Region:Middle East

Author(s):Rebecca

Product Code:KRAB4665

Pages:94

Published On:October 2025

By Type:The market is segmented into On-site ATMs Managed Services, Off-site ATMs Managed Services, Mobile ATMs Managed Services, Cash Management Services, ATM Site Maintenance, ATM Repair & Maintenance Services, and Other Value-Added Services. On-site and off-site managed services remain the largest segments, reflecting the widespread deployment of ATMs in bank branches and high-traffic commercial locations. Mobile ATM services are increasingly adopted for events and remote areas, while cash management and maintenance services are critical for ensuring uptime and operational reliability. Value-added services include transaction analytics, software upgrades, and security enhancements .

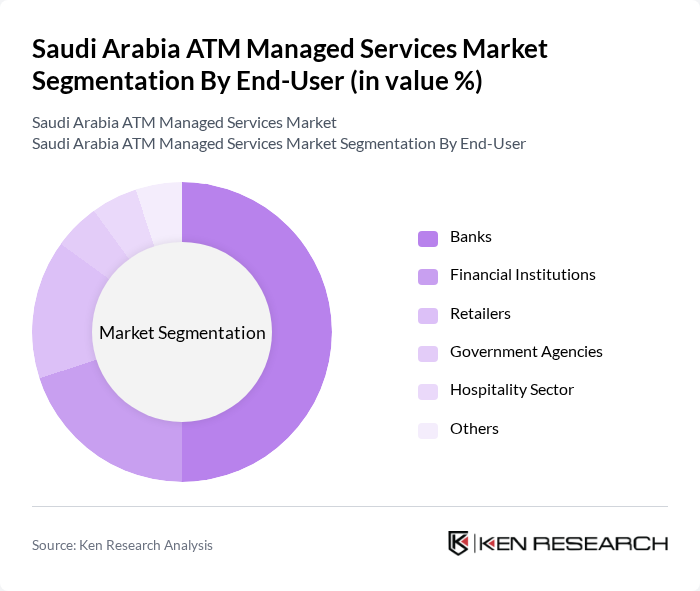

By End-User:The end-user segmentation includes Banks, Financial Institutions, Retailers, Government Agencies, Hospitality Sector, and Others. Banks account for the largest share due to their extensive ATM networks and regulatory compliance requirements. Financial institutions and retailers utilize managed services to optimize cash flow and enhance customer convenience. Government agencies and the hospitality sector increasingly deploy ATMs for public service and guest amenities, while other segments include healthcare and educational institutions .

The Saudi Arabia ATM Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, Diebold Nixdorf, GRG Banking Equipment Co., Ltd., Hyosung TNS, Abana Enterprises Group, Hamrani Universal Company, G4S Al Majal, Arabian Security & Safety Services Company (AMNCO), Sanid Organization, Hemaia Group, Cennox, TMD Security, ACI Worldwide, Euronet Worldwide, Inc., Cardtronics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ATM managed services market in Saudi Arabia appears promising, driven by ongoing technological advancements and a strong push towards digital banking. As the government continues to support financial inclusion initiatives, the demand for integrated ATM solutions is expected to rise. Additionally, the increasing focus on customer experience will likely lead to the adoption of innovative features, enhancing service delivery and operational efficiency in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | On-site ATMs Managed Services Off-site ATMs Managed Services Mobile ATMs Managed Services Cash Management Services ATM Site Maintenance ATM Repair & Maintenance Services Other Value-Added Services |

| By End-User | Banks Financial Institutions Retailers Government Agencies Hospitality Sector Others |

| By Application | Cash Withdrawal Balance Inquiry Fund Transfer Bill Payment Others |

| By Service Model | Full-Service ATM Management Transaction Processing Services Remote Monitoring Services Cash Replenishment & Logistics Security & Anti-Skimming Services Others |

| By Distribution Channel | Direct Sales Online Sales Third-party Distributors Partnerships with Financial Institutions Others |

| By Pricing Model | Subscription-based Pricing Pay-per-transaction Pricing Flat-rate Pricing Others |

| By Customer Segment | Individual Customers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Management | 100 | ATM Operations Managers, Bank Executives |

| Third-party ATM Service Providers | 60 | Service Delivery Managers, Business Development Heads |

| Financial Technology Consultants | 40 | Consultants, Industry Analysts |

| Regulatory Bodies and Compliance Officers | 40 | Regulatory Affairs Managers, Compliance Officers |

| End-user Experience and Satisfaction | 80 | Bank Customers, User Experience Researchers |

The Saudi Arabia ATM Managed Services Market is valued at approximately USD 1.1 billion, reflecting a robust growth driven by the increasing adoption of digital banking services and the expansion of the ATM network across the country.