Region:Asia

Author(s):Dev

Product Code:KRAA6563

Pages:80

Published On:January 2026

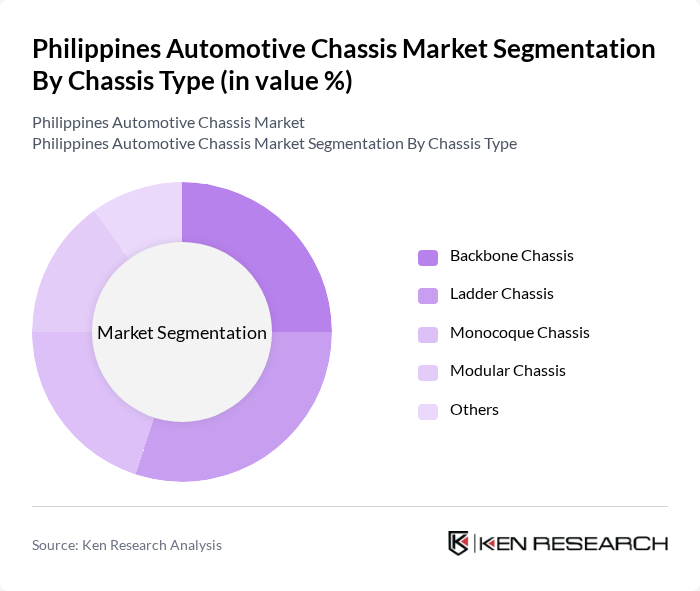

By Chassis Type:The chassis type segmentation includes Backbone Chassis, Ladder Chassis, Monocoque Chassis, Modular Chassis, and Others. The Backbone Chassis is known for its simplicity and strength, making it popular in commercial vehicles. The Ladder Chassis is favored for its robustness, particularly in trucks and SUVs. Monocoque Chassis is increasingly used in passenger cars due to its lightweight and fuel efficiency properties, with the global monocoque chassis segment valued at approximately USD 30 billion. Modular Chassis is gaining traction for its flexibility in design and manufacturing.

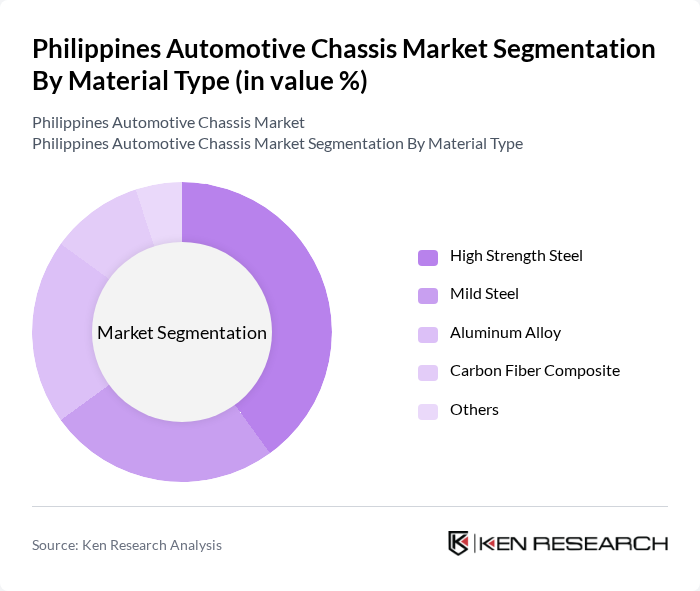

By Material Type:The material type segmentation includes High Strength Steel, Mild Steel, Aluminum Alloy, Carbon Fiber Composite, and Others. High Strength Steel is widely used due to its durability and cost-effectiveness. Mild Steel is common in lower-end vehicles, while Aluminum Alloy is preferred for its lightweight properties, enhancing fuel efficiency. Carbon Fiber Composite is emerging in high-performance vehicles due to its strength-to-weight ratio.

The Philippines Automotive Chassis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Philippines Corporation, Mitsubishi Motors Philippines Corporation, Honda Cars Philippines, Inc., Isuzu Philippines Corporation, Ford Motor Company Philippines, Nissan Philippines, Inc., Suzuki Philippines, Inc., Hyundai Asia Resources, Inc., Foton Motor Philippines, Inc., Hino Motors Philippines, Inc., Changan Automobile Philippines, BAIC Philippines, Inc., JAC Motors Philippines, Geely Philippines, Volkswagen Philippines, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines automotive chassis market is poised for significant transformation driven by technological advancements and evolving consumer preferences. The shift towards electric vehicles is expected to reshape chassis design, emphasizing lightweight materials and smart technologies. Additionally, the government's focus on local manufacturing and infrastructure development will create a conducive environment for growth. As the market adapts to these trends, manufacturers will need to innovate and collaborate to remain competitive and meet emerging demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Chassis Type | Backbone Chassis Ladder Chassis Monocoque Chassis Modular Chassis Others |

| By Material Type | High Strength Steel Mild Steel Aluminum Alloy Carbon Fiber Composite Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Others |

| By Electric Vehicle Type | Battery Electric Vehicle (BEV) Hybrid Electric Vehicle (HEV) Plug-in Hybrid Electric Vehicle (PHEV) Others |

| By Propulsion Type | Internal Combustion Engine (ICE) Electric Vehicle Others |

| By Distribution Channel | Direct Sales to OEMs Distributors and Dealers Aftermarket Suppliers Others |

| By Region | Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Chassis Manufacturers | 45 | Production Managers, Quality Assurance Leads |

| Automotive Component Suppliers | 40 | Supply Chain Managers, Procurement Specialists |

| Vehicle Assembly Plants | 35 | Operations Directors, Engineering Managers |

| Automotive Regulatory Bodies | 30 | Policy Makers, Compliance Officers |

| Automotive Research Institutions | 40 | Research Analysts, Automotive Engineers |

The Philippines Automotive Chassis Market is valued at approximately USD 1.3 billion, reflecting growth driven by increasing vehicle demand, rising disposable incomes, and government initiatives to enhance local manufacturing and infrastructure.