Region:Europe

Author(s):Shubham

Product Code:KRAA6462

Pages:82

Published On:September 2025

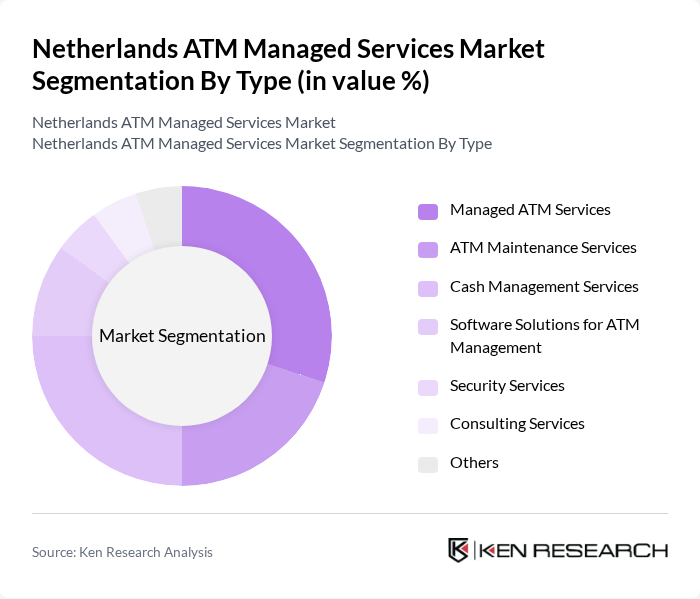

By Type:The segmentation by type includes Managed ATM Services, ATM Maintenance Services, Cash Management Services, Software Solutions for ATM Management, Security Services, Consulting Services, and Others. Each of these subsegments plays a crucial role in the overall market dynamics.

The Managed ATM Services subsegment is currently dominating the market due to the increasing reliance of banks and financial institutions on outsourcing their ATM operations. This trend is driven by the need for cost efficiency, enhanced service quality, and the ability to focus on core banking activities. Additionally, the rise in cashless transactions has led to a greater emphasis on maintaining and managing ATMs effectively, further solidifying the position of managed services as a preferred choice among financial entities.

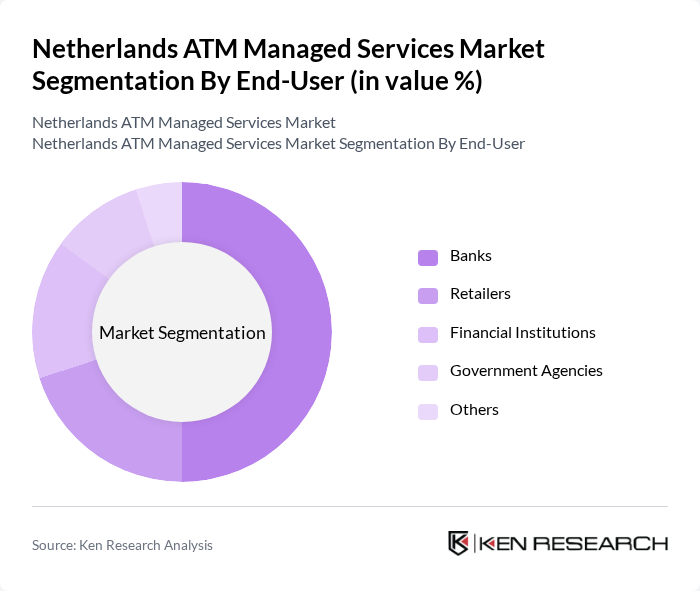

By End-User:The end-user segmentation includes Banks, Retailers, Financial Institutions, Government Agencies, and Others. Each of these categories represents a significant consumer base for ATM managed services.

Banks are the leading end-users in the market, accounting for a significant share due to their extensive ATM networks and the necessity for reliable cash management solutions. The increasing competition among banks to provide superior customer service and the need for operational efficiency have led to a higher adoption of managed services. Retailers also contribute to the market, particularly those with high foot traffic, as they seek to enhance customer convenience through accessible ATM services.

The Netherlands ATM Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diebold Nixdorf, NCR Corporation, Wincor Nixdorf, GRG Banking Equipment, Hitachi-Omron Terminal Solutions, Fujitsu Limited, TMD Security, Cardtronics, G4S Cash Solutions, SITA, ACI Worldwide, Verifone, Ingenico Group, Euronet Worldwide, PayPoint contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands ATM managed services market appears promising, driven by ongoing technological advancements and a shift towards digital banking. As consumer preferences evolve, the integration of mobile banking with ATMs is expected to enhance user experience. Additionally, the focus on sustainability in ATM operations will likely lead to innovative solutions that reduce environmental impact, positioning service providers to capitalize on these emerging trends and meet changing consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services ATM Maintenance Services Cash Management Services Software Solutions for ATM Management Security Services Consulting Services Others |

| By End-User | Banks Retailers Financial Institutions Government Agencies Others |

| By Service Model | Full-Service ATM Management Hybrid Service Model Self-Service Model |

| By Payment Method | Cash Withdrawals Balance Inquiries Fund Transfers Bill Payments |

| By Region | North Netherlands South Netherlands East Netherlands West Netherlands |

| By Customer Segment | Individual Customers Small and Medium Enterprises (SMEs) Large Corporations |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing Fixed Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Managed ATM Services | 100 | ATM Service Managers, Operations Directors |

| Technology Solutions for ATM | 80 | IT Managers, Technology Officers |

| Regulatory Compliance in ATM | 60 | Compliance Officers, Regulatory Affairs Managers |

| Airport Authority Perspectives | 70 | Airport Operations Managers, Strategic Planners |

| Air Traffic Controller Insights | 90 | Air Traffic Controllers, Training Supervisors |

The Netherlands ATM Managed Services Market is valued at approximately USD 1.2 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient cash management solutions and advancements in technology enhancing ATM operational efficiency.