Region:Middle East

Author(s):Rebecca

Product Code:KRAA6433

Pages:93

Published On:January 2026

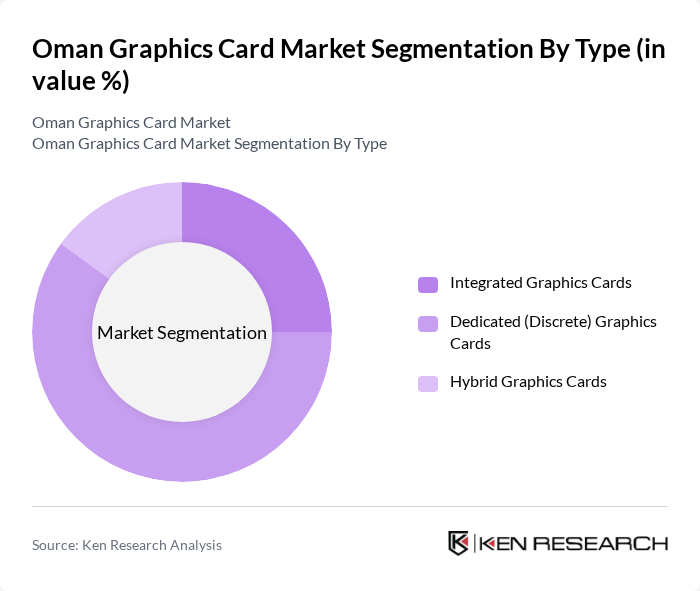

By Type:The market is segmented into Integrated Graphics Cards, Dedicated (Discrete) Graphics Cards, and Hybrid Graphics Cards. Among these, Dedicated Graphics Cards dominate the market due to their superior performance in gaming and professional applications. The increasing demand for high-resolution gaming and graphic-intensive applications has led consumers to prefer dedicated solutions over integrated options. Integrated graphics are often used in budget systems, while hybrid cards are gaining traction for their versatility.

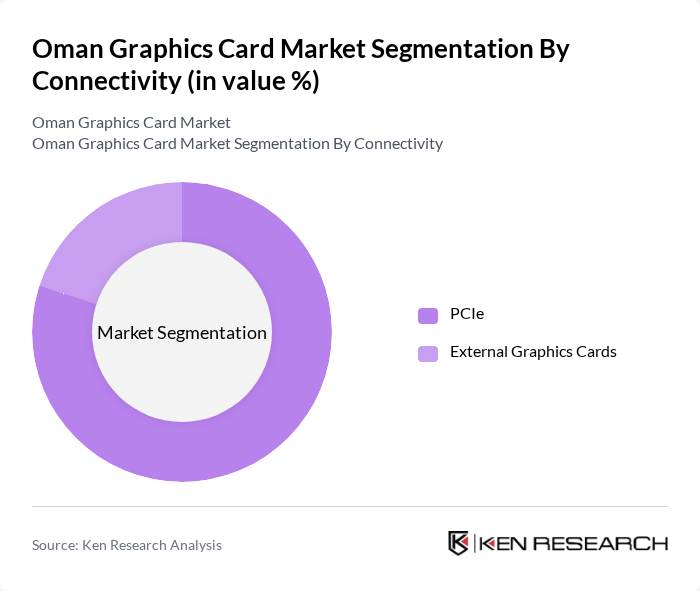

By Connectivity:The market is divided into PCIe and External Graphics Cards. PCIe graphics cards are the most widely used due to their high bandwidth and performance capabilities, making them the preferred choice for gamers and professionals. External graphics cards are gaining popularity among users who require portability and flexibility, particularly in laptop setups. However, the overall market is still heavily dominated by PCIe solutions, which are integral to most desktop systems.

The Oman Graphics Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, AMD (Advanced Micro Devices), Intel Corporation, ASUS, MSI (Micro-Star International), Gigabyte Technology, EVGA Corporation, Zotac, PNY Technologies, Sapphire Technology, Palit Microsystems, XFX, Colorful Technology, Inno3D, PowerColor contribute to innovation, geographic expansion, and service delivery in this space.

The Oman graphics card market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the demand for high-performance gaming and graphic-intensive applications continues to rise, manufacturers are likely to innovate and introduce more efficient products. Additionally, the growing interest in cloud gaming and AI-driven graphics processing will shape the future landscape, creating new opportunities for market players to capitalize on emerging trends and consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Integrated Graphics Cards Dedicated (Discrete) Graphics Cards Hybrid Graphics Cards |

| By Connectivity | PCIe External Graphics Cards |

| By Interface | PCI Express 4.0 PCI Express 5.0 |

| By Cooling Type | Air-Cooled Liquid-Cooled |

| By Memory Type | GDDR6 GDDR6X HBM2 HBM3 |

| By Application | Gaming Data Center Professional Visualization |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gaming Community Insights | 120 | Gamers, Community Leaders, Influencers |

| Professional Graphics Users | 100 | Graphic Designers, Video Editors, Architects |

| Retailer Feedback | 80 | Store Managers, Sales Representatives |

| Tech Enthusiasts | 70 | IT Professionals, Hardware Reviewers |

| Distribution Channel Insights | 60 | Distributors, Wholesalers, Importers |

The Oman Graphics Card Market is valued at approximately USD 20 million, reflecting a growing demand for high-performance computing in gaming, data centers, and professional visualization applications.