Region:Middle East

Author(s):Geetanshi

Product Code:KRAE3223

Pages:95

Published On:December 2025

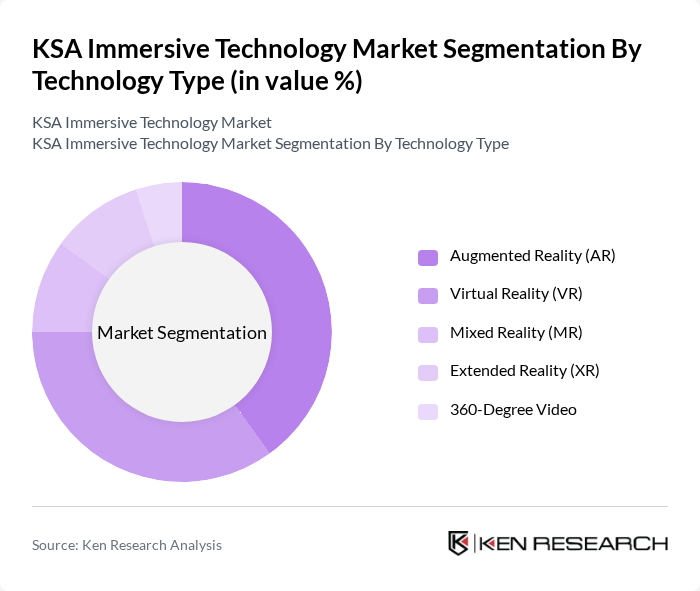

By Technology Type:The KSA Immersive Technology Market can be segmented into various technology types, including Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), Extended Reality (XR), and 360-Degree Video. Among these, AR and VR are the most prominent, driven by their applications in gaming, training, and marketing. The increasing consumer interest in interactive experiences has led to a surge in AR and VR adoption across multiple sectors. AR/VR revenues in the Saudi market are projected to reach USD 168.8 million by 2029, up from USD 124.4 million in 2025, reflecting strong sector momentum.

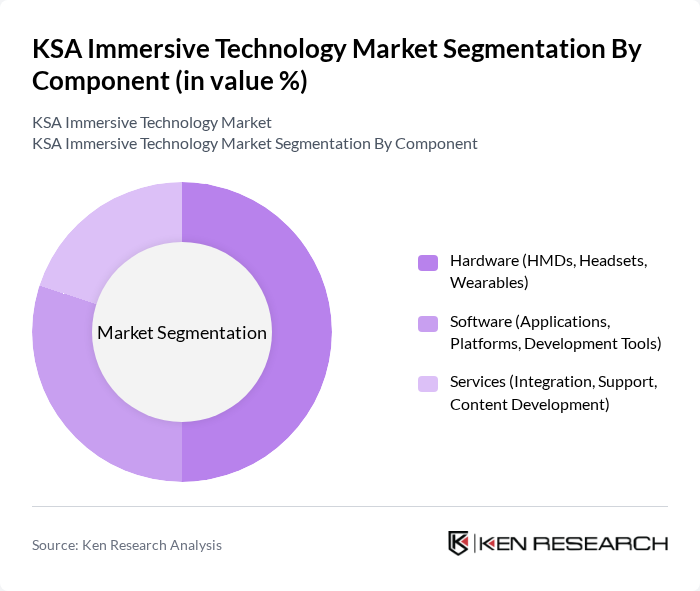

By Component:The market can also be segmented by components, which include Hardware (HMDs, Headsets, Wearables), Software (Applications, Platforms, Development Tools), and Services (Integration, Support, Content Development). Hardware is currently the leading segment, driven by the increasing demand for high-quality immersive experiences in gaming and training applications. The growth of software solutions is also notable, as businesses seek to develop customized applications for their specific needs. In July 2024, 5dVR expanded its operations to Saudi Arabia through a strategic partnership with AstroLabs, introducing immersive AR and VR solutions tailored to education, healthcare, and cultural preservation sectors.

The KSA Immersive Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA, MBC Group, Atheeb Group, Al-Faisaliah Group, Al-Rajhi Bank, Saudi Aramco, NEOM Company, Qiddiya Investment Company, Noon.com (Immersive Retail Solutions), Jarir Bookstore (AR/VR Retail Integration) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA immersive technology market is poised for substantial growth, driven by advancements in AI integration and the rollout of 5G technology, which enhances user experiences. As the government continues to invest in digital transformation, sectors such as education, healthcare, and entertainment will increasingly adopt immersive solutions. Additionally, the rise of social VR platforms will foster community engagement, while sustainability initiatives will shape the development of eco-friendly immersive technologies, ensuring a balanced approach to innovation and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Augmented Reality (AR) Virtual Reality (VR) Mixed Reality (MR) Extended Reality (XR) Degree Video |

| By Component | Hardware (HMDs, Headsets, Wearables) Software (Applications, Platforms, Development Tools) Services (Integration, Support, Content Development) |

| By End-User Sector | Education and Training Healthcare and Medical Simulation Entertainment and Gaming Retail and E-commerce Enterprise and Remote Collaboration Manufacturing and Industrial Tourism and Hospitality |

| By Application | Training and Simulation Remote Collaboration and Virtual Conferencing Marketing and Advertising Product Design and Visualization Remote Assistance and Technical Support Consumer Entertainment |

| By Distribution Channel | Direct Sales (B2B) Online Platforms and E-commerce Retail Stores and Experience Centers Partnerships with Educational Institutions Managed Service Providers (MSPs) |

| By Geographic Location | Riyadh Jeddah Dammam Other Major Cities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Education Sector Adoption | 100 | School Administrators, Educational Technology Coordinators |

| Healthcare Training Programs | 80 | Medical Educators, Simulation Lab Managers |

| Entertainment and Gaming | 120 | Game Developers, Content Creators |

| Corporate Training Solutions | 90 | HR Managers, Learning and Development Specialists |

| Tourism and Virtual Experiences | 70 | Tour Operators, Marketing Managers |

The KSA Immersive Technology Market is valued at approximately USD 1.2 billion, reflecting a significant growth trajectory driven by advancements in technology and increasing adoption across sectors such as education, healthcare, and entertainment.