Region:Middle East

Author(s):Shubham

Product Code:KRAB0746

Pages:95

Published On:August 2025

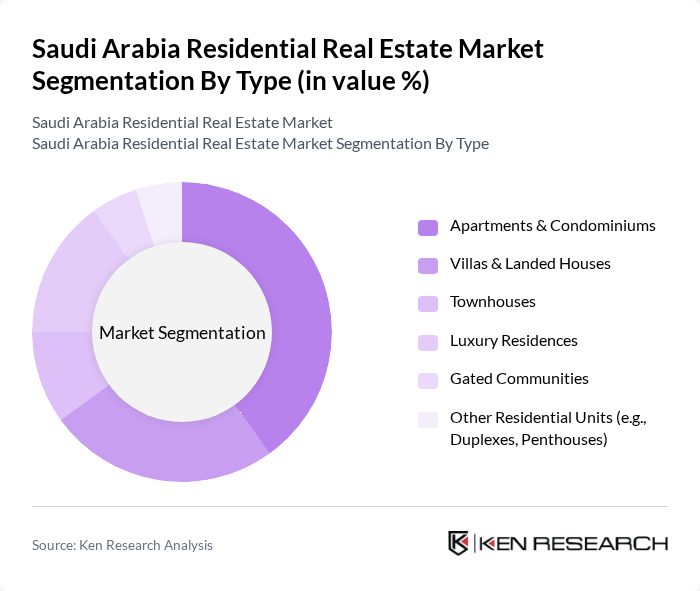

By Type:The residential real estate market can be segmented into various types, includingApartments & Condominiums, Villas & Landed Houses, Townhouses, Luxury Residences, Gated Communities, and Other Residential Units(e.g., Duplexes, Penthouses). Among these, Apartments & Condominiums are currently leading the market due to their affordability and suitability for urban living, particularly in major cities. The demand for Villas & Landed Houses is also significant, driven by families seeking larger living spaces. The Luxury Residences segment is growing, catering to affluent buyers looking for high-end amenities .

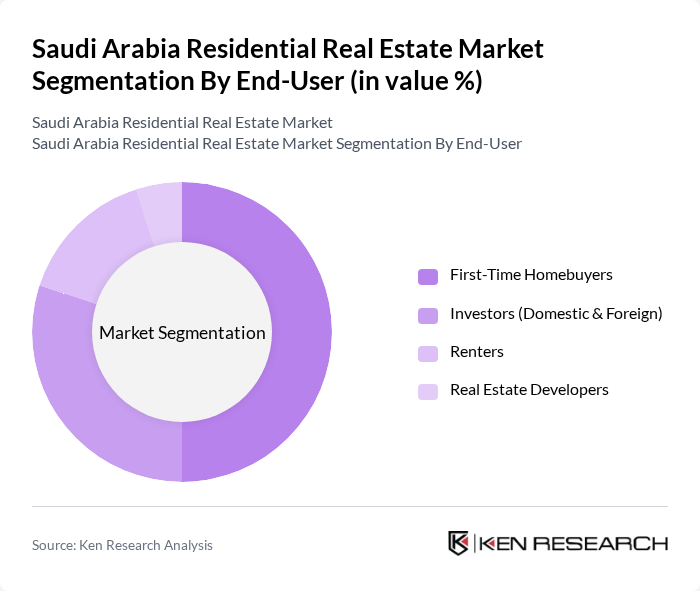

By End-User:The end-user segmentation includesFirst-Time Homebuyers, Investors (Domestic & Foreign), Renters, and Real Estate Developers. First-Time Homebuyers are the dominant segment, driven by government incentives and affordable financing options. Investors are increasingly attracted to the market due to the potential for high returns, while Renters represent a significant portion of the market, particularly in urban areas. Real Estate Developers are also crucial, as they drive the supply of new residential units to meet growing demand .

The Saudi Arabia Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dar Al Arkan Real Estate Development Company, Saudi Real Estate Company (Al Akaria), Emaar, The Economic City, Retal Urban Development Company, Roshn (A PIF Company), Al Oula Real Estate Development Company, Sumou Real Estate Company, Red Sea Global, Jabal Omar Development Company, Alandalus Property Company, Al Saedan Real Estate Company, Al Mazaya Holding Company, Cayan Group, Al Rajhi Real Estate Investments Company, Alinma Investment contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi residential real estate market is poised for significant transformation in the coming years, driven by demographic shifts and government initiatives. As urbanization accelerates, demand for diverse housing options will increase, particularly in metropolitan areas. The focus on affordable housing and sustainable development will shape future projects, while technological advancements in smart home solutions will enhance living experiences. Overall, the market is expected to adapt to evolving consumer preferences, creating a dynamic environment for investors and developers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Apartments & Condominiums Villas & Landed Houses Townhouses Luxury Residences Gated Communities Other Residential Units (e.g., Duplexes, Penthouses) |

| By End-User | First-Time Homebuyers Investors (Domestic & Foreign) Renters Real Estate Developers |

| By Price Range | Affordable Segment Mid-Range Segment Premium/Luxury Segment |

| By Location | Major Cities (Riyadh, Jeddah, Dammam, Khobar) Secondary Cities Emerging Urban Centers (e.g., NEOM, Qiddiya) Suburban & Rural Areas |

| By Financing Type | Mortgages Cash Purchases Government-Backed Loans (e.g., Sakani, REDF) |

| By Development Stage | Pre-Construction Under Construction Completed |

| By Policy Support | Subsidized Housing Programs Tax Incentives Government Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Developers | 100 | Project Managers, Business Development Executives |

| Real Estate Agents and Brokers | 120 | Sales Agents, Market Analysts |

| Potential Homebuyers | 140 | First-time Buyers, Investors |

| Property Management Firms | 80 | Property Managers, Operations Directors |

| Government Housing Authorities | 50 | Policy Makers, Housing Program Coordinators |

The Saudi Arabia Residential Real Estate Market is valued at approximately USD 72 billion, driven by urbanization, government initiatives to boost home ownership, and a growing expatriate population seeking housing solutions.