Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1173

Pages:80

Published On:November 2025

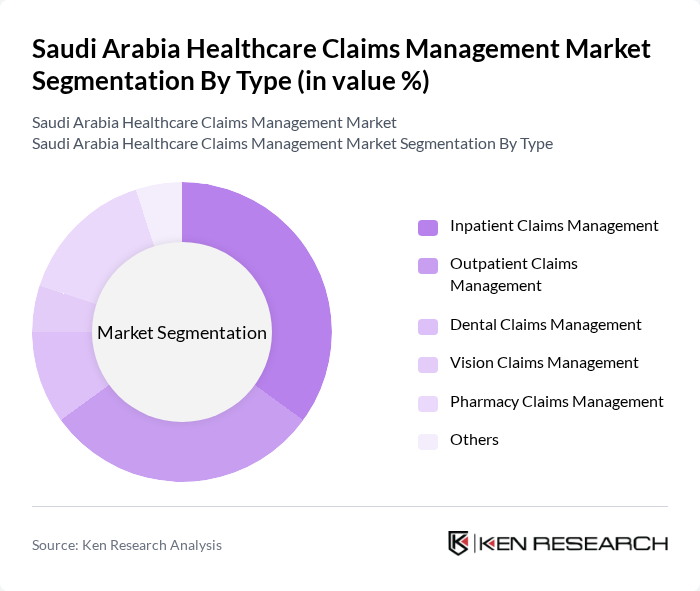

By Type:The market is segmented into various types of claims management services, including inpatient claims management, outpatient claims management, dental claims management, vision claims management, pharmacy claims management, and others. Each of these segments plays a crucial role in addressing the diverse needs of healthcare providers and insurers. The segmentation reflects the growing complexity of healthcare delivery and the need for specialized claims processing for different service categories .

Theinpatient claims managementsegment is currently dominating the market due to the high costs associated with hospital stays and treatments. This segment is essential for healthcare providers as it involves significant financial transactions and requires meticulous management to ensure accurate reimbursements. The increasing number of hospital admissions and the complexity of inpatient care further contribute to the growth of this segment, making it a focal point for claims management services .

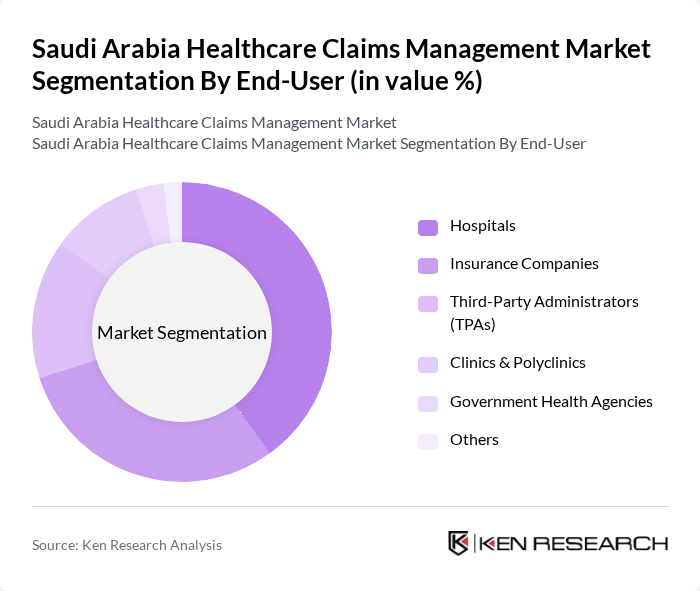

By End-User:The market is segmented by end-users, including hospitals, insurance companies, third-party administrators (TPAs), clinics & polyclinics, government health agencies, and others. Each end-user category has unique requirements and plays a vital role in the healthcare claims management ecosystem. Hospitals and insurance companies are the largest end-users due to their central role in claims generation and processing. TPAs are increasingly important as outsourcing partners, supporting efficient claims adjudication and fraud prevention .

Hospitalsare the leading end-users in the healthcare claims management market, accounting for a significant share. This dominance is attributed to the high volume of claims generated from inpatient and outpatient services. Hospitals require efficient claims management systems to handle the complexities of billing, insurance verification, and reimbursement processes, making them a critical player in the market .

The Saudi Arabia Healthcare Claims Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bupa Arabia, Tawuniya, Medgulf, Alinma Tokio Marine, Gulf Insurance Group, United Cooperative Assurance, Al Rajhi Takaful, AXA Cooperative Insurance, Al-Ahlia Insurance Company, Al Sagr Cooperative Insurance, Al-Etihad Cooperative Insurance, Aljazira Takaful, Walaa Cooperative Insurance, The Cigna Group, Nextcare (Allianz Partners), GlobeMed Saudi, MedNet Saudi Arabia, NAS Neuron Health Services contribute to innovation, geographic expansion, and service delivery in this space. These companies leverage advanced digital platforms, AI-driven claims analytics, and compliance with national e-claims standards to maintain competitiveness .

The future of the healthcare claims management market in Saudi Arabia appears promising, driven by ongoing investments in healthcare infrastructure and technology. As the government continues to prioritize healthcare reforms, the adoption of digital solutions will likely accelerate. Additionally, the integration of artificial intelligence and machine learning into claims processing is expected to enhance efficiency and accuracy. These trends will create a more streamlined claims management environment, ultimately benefiting both providers and patients in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient Claims Management Outpatient Claims Management Dental Claims Management Vision Claims Management Pharmacy Claims Management Others |

| By End-User | Hospitals Insurance Companies Third-Party Administrators (TPAs) Clinics & Polyclinics Government Health Agencies Others |

| By Region | Central Region Western Region Eastern Region Southern Region Northern Region |

| By Technology | Cloud-Based Solutions On-Premise Solutions Web-Based Solutions Mobile Applications AI & Machine Learning Solutions Blockchain Solutions Others |

| By Application | Claims Processing Fraud Detection & Prevention Analytics and Reporting Billing & Coding Pre-Authorization Management Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Claims Processing | 100 | Claims Managers, Billing Coordinators |

| Insurance Claims Management | 80 | Claims Adjusters, Underwriters |

| Healthcare Provider Billing | 70 | Billing Specialists, Revenue Cycle Managers |

| Telemedicine Claims Handling | 40 | Telehealth Coordinators, IT Managers |

| Pharmaceutical Claims Processing | 50 | Pharmacy Managers, Claims Analysts |

The Saudi Arabia Healthcare Claims Management Market is valued at approximately USD 230 million, reflecting significant growth driven by increased healthcare service demand, expanded health insurance coverage, and advancements in technology for claims processing.