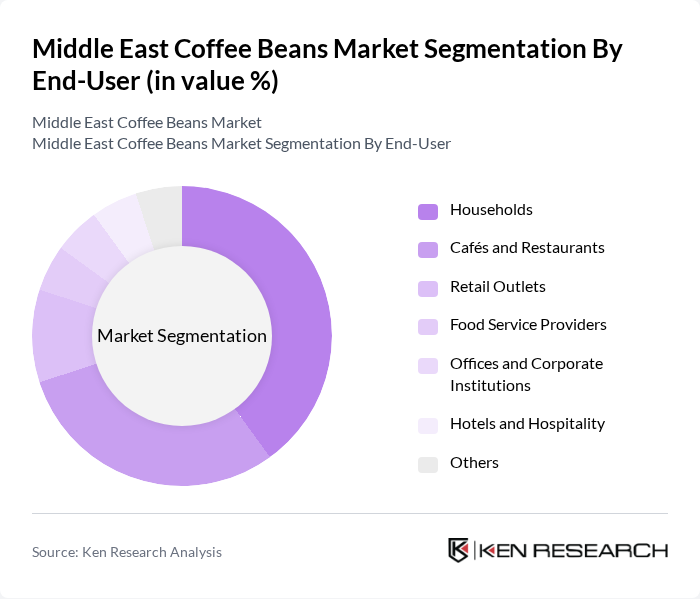

By End-User:The end-user segmentation includes households, cafés and restaurants, retail outlets, food service providers, offices and corporate institutions, hotels and hospitality, and others. Households represent a significant portion of the market, driven by the increasing trend of home brewing and coffee consumption. Cafés and restaurants are also key players, as they continue to innovate their coffee offerings to attract customers. The food service sector is expanding, with more establishments focusing on high-quality coffee experiences. The proliferation of specialty coffee shops and premium café chains is further shaping end-user demand .

The Middle East Coffee Beans Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mokha Coffee, Coffee Planet, Arabica Coffee Company, Nespresso Middle East, Lavazza, Illycaffè, Starbucks Coffee Company, Costa Coffee, Tim Hortons Middle East, Dunkin', Caffè Nero, Peet's Coffee, Raw Coffee Company, Seven Fortunes Coffee Roasters, The Coffee Bean & Tea Leaf contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East coffee beans market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and ethical sourcing will shape purchasing decisions, with consumers favoring brands that prioritize environmental responsibility. Additionally, innovations in coffee brewing technology are expected to enhance the home brewing experience, further stimulating demand. As the market adapts to these trends, businesses that embrace quality and sustainability will likely thrive in this competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Arabica Robusta Liberica Excelsa Others |

| By End-User | Households Cafés and Restaurants Retail Outlets Food Service Providers Offices and Corporate Institutions Hotels and Hospitality Others |

| By Origin | Local Roasters (Middle Eastern Origin) Imported Beans (Africa, Latin America, Asia-Pacific) Specialty Coffee Regions (e.g., Yemen, Ethiopia, Colombia) Others |

| By Packaging Type | Whole Beans Ground Coffee Instant Coffee Pods and Capsules Ready-to-Drink (RTD) Coffee Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Coffee Shops Convenience Stores HoReCa (Hotels, Restaurants, Cafés) Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Nationality/Ethnicity Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Coffee Outlets | 100 | Store Managers, Franchise Owners |

| Wholesale Coffee Distributors | 70 | Sales Managers, Distribution Coordinators |

| Specialty Coffee Roasters | 60 | Head Roasters, Quality Control Managers |

| Consumer Coffee Preferences | 120 | Regular Coffee Drinkers, Specialty Coffee Enthusiasts |

| Coffee Import/Export Firms | 40 | Import Managers, Trade Compliance Officers |

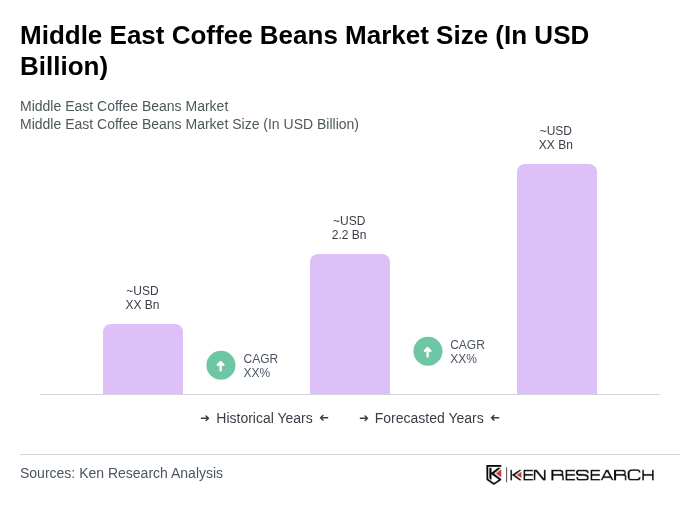

The Middle East Coffee Beans Market is valued at approximately USD 2.2 billion, reflecting a significant growth trend driven by increasing coffee consumption, especially among the youth, and the rise of specialty coffee shops in urban areas.