Region:Global

Author(s):Shubham

Product Code:KRAD2564

Pages:94

Published On:January 2026

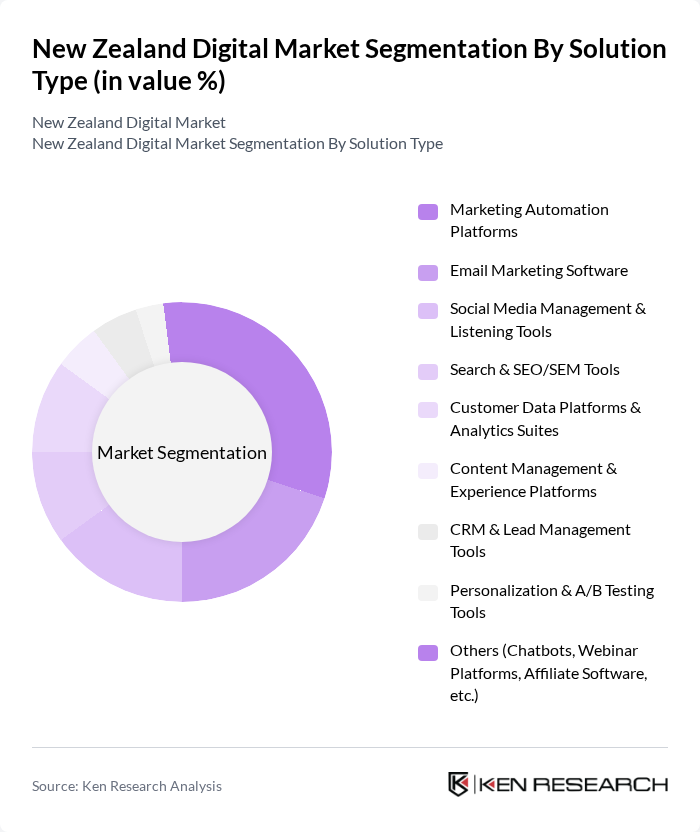

By Solution Type:The solution type segmentation includes various subsegments such as Marketing Automation Platforms, Email Marketing Software, Social Media Management & Listening Tools, Search & SEO/SEM Tools, Customer Data Platforms & Analytics Suites, Content Management & Experience Platforms, CRM & Lead Management Tools, Personalization & A/B Testing Tools, and Others (Chatbots, Webinar Platforms, Affiliate Software, etc.). This reflects the typical structure of global digital marketing software stacks, where automation, analytics, social, search, and CRM tools form the core application categories used by enterprises. Among these, Marketing Automation Platforms are increasingly prominent in New Zealand as organisations look to orchestrate omnichannel campaigns, score and nurture leads, and deliver personalized communication at scale using email, social, and in-app messaging.

By Deployment Mode:The deployment mode segmentation includes Cloud / SaaS, On-Premise, and Hybrid. The Cloud / SaaS model is dominating the market due to its flexibility, scalability, and subscription-based cost structure, aligning with the strong shift toward enterprise SaaS and cloud software adoption observed in New Zealand’s software and digital marketplace segments. This model is particularly appealing to small and medium enterprises looking to enhance their digital marketing capabilities without substantial upfront capital expenditure, and to integrate marketing tools rapidly with e-commerce platforms, CRM, and analytics solutions.

The New Zealand Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as HubSpot, Salesforce Marketing Cloud, Adobe Experience Cloud, Mailchimp, ActiveCampaign, Klaviyo, Hootsuite, Sprout Social, SEMrush, Google Marketing Platform (including Google Ads & Analytics), Meta Ads (Facebook & Instagram), LinkedIn Marketing Solutions, Canva, Local NZ SaaS Providers (e.g., Vend, Timely, Xero Ecosystem Apps), Others (Specialized Niche & Vertical Solutions) contribute to innovation, geographic expansion, and service delivery in this space, addressing a highly digitised user base where social media and online platforms reach the majority of the population.

The New Zealand digital market is poised for continued growth, driven by advancements in technology and changing consumer preferences. As businesses increasingly adopt AI-driven marketing solutions, the focus on personalized customer experiences will intensify. Additionally, the integration of sustainable practices in digital marketing strategies is expected to resonate with environmentally conscious consumers. Companies that adapt to these trends will likely enhance their market positioning and drive innovation in the digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Marketing Automation Platforms Email Marketing Software Social Media Management & Listening Tools Search & SEO/SEM Tools Customer Data Platforms & Analytics Suites Content Management & Experience Platforms CRM & Lead Management Tools Personalization & A/B Testing Tools Others (Chatbots, Webinar Platforms, Affiliate Software, etc.) |

| By Deployment Mode | Cloud / SaaS On-Premise Hybrid |

| By Application | Campaign Management Lead Generation & Nurturing Customer Acquisition & Onboarding Customer Engagement & Retention Analytics, Reporting & Attribution E-commerce & Performance Marketing Others |

| By End-User Enterprise Size | Micro and Small Businesses Medium Enterprises Large Enterprises |

| By Industry Vertical | Retail & E-commerce Banking, Financial Services & Insurance (BFSI) IT & Telecom Healthcare & Life Sciences Education Travel, Tourism & Hospitality Government & Public Sector Media, Entertainment & Gaming Others |

| By Channel / Touchpoint | Search (SEO & Paid Search) Social Media Display & Programmatic Mobile & In-App Marketplaces & Affiliate Networks Others (SMS, Direct Messaging, etc.) |

| By Buyer Type | Agencies Brand/Advertiser In-house Teams System Integrators & IT Service Providers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer E-commerce Behavior | 120 | Online Shoppers, Digital Natives |

| SME Digital Adoption | 100 | Business Owners, IT Managers |

| Digital Marketing Strategies | 80 | Marketing Directors, Brand Managers |

| Online Payment Systems | 70 | Finance Officers, E-commerce Managers |

| Social Media Engagement | 90 | Social Media Managers, Content Creators |

The New Zealand Digital Marketing Software market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the adoption of digital marketing strategies, the expansion of digital marketplaces, and the increasing importance of data analytics and AI in marketing.