Region:Middle East

Author(s):Dev

Product Code:KRAD6417

Pages:82

Published On:December 2025

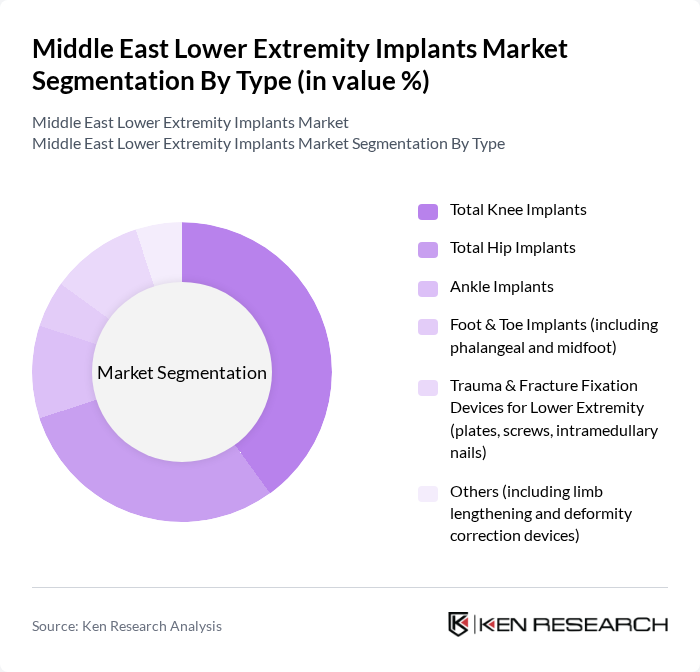

By Type:The market is segmented into various types of implants, including Total Knee Implants, Total Hip Implants, Ankle Implants, Foot & Toe Implants (including phalangeal and midfoot), Trauma & Fracture Fixation Devices for Lower Extremity (plates, screws, intramedullary nails), and Others (including limb lengthening and deformity correction devices). This structure aligns with the broader lower extremity implants taxonomy, which typically covers large joint arthroplasty (hip and knee), ankle and foot reconstruction, and trauma fixation systems. Among these, Total Knee Implants are the most dominant due to the high incidence and treatment rates of knee osteoarthritis, and the large volume of knee replacement surgeries performed annually in hospital settings. The growing elderly population, increasing obesity prevalence, and expansion of high-volume arthroplasty centers in Gulf Cooperation Council (GCC) countries contribute significantly to the demand for knee implants, making them a focal point in the market.

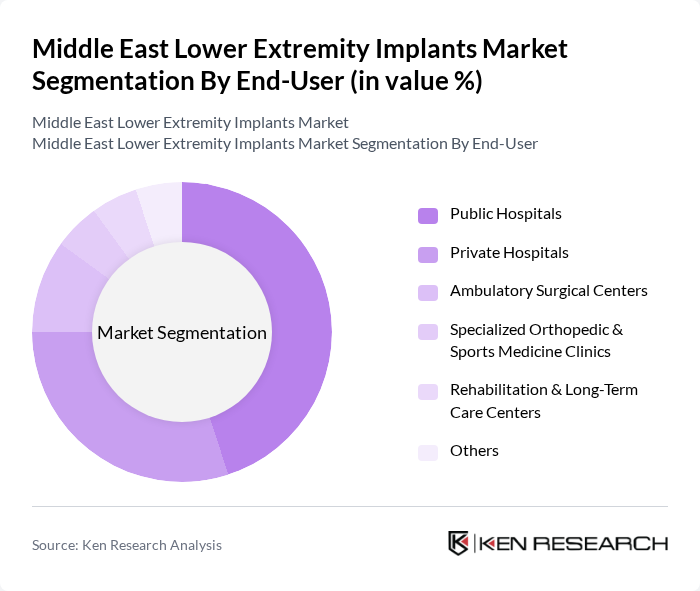

By End-User:The market is segmented by end-users, including Public Hospitals, Private Hospitals, Ambulatory Surgical Centers, Specialized Orthopedic & Sports Medicine Clinics, Rehabilitation & Long-Term Care Centers, and Others. This segmentation reflects the global pattern where hospitals and surgical centers account for most lower extremity implant procedures. Public Hospitals are the leading segment due to their extensive patient base, centralized trauma and joint replacement services, and government funding, which allows for the procurement of advanced lower extremity implants and navigation systems. The increasing number of joint replacement and trauma surgeries performed in public healthcare facilities, coupled with rising demand for orthopedic treatments and expanding insurance coverage in GCC markets, drives the growth of this segment.

The Middle East Lower Extremity Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson MedTech), Smith & Nephew plc, Medtronic plc, Arthrex, Inc., Globus Medical, Inc., Exactech, Inc., B. Braun Melsungen AG (Aesculap Division), Orthofix Medical Inc., Medacta International SA, Conformis, Inc., LimaCorporate S.p.A., United Orthopedic Corporation, Amico Group (Middle East Orthopedic Distributor & Manufacturer) contribute to innovation, geographic expansion, and service delivery in this space, with portfolios spanning knee and hip arthroplasty, ankle and foot reconstruction, and trauma fixation systems.

The future of the Middle East lower extremity implants market appears promising, driven by technological advancements and demographic shifts. As healthcare systems evolve, there is a growing emphasis on personalized medicine and patient-centric care. Additionally, the integration of digital technologies, such as telemedicine and AI, is expected to enhance surgical planning and patient outcomes. These trends will likely foster a more robust market environment, encouraging innovation and improving access to care.

| Segment | Sub-Segments |

|---|---|

| By Type | Total Knee Implants Total Hip Implants Ankle Implants Foot & Toe Implants (including phalangeal and midfoot) Trauma & Fracture Fixation Devices for Lower Extremity (plates, screws, intramedullary nails) Others (including limb lengthening and deformity correction devices) |

| By End-User | Public Hospitals Private Hospitals Ambulatory Surgical Centers Specialized Orthopedic & Sports Medicine Clinics Rehabilitation & Long-Term Care Centers Others |

| By Material | Metal Implants (stainless steel, cobalt-chromium, titanium) Polymer Implants (UHMWPE and others) Ceramic Implants Composite & Bioabsorbable Implants Patient-Specific / 3D-Printed Implants Others |

| By Procedure Type | Primary Replacement Procedures Revision Replacement Procedures Trauma Reconstruction Procedures Minimally Invasive / Robotic-Assisted Procedures Others |

| By Distribution Channel | Direct Sales to Hospitals and Large Buying Groups Local & Regional Distributors / Agents Tender-Based Government Procurement Online / E-Procurement Platforms Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Iraq, others) North Africa (Egypt and neighboring markets) Iran & Turkey Others |

| By Patient Demographics | Age Group (Pediatric, Adult, Geriatric) Gender (Male, Female) Activity Level (Elite / Athletic, Moderately Active, Sedentary) Obesity & Comorbidity Status Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Knee Implant Procedures | 120 | Orthopedic Surgeons, Hospital Administrators |

| Hip Replacement Market | 100 | Procurement Managers, Medical Device Distributors |

| Ankle Implant Usage | 80 | Surgeons, Rehabilitation Specialists |

| Patient Experience with Implants | 100 | Patients, Caregivers |

| Market Trends in Lower Extremity Implants | 90 | Healthcare Analysts, Market Researchers |

The Middle East Lower Extremity Implants Market is valued at approximately USD 0.45 billion. This valuation reflects a significant share within the regional orthopedic implants segment, driven by increasing orthopedic disorders and advancements in implant technologies.