Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5918

Pages:100

Published On:December 2025

Market.png)

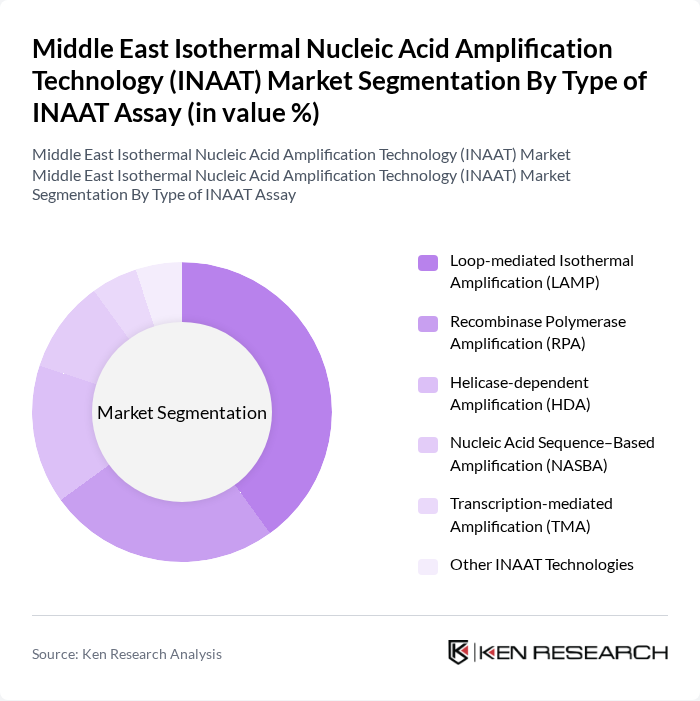

By Type of INAAT Assay:The INAAT market is segmented into various assay types, each catering to specific diagnostic needs. The dominant sub-segment is Loop-mediated Isothermal Amplification (LAMP), which is favored for its rapid results and ease of use in field settings. Recombinase Polymerase Amplification (RPA) is also gaining traction due to its sensitivity and speed. Other technologies like Helicase-dependent Amplification (HDA) and Nucleic Acid Sequence–Based Amplification (NASBA) are utilized in specialized applications, while Transcription-mediated Amplification (TMA) is preferred for its high specificity in clinical diagnostics.

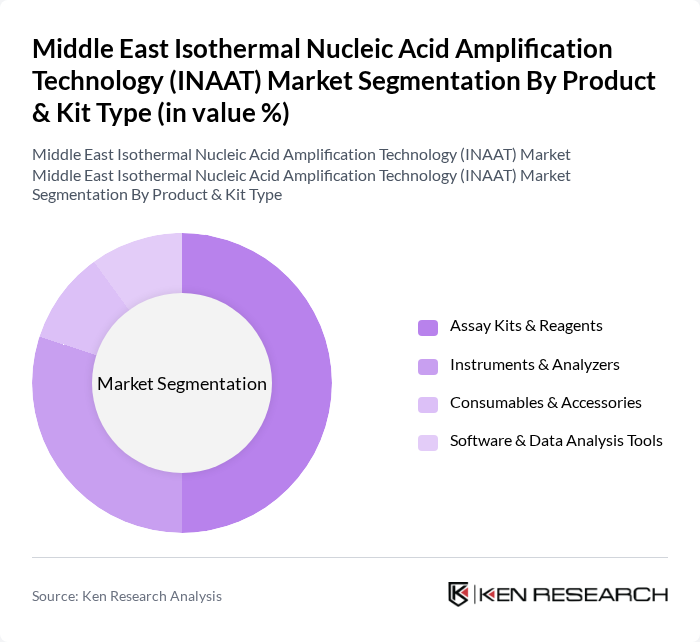

By Product & Kit Type:The product and kit type segmentation includes assay kits and reagents, instruments and analyzers, consumables and accessories, and software and data analysis tools. Assay kits and reagents dominate this segment due to their essential role in the testing process, providing the necessary components for accurate results. Instruments and analyzers are also critical, particularly as laboratories seek to enhance their testing capabilities. The demand for consumables and accessories is driven by the need for ongoing testing and maintenance, while software tools are increasingly important for data management and analysis.

The Middle East Isothermal Nucleic Acid Amplification Technology (INAAT) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories (ID NOW Isothermal Platform), Hologic, Inc. (Panther and TMA-based Assays), Becton, Dickinson and Company (BD MAX and Point-of-care Molecular Platforms), QuidelOrtho Corporation (QuickVue and Molecular Point-of-care Portfolio), Eiken Chemical Co., Ltd. (LAMP-based Loopamp Assays), Meridian Bioscience, Inc. (Illumigene LAMP Platform), Grifols, S.A. (Procleix TMA-based NAT Systems), bioMérieux SA (Isothermal and Rapid Molecular Assay Portfolio), QIAGEN N.V. (Isothermal Amplification Technologies and Assays), Thermo Fisher Scientific Inc. (Isothermal Reagents and Applied Technologies), Roche Diagnostics (Molecular and Isothermal Assay Portfolio in MEA), Co-Diagnostics, Inc. (Co-Dx Molecular Platforms and Regional Partnerships), Seegene Inc. (Syndromic and Isothermal-compatible Molecular Panels), Siemens Healthineers AG (Molecular Diagnostics Presence in the Middle East), Local & Regional Players (e.g., National Reference Labs, Saudi Bio, and UAE-based Molecular Labs) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the INAAT market in the Middle East appears promising, driven by ongoing technological advancements and increasing healthcare investments. As governments prioritize healthcare innovation, the integration of INAAT technologies into routine diagnostics is expected to accelerate. Additionally, the growing emphasis on personalized medicine will likely enhance the demand for rapid and accurate diagnostic solutions, positioning INAAT as a critical component in the region's healthcare landscape. Collaborative efforts between public and private sectors will further bolster market growth.

| Segment | Sub-Segments |

|---|---|

| By Type of INAAT Assay | Loop-mediated Isothermal Amplification (LAMP) Recombinase Polymerase Amplification (RPA) Helicase-dependent Amplification (HDA) Nucleic Acid Sequence–Based Amplification (NASBA) Transcription-mediated Amplification (TMA) Other INAAT Technologies |

| By Product & Kit Type | Assay Kits & Reagents Instruments & Analyzers Consumables & Accessories Software & Data Analysis Tools |

| By Application | Infectious Disease Testing Respiratory Pathogen Panels Sexually Transmitted Infections (STIs) Tuberculosis & Other Mycobacterial Infections Hospital-acquired Infections (HAIs) Food & Water Safety Testing Veterinary & Zoonotic Disease Testing Other Applications |

| By End-User | Hospital & Clinic Laboratories Independent & Reference Diagnostic Laboratories Point-of-Care Testing Sites & Primary Care Centers Academic & Research Institutions Public Health & Government Laboratories Other End-Users |

| By Test Setting / Modality | Centralized Laboratory Testing Near-Patient / Point-of-Care Testing Home-based & Self-testing Mobile & Field-deployable Testing Units |

| By Country / Sub-region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Egypt Rest of Middle East |

| By Technology Platform Integration | Stand-alone Benchtop INAAT Systems Cartridge-based / Sample-to-answer Platforms Microfluidics & Lab-on-a-chip INAAT Systems Portable & Handheld INAAT Devices Integrated Digital & Connected INAAT Platforms |

| By Funding & Procurement Source | Public Sector Procurement (MoH, Public Hospitals) Multilateral & Donor-funded Programs Private Healthcare Providers Academic & Research Grants Corporate & Industry Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 120 | Laboratory Managers, Diagnostic Technologists |

| Healthcare Providers | 90 | Physicians, Medical Directors |

| Biotechnology Firms | 70 | Product Development Managers, R&D Scientists |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Academic Institutions | 60 | Research Professors, Graduate Students |

The Middle East INAAT Market is valued at approximately USD 150 million, driven by the rising prevalence of infectious diseases and the demand for rapid diagnostic testing solutions.