Region:Middle East

Author(s):Shubham

Product Code:KRAA0724

Pages:82

Published On:August 2025

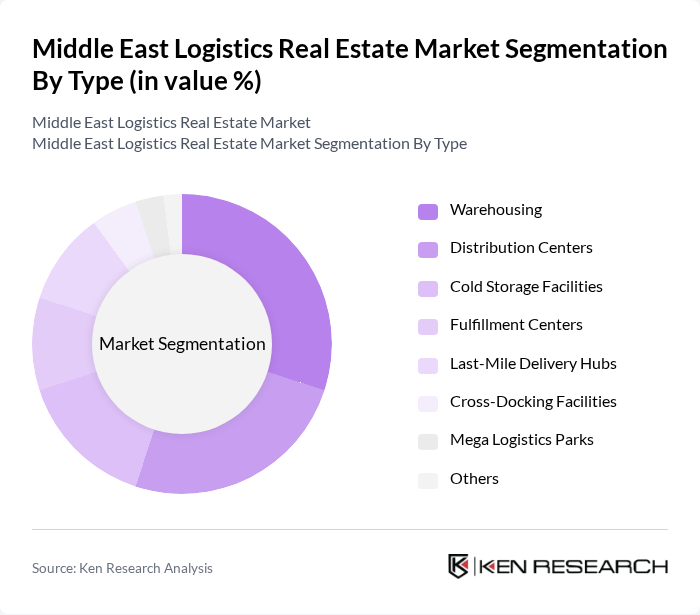

By Type:The logistics real estate market can be segmented into warehousing, distribution centers, cold storage facilities, fulfillment centers, last-mile delivery hubs, cross-docking facilities, mega logistics parks, and others. Warehousing remains the largest segment, driven by the surge in e-commerce and the need for efficient inventory management. Distribution centers and fulfillment centers are increasingly important for rapid order processing and delivery. Cold storage facilities are gaining prominence due to the growth in food, pharmaceutical, and temperature-sensitive goods sectors. Last-mile delivery hubs and cross-docking facilities are essential for optimizing urban logistics and reducing delivery times, while mega logistics parks offer integrated solutions for large-scale operations .

By End-User:The end-user segmentation includes retail, e-commerce, manufacturing, pharmaceuticals, automotive, food and beverage, third-party logistics (3PL), and others. E-commerce is the leading end-user segment, reflecting the region’s digital transformation and consumer shift to online shopping. Retail and manufacturing sectors continue to drive demand for logistics facilities, while pharmaceuticals and food and beverage require specialized storage and distribution solutions. Third-party logistics providers are expanding their footprint to support diverse industry needs .

The Middle East Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as DP World Logistics, Agility Logistics, Aramex, Dubai South, JAFZA (Jebel Ali Free Zone Authority), Abu Dhabi Ports Group (AD Ports Group), Al-Futtaim Logistics, MAF Logistics (Majid Al Futtaim), Gulf Warehousing Company (GWC), Saudi Industrial Services Co. (SISCO), Prologis Middle East, Goodman Group, DHL Supply Chain Middle East, CEVA Logistics Middle East, JLL (Jones Lang LaSalle) Middle East, CBRE Group Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East logistics real estate market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of automation and smart technologies is expected to enhance operational efficiency, while sustainability initiatives will shape future investments. Additionally, the ongoing development of free trade zones will facilitate smoother trade flows, attracting more international players. As the region continues to adapt to these trends, it will solidify its position as a key logistics hub in the global supply chain network.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehousing Distribution Centers Cold Storage Facilities Fulfillment Centers Last-Mile Delivery Hubs Cross-Docking Facilities Mega Logistics Parks Others |

| By End-User | Retail E-commerce Manufacturing Pharmaceuticals Automotive Food and Beverage Third-Party Logistics (3PL) Others |

| By Location | Urban Areas Suburban Areas Industrial Zones Free Trade Zones Port Proximity Airport Proximity Inland Logistics Corridors Others |

| By Facility Size | Small (<10,000 sq ft) Medium (10,000 - 50,000 sq ft) Large (>50,000 sq ft) Mega Facilities (>250,000 sq ft) Others |

| By Ownership Type | Owned Leased Managed Joint Ventures REIT-Owned Others |

| By Investment Type | Private Investment Public Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Institutional Investment Others |

| By Service Type | Transportation Services Warehousing Services Value-Added Services (Packaging, Labelling, Kitting) Technology Solutions (WMS, Automation, IoT) Facility Management Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehousing Operations | 100 | Warehouse Managers, Logistics Directors |

| Distribution Center Management | 80 | Operations Managers, Supply Chain Analysts |

| Cold Storage Facilities | 60 | Facility Managers, Quality Control Officers |

| Last-Mile Delivery Solutions | 50 | Delivery Managers, Fleet Coordinators |

| Logistics Technology Adoption | 40 | IT Managers, Innovation Leads |

The Middle East Logistics Real Estate Market is valued at approximately USD 18 billion, driven by the growth of e-commerce, demand for efficient supply chain solutions, and significant infrastructure investments across the region.