Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0537

Pages:93

Published On:December 2025

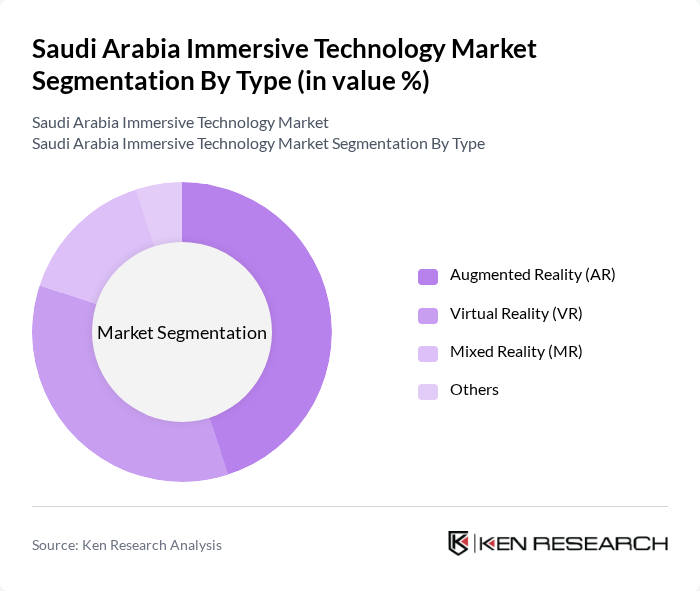

By Type:The market is segmented into Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), and Others. Among these, Augmented Reality (AR) is currently the leading sub-segment, driven by its applications in retail, education, and training. The increasing adoption of AR in mobile applications and marketing strategies has significantly contributed to its dominance. Virtual Reality (VR) follows closely, particularly in gaming and entertainment sectors, while Mixed Reality (MR) is gaining traction in specialized applications.

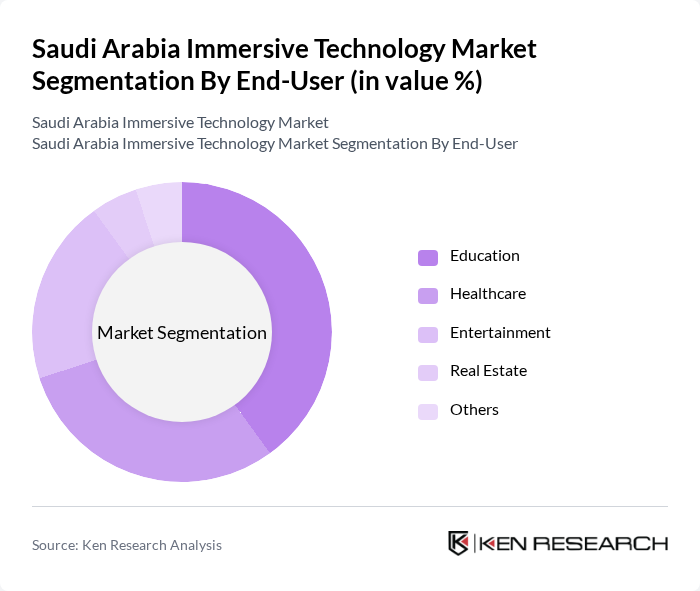

By End-User:The end-user segmentation includes Education, Healthcare, Entertainment, Real Estate, and Others. The Education sector is the most significant contributor, leveraging immersive technology for enhanced learning experiences and training simulations. Healthcare follows, utilizing VR and AR for medical training and patient treatment. The Entertainment sector, particularly gaming, is also a major player, with increasing consumer interest in immersive experiences.

The Saudi Arabia Immersive Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group, Saudi Telecom Company, Noura Technologies, MBC Group, Atheer, Immersive Technologies, VIRTUOSO, 3D Vision, Axiom VR, Taqnia, Qiddiya Investment Company, Red Sea Project, Saudi Aramco, Al-Falak, and Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the immersive technology market in Saudi Arabia appears promising, driven by ongoing government support and increasing investments in digital transformation. As the education sector continues to embrace AR/VR technologies, and the entertainment industry expands, the demand for innovative solutions will likely rise. Additionally, the integration of immersive experiences in healthcare and smart city initiatives will further enhance market potential, fostering a vibrant ecosystem for local and international players in the immersive technology landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Augmented Reality (AR) Virtual Reality (VR) Mixed Reality (MR) Others |

| By End-User | Education Healthcare Entertainment Real Estate Others |

| By Industry Vertical | Gaming Retail Automotive Tourism Others |

| By Technology | Hardware Software Services Others |

| By Application | Training and Simulation Marketing and Advertising Product Design and Development Others |

| By Distribution Channel | Online Offline Others |

| By Policy Support | Government Grants Tax Incentives Research and Development Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Education Sector Adoption of AR/VR | 100 | School Administrators, Curriculum Developers |

| Healthcare Applications of Immersive Technology | 80 | Medical Professionals, Hospital Administrators |

| Entertainment Industry Utilization of VR | 70 | Content Creators, Studio Executives |

| Corporate Training Programs Using AR | 90 | HR Managers, Training Coordinators |

| Retail Sector Engagement through Immersive Experiences | 75 | Marketing Managers, Retail Executives |

The Saudi Arabia Immersive Technology Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advancements in technology, increased investment in digital infrastructure, and rising demand for immersive experiences across various sectors such as education, healthcare, and entertainment.