Region:Central and South America

Author(s):Shubham

Product Code:KRAB1266

Pages:95

Published On:October 2025

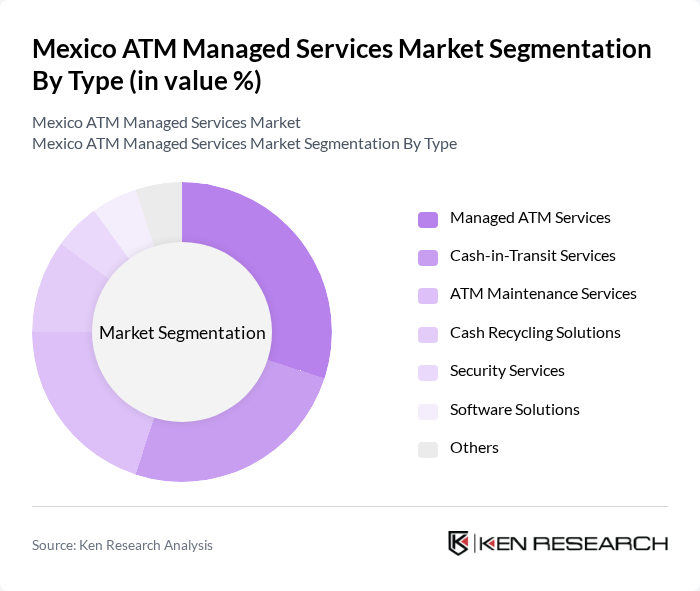

By Type:The market can be segmented into various types of services, including ATM Replenishment and Currency Management, Network Management, Security Management, Incident Management, Cash-in-Transit Services, ATM Maintenance Services, and Others. These services encompass comprehensive operational support including deposit collection, electronic product delivery, anti-skimming monitoring, camera security, and disaster recovery solutions.

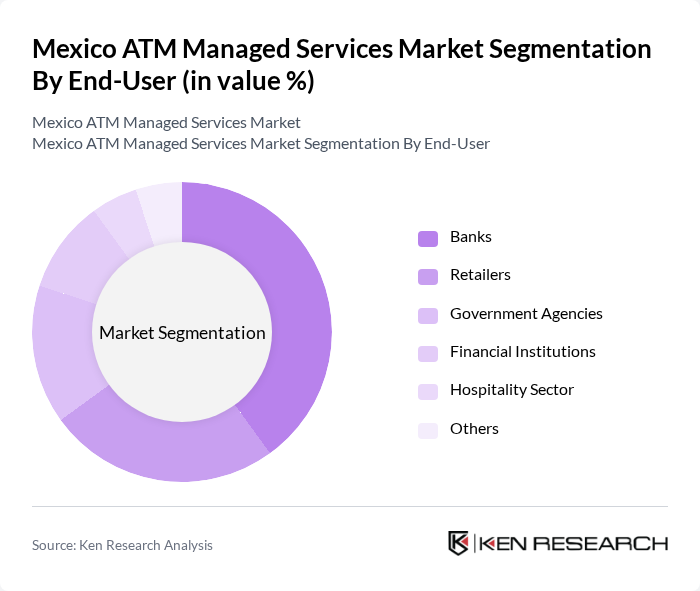

By End-User:The end-user segmentation includes Banks, Retailers, Government Agencies, Financial Institutions, Hospitality Sector, and Others. Each of these sectors utilizes ATM services to meet their cash management and customer service needs, with banks and financial institutions driving the majority of demand through their extensive ATM networks.

The Mexico ATM Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, Diebold Nixdorf, GRG Banking Equipment, Hitachi-Omron Terminal Solutions, Fujitsu Limited, Brinks México, G4S Cash Solutions México, Prosegur México, Grupo Multisistemas de Seguridad Industrial, Euronet Worldwide, Cardtronics (now part of NCR Atleos), C3S, Securitas Direct México, Cash Connect, Grupo Prodigy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico ATM managed services market appears promising, driven by technological innovations and evolving consumer preferences. The shift towards contactless transactions is expected to accelerate, with a projected 50% of ATM transactions being contactless in future. Additionally, the integration of AI and machine learning will enhance operational efficiencies, allowing for better customer service and fraud detection. As financial institutions adapt to these trends, the market is likely to witness significant transformations in service delivery and customer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash-in-Transit Services ATM Maintenance Services Cash Recycling Solutions Security Services Software Solutions Others |

| By End-User | Banks Retailers Government Agencies Financial Institutions Hospitality Sector Others |

| By Service Model | Full-Service Model Hybrid Model Self-Service Model Others |

| By Payment Method | Cash Card Payments Mobile Payments Others |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Others |

| By Contract Type | Long-term Contracts Short-term Contracts Project-based Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Management | 85 | ATM Operations Managers, Banking Executives |

| Independent ATM Deployers | 65 | Business Development Managers, Technical Support Leads |

| ATM Technology Providers | 55 | Product Managers, R&D Engineers |

| Regulatory Bodies and Compliance Officers | 45 | Compliance Managers, Regulatory Affairs Specialists |

| Consumer Insights on ATM Usage | 75 | Bank Customers, Financial Service Users |

The Mexico ATM Managed Services Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing adoption of digital banking services and the expansion of ATM networks across the country.