Region:Europe

Author(s):Dev

Product Code:KRAB4241

Pages:90

Published On:October 2025

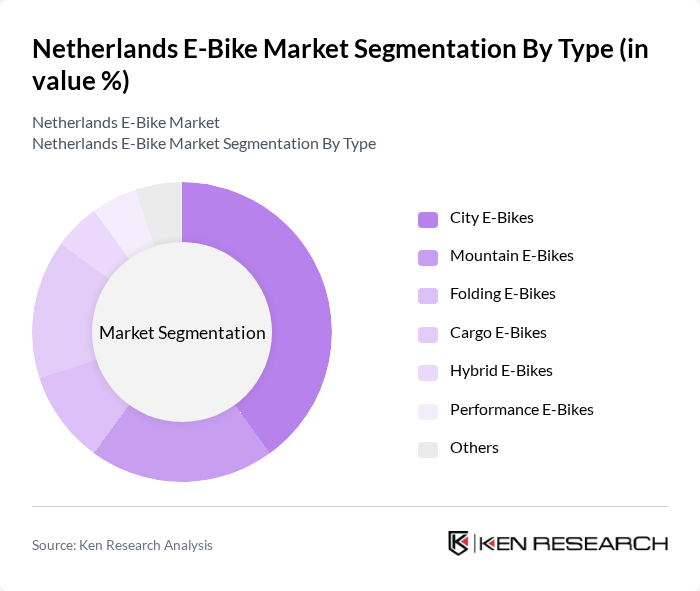

By Type:The e-bike market can be segmented into various types, including City E-Bikes, Mountain E-Bikes, Folding E-Bikes, Cargo E-Bikes, Hybrid E-Bikes, Performance E-Bikes, and Others. City E-Bikes are particularly popular due to their practicality for urban commuting, while Mountain E-Bikes cater to outdoor enthusiasts. Folding E-Bikes offer convenience for those with limited storage space, and Cargo E-Bikes are increasingly used for deliveries. Hybrid and Performance E-Bikes appeal to a niche market focused on versatility and high performance.

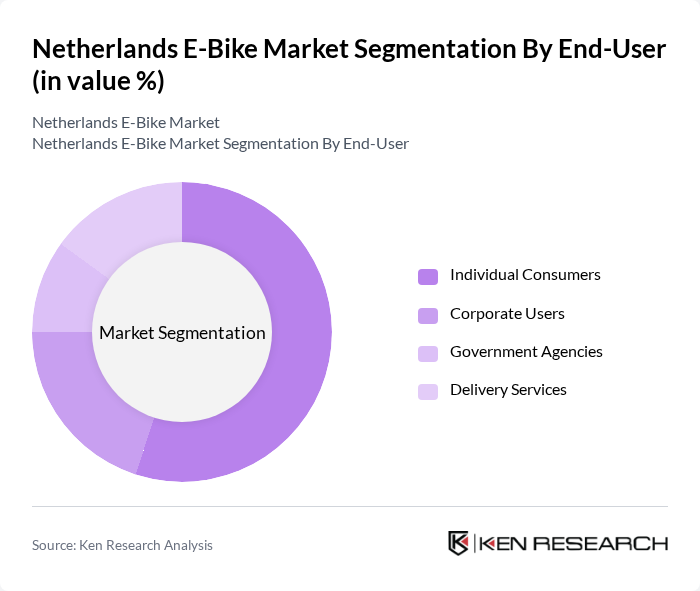

By End-User:The e-bike market is segmented by end-users, including Individual Consumers, Corporate Users, Government Agencies, and Delivery Services. Individual consumers represent the largest segment, driven by the growing trend of personal mobility solutions. Corporate users are increasingly adopting e-bikes for employee commuting programs, while government agencies promote e-bikes for public transport integration. Delivery services are also leveraging e-bikes for efficient last-mile delivery solutions.

The Netherlands E-Bike Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accell Group N.V., Gazelle, Koga, Batavus, Riese & Müller, Trek Bicycle Corporation, Giant Bicycles, Specialized Bicycle Components, Bulls Bikes, Haibike, Cube Bikes, Shimano Inc., Bosch eBike Systems, Panasonic Corporation, Yamaha Motor Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-bike market in the Netherlands appears promising, driven by increasing urbanization and government support for sustainable transport. As more consumers prioritize health and eco-friendly commuting options, e-bike adoption is expected to rise. Additionally, advancements in battery technology and the expansion of e-bike sharing programs will likely enhance accessibility. The integration of smart technologies into e-bikes will further attract tech-savvy consumers, solidifying the Netherlands' position as a leader in the e-bike market.

| Segment | Sub-Segments |

|---|---|

| By Type | City E-Bikes Mountain E-Bikes Folding E-Bikes Cargo E-Bikes Hybrid E-Bikes Performance E-Bikes Others |

| By End-User | Individual Consumers Corporate Users Government Agencies Delivery Services |

| By Sales Channel | Online Retail Brick-and-Mortar Stores E-Bike Rentals Direct Sales |

| By Price Range | Budget E-Bikes Mid-Range E-Bikes Premium E-Bikes |

| By Battery Type | Lithium-Ion Batteries Lead-Acid Batteries Nickel-Metal Hydride Batteries |

| By Usage | Commuting Leisure Delivery |

| By Region | North Holland South Holland North Brabant Gelderland Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer E-Bike Purchases | 150 | Urban Commuters, Recreational Cyclists |

| Retailer Insights | 100 | Store Managers, Sales Representatives |

| Government Policy Impact | 80 | Transportation Officials, Policy Makers |

| Infrastructure Development | 70 | Urban Planners, Civil Engineers |

| Consumer Attitudes Towards E-Bikes | 120 | General Public, Environmental Advocates |

The Netherlands E-Bike Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by urbanization, sustainable transportation trends, and government initiatives promoting electric mobility.