Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7925

Pages:80

Published On:October 2025

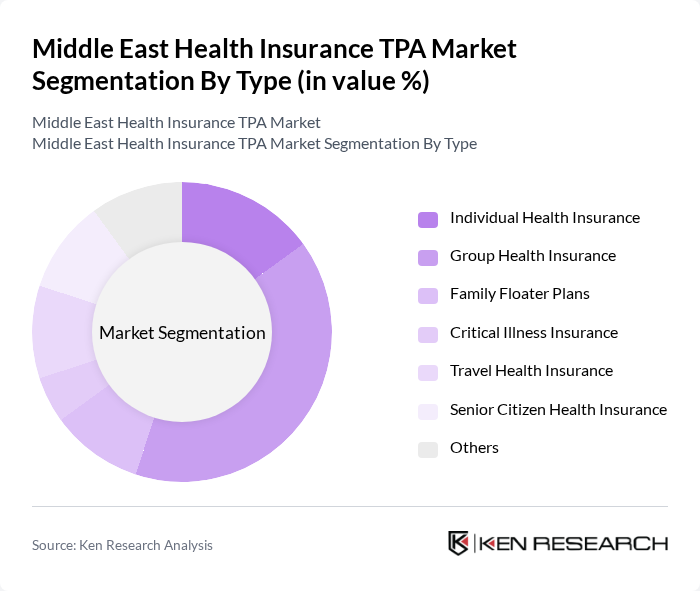

By Type:The segmentation by type includes various health insurance plans tailored to meet diverse consumer needs. The subsegments are Individual Health Insurance, Group Health Insurance, Family Floater Plans, Critical Illness Insurance, Travel Health Insurance, Senior Citizen Health Insurance, and Others. Among these, Group Health Insurance is currently the leading subsegment due to its popularity among corporates seeking to provide comprehensive health benefits to employees. The increasing trend of employer-sponsored health plans has significantly contributed to its dominance.

By End-User:The end-user segmentation includes Individuals, Corporates, Government Entities, and Non-Governmental Organizations. Corporates are the leading end-user segment, driven by the increasing trend of employee benefits and wellness programs. Companies are increasingly recognizing the importance of health insurance in attracting and retaining talent, which has led to a surge in corporate health insurance plans.

The Middle East Health Insurance TPA Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Partners, AXA Gulf, Daman, Bupa Arabia, Medgulf, Oman Insurance Company, Qatar Insurance Company, Abu Dhabi National Insurance Company, Saudi Arabian Insurance Company, Emirates Insurance Company, National Health Insurance Company (Daman), Al Ain Ahlia Insurance Company, Gulf Insurance Group, Al Sagr Cooperative Insurance Company, United Cooperative Assurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East health insurance TPA market appears promising, driven by ongoing healthcare reforms and technological advancements. As governments continue to mandate health insurance, the number of insured individuals is expected to rise significantly. Furthermore, the integration of digital health solutions and AI technologies in claims processing will enhance operational efficiencies. These trends indicate a shift towards more personalized and customer-centric health insurance services, positioning TPAs to capitalize on emerging opportunities in the evolving healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Group Health Insurance Family Floater Plans Critical Illness Insurance Travel Health Insurance Senior Citizen Health Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Plans |

| By Premium Range | Low Premium Plans Medium Premium Plans High Premium Plans |

| By Claim Settlement Ratio | High Settlement Ratio Medium Settlement Ratio Low Settlement Ratio |

| By Policy Tenure | Short-Term Policies Long-Term Policies Lifetime Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance TPAs | 100 | TPA Executives, Business Development Managers |

| Healthcare Providers | 80 | Hospital Administrators, Clinic Managers |

| Insurance Brokers | 70 | Insurance Agents, Sales Directors |

| Policyholders | 90 | Individual Policyholders, Corporate Clients |

| Regulatory Bodies | 50 | Policy Analysts, Compliance Officers |

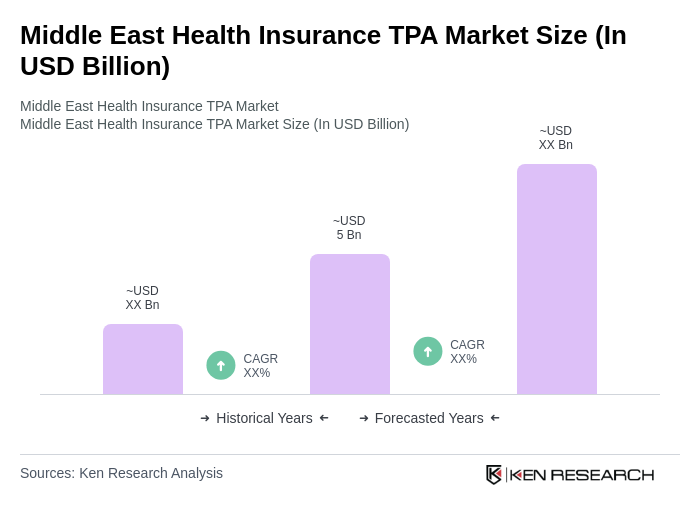

The Middle East Health Insurance TPA Market is valued at approximately USD 5 billion, driven by increasing healthcare expenditures, a rise in chronic diseases, and greater awareness of health insurance benefits among the population.