Region:Asia

Author(s):Dev

Product Code:KRAA5316

Pages:89

Published On:January 2026

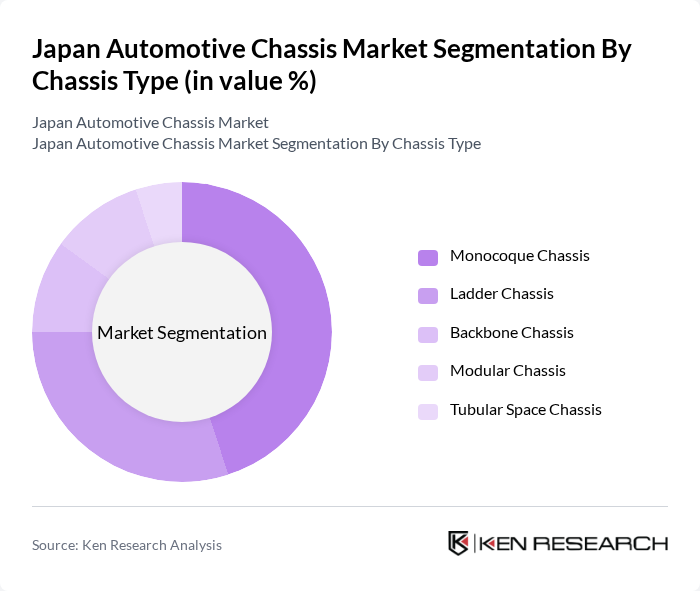

By Chassis Type:The chassis type segment includes various designs that cater to different vehicle requirements. The dominant sub-segment is the Monocoque Chassis, which is favored for its lightweight and structural integrity, making it ideal for passenger vehicles. The Ladder Chassis is also significant, particularly in commercial vehicles, due to its robustness and ease of repair. Modular Chassis platforms represent high-growth opportunities, with anticipated growth exceeding 22% driven by electrification and digitalization trends, enabling efficient accommodation of large battery packs and streamlined production across multiple models. Tubular Space Chassis continue to gain traction as manufacturers seek flexibility in production and design.

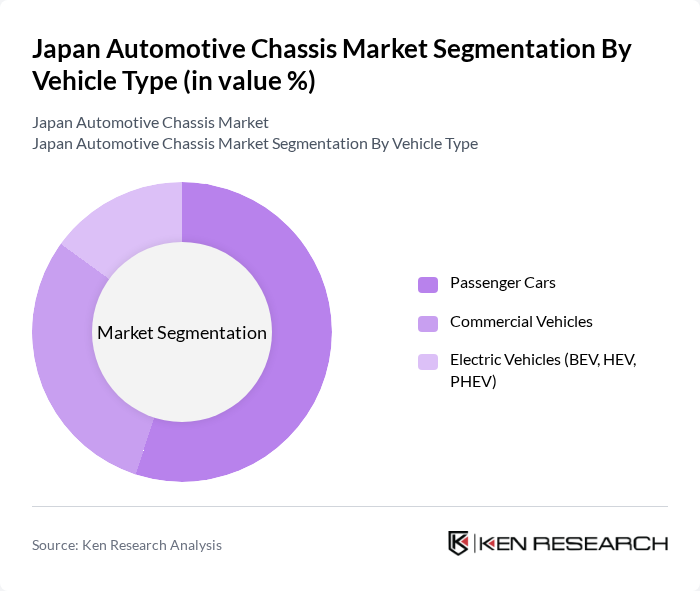

By Vehicle Type:The vehicle type segment encompasses various categories, with Passenger Cars leading the market due to their high production volumes and consumer demand, historically commanding over 60% of the total market share. Commercial Vehicles follow closely, driven by the need for logistics and transportation solutions, with particular strength in regions with growing logistics needs and rugged terrain. Electric Vehicles (BEV, HEV, PHEV) are rapidly emerging as a significant segment, reflecting the shift towards sustainable transportation and the increasing adoption of electric mobility solutions, supported by advanced chassis architectures designed to house large battery packs efficiently.

The Japan Automotive Chassis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Subaru Corporation, Mazda Motor Corporation, Mitsubishi Motors Corporation, Isuzu Motors Ltd., Suzuki Motor Corporation, Daihatsu Motor Co., Ltd., Hino Motors, Ltd., Aisin Seiki Co., Ltd., Denso Corporation, Hitachi Automotive Systems, Ltd., NTN Corporation, JTEKT Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan automotive chassis market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt modular chassis systems, production efficiency is expected to improve significantly. Furthermore, the integration of smart manufacturing technologies will enhance operational capabilities, allowing for real-time monitoring and optimization. The rise of electric and autonomous vehicles will also create new opportunities for innovation, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Chassis Type | Monocoque Chassis Ladder Chassis Backbone Chassis Modular Chassis Tubular Space Chassis |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles (BEV, HEV, PHEV) |

| By Material | Steel Aluminum Alloy Carbon Fiber Composite |

| By Component Type | Control Arms Tie-Rods Stabilizer Links Suspension Ball Joints Cross-Axis Joints Knuckles and Hubs |

| By Chassis System | Front Axle Rear Axle Corner Modules Active Kinematics Control |

| By Sales Channel | Direct Sales to OEMs Aftermarket Distributors Online Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Chassis Manufacturers | 45 | Production Managers, Quality Assurance Leads |

| Commercial Vehicle Chassis Suppliers | 38 | Supply Chain Managers, Procurement Specialists |

| Electric Vehicle Chassis Innovators | 32 | R&D Engineers, Product Development Managers |

| Chassis Component Material Suppliers | 28 | Sales Directors, Technical Support Engineers |

| Automotive Design Consultants | 22 | Lead Designers, Engineering Consultants |

The Japan Automotive Chassis Market is valued at approximately USD 18 billion, driven by the demand for lightweight and fuel-efficient vehicles, advancements in automotive technology, and the rising trend of electric vehicles requiring innovative chassis designs.