Region:Europe

Author(s):Geetanshi

Product Code:KRAB4031

Pages:83

Published On:October 2025

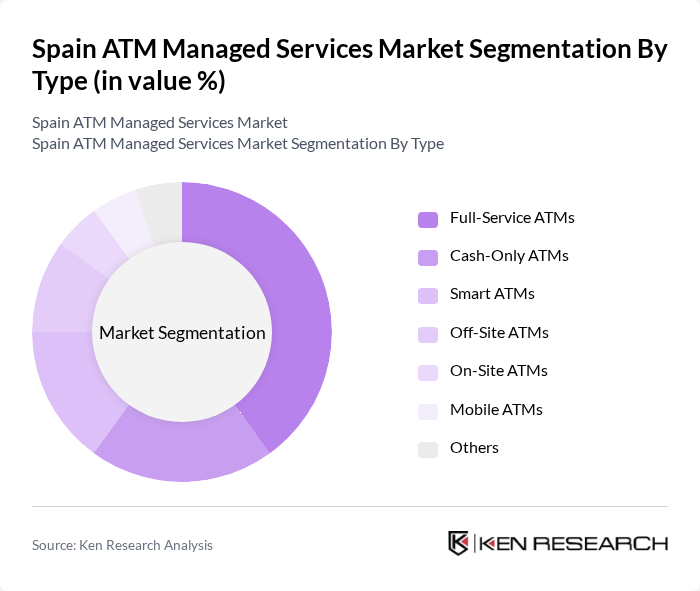

By Type:The market is segmented into Full-Service ATMs, Cash-Only ATMs, Smart ATMs, Off-Site ATMs, On-Site ATMs, Mobile ATMs, and Others. Full-Service ATMs lead the market, offering multifunctional capabilities such as cash withdrawals, deposits, bill payments, and cardless transactions. The growing consumer preference for convenience and comprehensive banking solutions drives the adoption of these ATMs, while Smart ATMs are gaining traction due to their enhanced security and digital features.

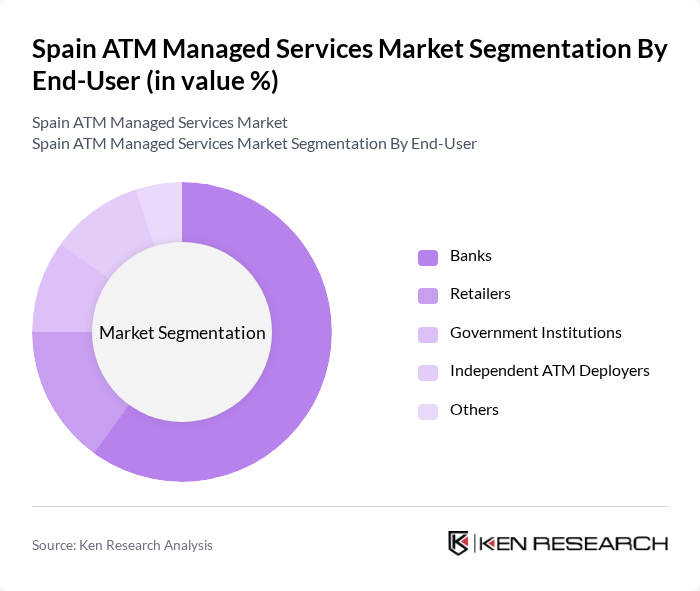

By End-User:The end-user segmentation includes Banks, Retailers, Government Institutions, Independent ATM Deployers, and Others. Banks remain the dominant end-user segment, as they are the primary providers of ATM services and continue to invest in upgrading their ATM networks with advanced security and digital functionalities. The competitive drive among banks to enhance customer experience and expand ATM accessibility has led to increased deployments, solidifying their market leadership.

The Spain ATM Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, Diebold Nixdorf, GRG Banking Equipment, Hitachi-Omron Terminal Solutions, Wincor Nixdorf, Fujitsu Limited, TMD Security, Cennox, Cardtronics, Euronet Worldwide, S1 Corporation, ACI Worldwide, KAL ATM Software, CashTech Currency Services, Talaris Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain ATM managed services market appears promising, driven by ongoing technological advancements and a shift towards contactless transactions. As consumer preferences evolve, the integration of digital payment solutions will likely enhance service offerings. Additionally, the focus on improving customer experience through innovative ATM features will be crucial. Financial institutions are expected to prioritize partnerships with technology providers to stay competitive and address emerging market demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service ATMs Cash-Only ATMs Smart ATMs Off-Site ATMs On-Site ATMs Mobile ATMs Others |

| By End-User | Banks Retailers Government Institutions Independent ATM Deployers Others |

| By Service Type | Maintenance Services Cash Management Services Software Management Services Security Services Transaction Monitoring Services ATM Replenishment and Currency Management Incident Management Network Management |

| By Payment Method | Card-Based Transactions Mobile Wallet Transactions Contactless Payments Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Customer Segment | Individual Customers Small Businesses Large Enterprises Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Flat Rate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 120 | ATM Operations Managers, Operations Directors |

| Retail ATM Services | 100 | Retail Managers, Financial Service Providers |

| Technology Providers for ATMs | 80 | Product Managers, Technical Directors |

| Consumer Usage Patterns | 120 | Bank Customers, Financial Advisors |

| Regulatory Impact Assessment | 60 | Compliance Officers, Regulatory Analysts |

The Spain ATM Managed Services Market is valued at approximately USD 1.1 billion, reflecting its significant role within the broader European ATM managed services sector, driven by increasing demand for cash withdrawal services and advancements in ATM technology.