Region:Middle East

Author(s):Dev

Product Code:KRAA5312

Pages:84

Published On:January 2026

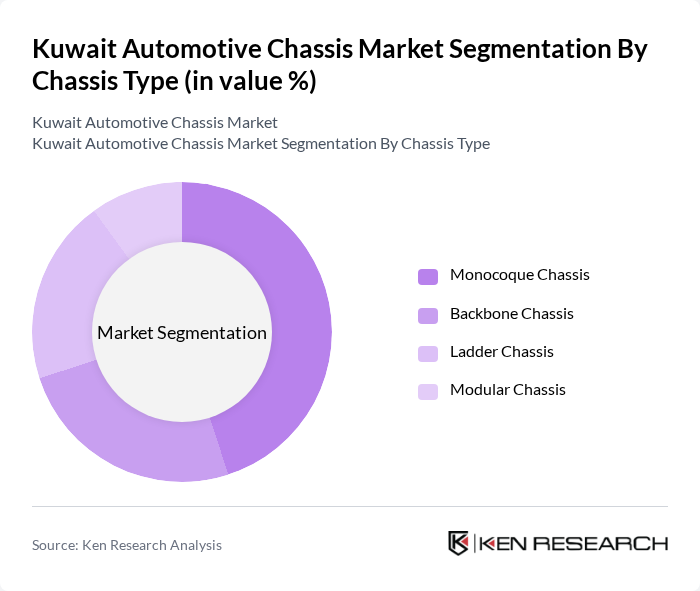

By Chassis Type:The chassis type segmentation includes Monocoque Chassis, Backbone Chassis, Ladder Chassis, and Modular Chassis. Among these, the Monocoque Chassis is currently leading the market due to its lightweight design and structural efficiency, which enhances vehicle performance and fuel economy. The increasing adoption of passenger cars and light commercial vehicles utilizing this chassis type is a significant factor driving its dominance. The Backbone Chassis is also gaining traction, particularly in utility vehicles, due to its robustness and ease of manufacturing.

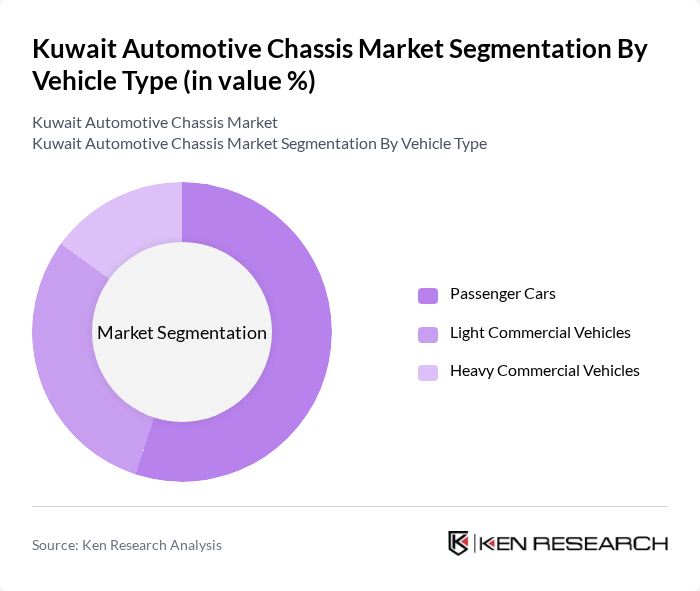

By Vehicle Type:The vehicle type segmentation encompasses Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. Passenger Cars dominate the market, driven by the increasing consumer preference for personal vehicles and the growing urban population. The rise in disposable income and changing lifestyles have led to a surge in demand for passenger cars, which in turn boosts the demand for automotive chassis. Light Commercial Vehicles are also witnessing growth, particularly in logistics and delivery services, while Heavy Commercial Vehicles are essential for the transportation of goods across the region.

The Kuwait Automotive Chassis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Automotive Industries Company, Alghanim Industries, Al-Futtaim Group, Al-Mansour Automotive, Al-Sayer Group, Al-Majed Group, Al-Jazeera Automotive, Al-Muhaidib Group, Al-Qatami Global for General Trading and Contracting, Al-Homaizi Group, Al-Muhanna Group, Al-Sabhan Group, Al-Khaldi Group, Al-Mutawa Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait automotive chassis market appears promising, driven by technological advancements and a growing emphasis on sustainability. As the government continues to invest in EV infrastructure and local manufacturing initiatives, the market is likely to see increased collaboration between local and international manufacturers. Additionally, the integration of smart technologies and modular designs will enhance vehicle performance and customization options, positioning Kuwait as a competitive player in the regional automotive landscape.

| Segment | Sub-Segments |

|---|---|

| By Chassis Type | Monocoque Chassis Backbone Chassis Ladder Chassis Modular Chassis |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles |

| By Material | Steel Aluminum Alloy Carbon Fiber Composite |

| By Electric Vehicle Type | Battery Electric Vehicle (BEV) Hybrid Electric Vehicle (HEV) Plug-in Hybrid Electric Vehicle (PHEV) |

| By Region | Urban Areas Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Chassis Manufacturers | 120 | Production Managers, Quality Assurance Engineers |

| Commercial Vehicle Chassis Suppliers | 100 | Supply Chain Managers, Procurement Specialists |

| Electric Vehicle Chassis Innovators | 80 | R&D Engineers, Product Development Managers |

| Automotive Component Distributors | 90 | Sales Directors, Market Analysts |

| Regulatory Bodies and Industry Associations | 60 | Policy Makers, Industry Advocates |

The Kuwait Automotive Chassis Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increasing vehicle demand, advancements in automotive technology, and a focus on lightweight materials for improved fuel efficiency.