Region:Asia

Author(s):Shubham

Product Code:KRAA6488

Pages:97

Published On:September 2025

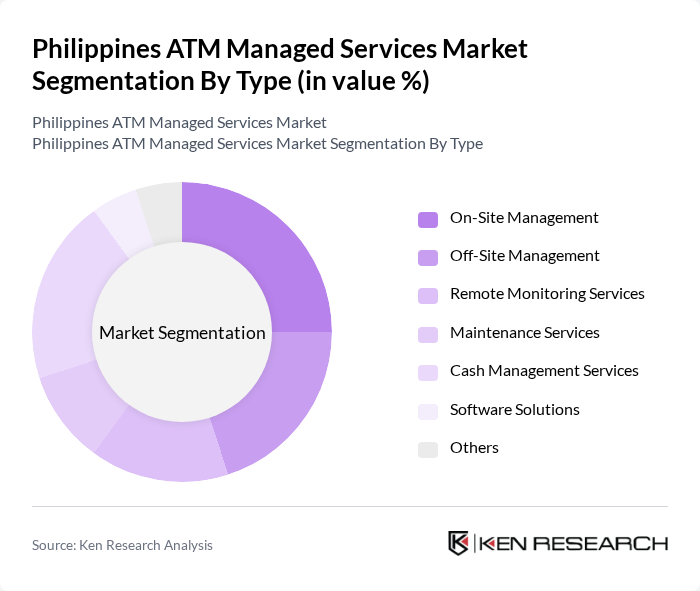

By Type:The market can be segmented into various types of services that cater to different operational needs. The subsegments include On-Site Management, Off-Site Management, Remote Monitoring Services, Maintenance Services, Cash Management Services, Software Solutions, and Others. Each of these subsegments plays a crucial role in ensuring the efficient operation of ATMs across the country.

The On-Site Management subsegment is currently dominating the market due to the increasing need for direct oversight and maintenance of ATMs. Banks and financial institutions prefer on-site management to ensure that their machines are operational and secure, which directly impacts customer satisfaction and service reliability. The trend towards enhanced customer service and operational efficiency has led to a significant investment in on-site management solutions, making it the leading subsegment in the market.

By End-User:The market is segmented based on the end-users of ATM managed services, which include Banks, Credit Unions, Retailers, Government Agencies, and Others. Each end-user category has distinct requirements and preferences for ATM services, influencing the overall market dynamics.

Banks are the primary end-users of ATM managed services, accounting for a significant portion of the market. This dominance is attributed to the extensive ATM networks operated by banks, which require comprehensive management services to ensure functionality and security. The increasing competition among banks to provide superior customer service and accessibility further drives the demand for efficient ATM management solutions.

The Philippines ATM Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as BancNet, Inc., Megalink, Inc., UnionBank of the Philippines, RCBC (Rizal Commercial Banking Corporation), BDO Unibank, Inc., Philippine National Bank (PNB), Land Bank of the Philippines, EastWest Banking Corporation, Security Bank Corporation, China Banking Corporation, Metrobank (Metropolitan Bank & Trust Company), Philippine Bank of Communications, Sterling Bank of Asia, Asia United Bank, Union Bank of the Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines ATM managed services market appears promising, driven by technological innovations and a growing preference for cashless transactions. As financial institutions increasingly adopt managed services to enhance operational efficiency, the integration of AI and machine learning will likely optimize ATM performance and security. Additionally, the government's commitment to improving financial inclusion will further stimulate ATM deployment, particularly in underserved regions, creating a robust environment for growth and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Site Management Off-Site Management Remote Monitoring Services Maintenance Services Cash Management Services Software Solutions Others |

| By End-User | Banks Credit Unions Retailers Government Agencies Others |

| By Service Model | Full-Service Management Hybrid Model Self-Service Model Others |

| By Geographic Coverage | Urban Areas Rural Areas Regional Coverage National Coverage |

| By Payment Type | Cash Withdrawals Balance Inquiries Fund Transfers Bill Payments Others |

| By Customer Segment | Individual Customers Small Businesses Corporates Government Entities |

| By Pricing Model | Subscription-Based Pay-Per-Use Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 150 | ATM Managers, Operations Directors |

| Retail ATM Usage | 100 | Retail Managers, Customer Experience Officers |

| ATM Service Providers | 80 | Business Development Managers, Technical Support Leads |

| Consumer ATM User Experience | 120 | Regular ATM Users, Financial Service Customers |

| Regulatory Impact on ATM Services | 60 | Compliance Officers, Regulatory Affairs Managers |

The Philippines ATM Managed Services Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing adoption of digital banking services and the expansion of the ATM network across the country.