Region:Global

Author(s):Rebecca

Product Code:KRAA6437

Pages:85

Published On:January 2026

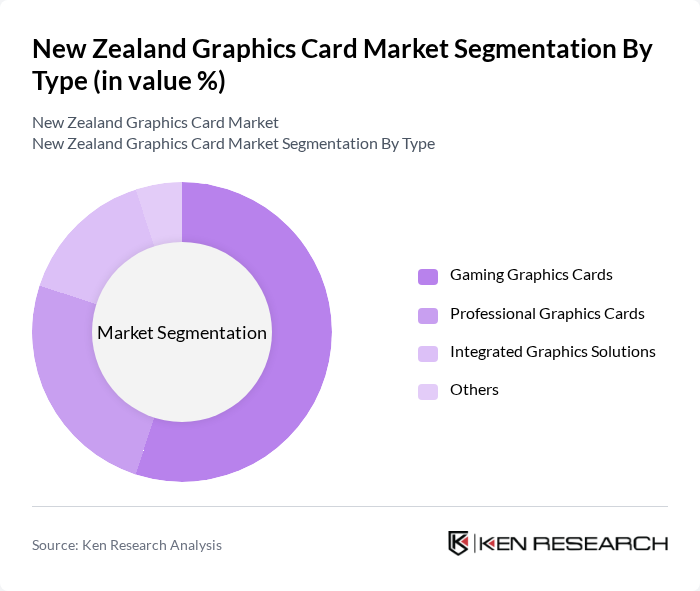

By Type:The market is segmented into various types of graphics cards, including Gaming Graphics Cards, Professional Graphics Cards, Integrated Graphics Solutions, and Others. Gaming Graphics Cards dominate the market due to the increasing popularity of gaming and the demand for high-performance hardware. The rise of competitive gaming and streaming has led to a surge in consumer interest in powerful graphics solutions that enhance gaming experiences. Professional Graphics Cards are also significant, catering to industries such as graphic design and video editing, where high-quality visuals are essential.

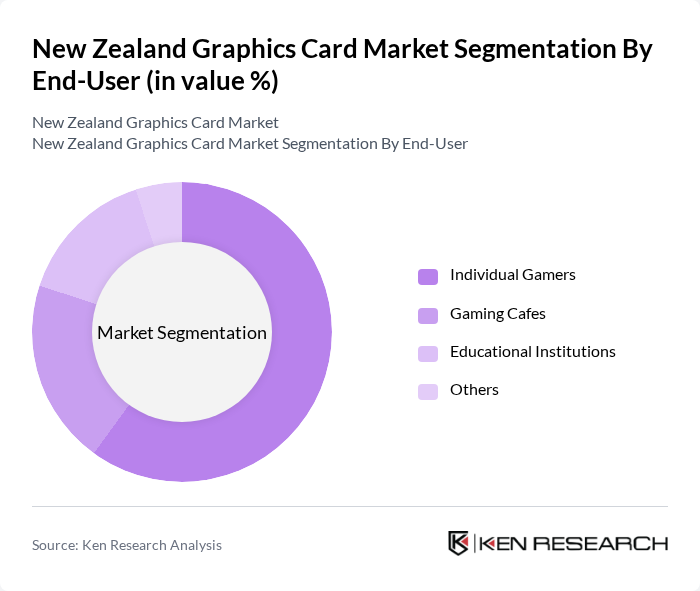

By End-User:The end-user segmentation includes Individual Gamers, Gaming Cafes, Educational Institutions, and Others. Individual Gamers represent the largest segment, driven by the growing gaming culture and the increasing number of gamers seeking high-performance graphics for immersive experiences. Gaming Cafes also contribute significantly, as they provide access to advanced gaming setups for users who may not own high-end hardware. Educational Institutions are increasingly adopting graphics cards for design and engineering programs, further expanding the market.

The New Zealand Graphics Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, AMD (Advanced Micro Devices), Intel Corporation, ASUS, MSI (Micro-Star International), Gigabyte Technology, EVGA Corporation, Zotac, PNY Technologies, Sapphire Technology, Palit Microsystems, XFX, Colorful Technology, Inno3D, PowerColor contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand graphics card market is poised for continued growth, driven by technological advancements and increasing consumer demand for high-performance computing. As cloud gaming and virtual reality applications gain traction, the need for powerful graphics solutions will intensify. Additionally, manufacturers are likely to focus on sustainability, developing eco-friendly graphics solutions to meet consumer preferences. The collaboration between tech companies and gaming developers will further enhance product offerings, ensuring a dynamic and competitive market landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Gaming Graphics Cards Professional Graphics Cards Integrated Graphics Solutions Others |

| By End-User | Individual Gamers Gaming Cafes Educational Institutions Others |

| By Brand | NVIDIA AMD Intel Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Application | Gaming Graphic Design Video Editing Others |

| By Performance Level | Entry-Level Mid-Range High-End Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gaming Enthusiasts | 120 | PC Gamers, Streamers, eSports Participants |

| Professional Users | 100 | Graphic Designers, Video Editors, 3D Modelers |

| Retail Sector Insights | 80 | Store Managers, Sales Representatives |

| Tech Influencers and Reviewers | 60 | Bloggers, YouTubers, Social Media Influencers |

| IT Procurement Officers | 70 | Corporate Buyers, IT Managers |

The New Zealand Graphics Card Market is valued at approximately USD 35 million, reflecting a growing demand for high-performance computing in sectors such as gaming, graphic design, and video editing.