Region:Africa

Author(s):Shubham

Product Code:KRAB1227

Pages:91

Published On:October 2025

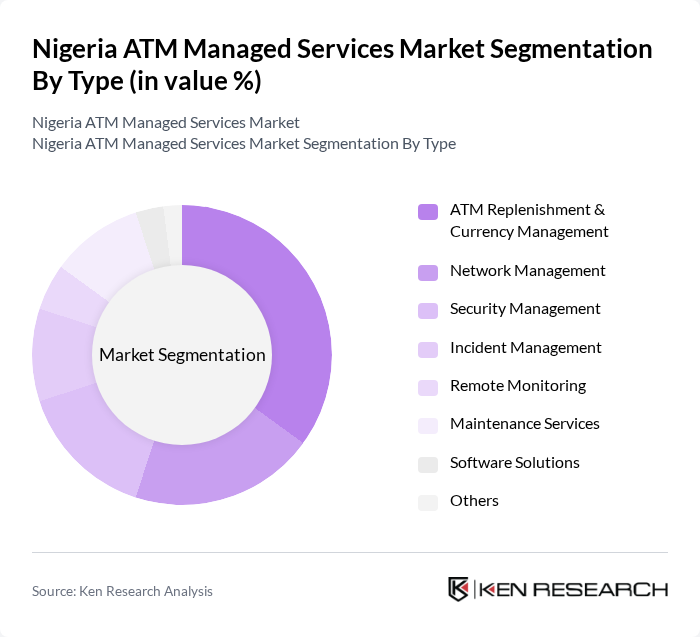

By Type:The market is segmented into various types of services that cater to the operational needs of ATMs. The subsegments include ATM Replenishment & Currency Management, Network Management, Security Management, Incident Management, Remote Monitoring, Maintenance Services, Software Solutions, and Others. Among these, ATM Replenishment & Currency Management is the leading subsegment due to the critical need for ensuring cash availability at ATMs, which directly impacts customer satisfaction and operational efficiency.

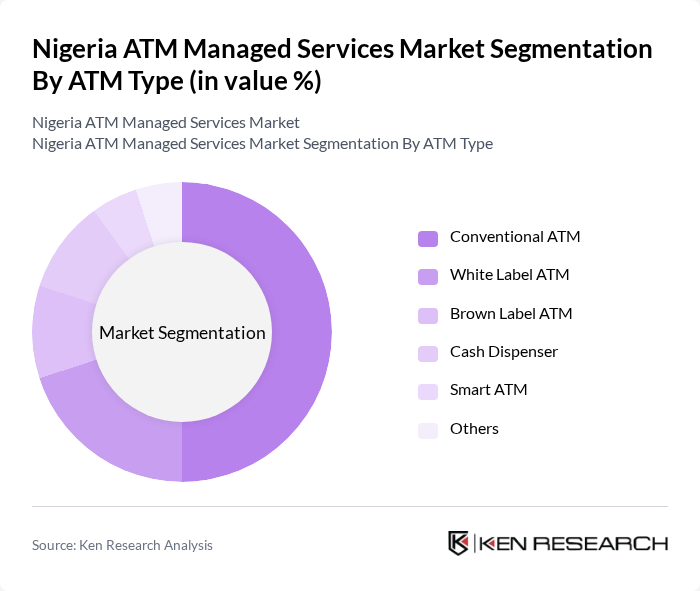

By ATM Type:This segmentation includes Conventional ATM, White Label ATM, Brown Label ATM, Cash Dispenser, Smart ATM, and Others. The Conventional ATM segment dominates the market as it is the most widely used type of ATM, providing essential banking services to customers across various locations. The increasing number of bank branches and the need for cash withdrawal facilities contribute to the growth of this segment.

The Nigeria ATM Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Interswitch Limited, Automated Financial Systems Ltd (AFS), NCR Nigeria (NCR Corporation), Diebold Nixdorf Nigeria, Wincor Nixdorf Nigeria, Etranzact International Plc, First Bank of Nigeria Ltd, Zenith Bank Plc, Access Bank Plc, Guaranty Trust Bank Plc, Ecobank Nigeria, United Bank for Africa Plc, Stanbic IBTC Bank Plc, Fidelity Bank Plc, Union Bank of Nigeria Plc, Wema Bank Plc, Heritage Bank Plc, Polaris Bank Ltd, Jaiz Bank Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria ATM managed services market appears promising, driven by technological advancements and a growing consumer preference for digital banking. As mobile banking integration continues to rise, financial institutions are likely to invest in innovative ATM solutions that enhance customer experience. Additionally, the shift towards managed services will enable banks to focus on core operations while outsourcing ATM management, leading to improved efficiency and service delivery in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | ATM Replenishment & Currency Management Network Management Security Management Incident Management Remote Monitoring Maintenance Services Software Solutions Others |

| By ATM Type | Conventional ATM White Label ATM Brown Label ATM Cash Dispenser Smart ATM Others |

| By Location | Onsite ATMs Offsite ATMs Worksite ATMs Mobile ATMs |

| By End-User | Banks Financial Institutions Retailers Government Agencies Others |

| By Service Model | Full-Service Management Hybrid Model Self-Service Model |

| By Payment Method | Cash Transactions Card Transactions Mobile Payments |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Individual Customers Small and Medium Enterprises Large Corporations |

| By Pricing Model | Subscription-Based Pay-Per-Use Fixed Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 100 | ATM Managers, Operations Directors |

| Independent ATM Deployers | 60 | Business Development Managers, Technical Support Leads |

| Consumer Usage Patterns | 120 | General Consumers, Small Business Owners |

| Technology Providers for ATM Services | 40 | Product Managers, Technical Engineers |

| Regulatory Impact Assessment | 40 | Policy Makers, Compliance Officers |

The Nigeria ATM Managed Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking services and the expansion of the banking sector across the country.