Region:Asia

Author(s):Rebecca

Product Code:KRAA6435

Pages:99

Published On:January 2026

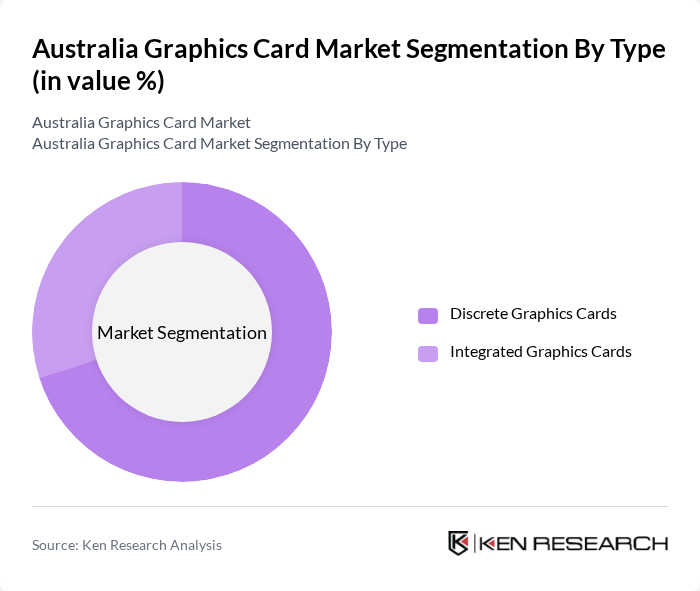

By Type:The market is segmented into discrete graphics cards and integrated graphics cards. Discrete graphics cards are typically preferred for high-performance tasks such as gaming and professional graphics work, while integrated graphics cards are commonly used in budget-friendly devices and casual computing. The discrete graphics card segment is currently dominating the market due to the increasing demand for high-quality gaming experiences and professional applications that require superior graphics performance.

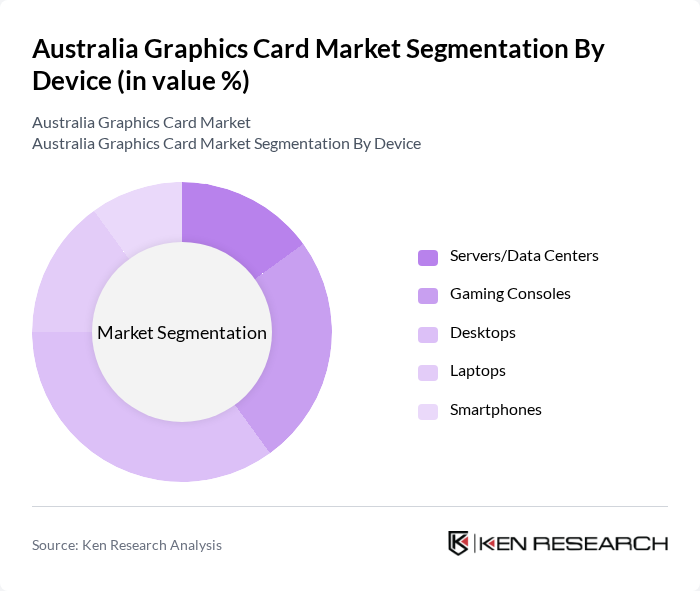

By Device:The market is categorized into servers/data centers, gaming consoles, desktops, laptops, and smartphones. Among these, desktops and gaming consoles are leading the market due to the growing popularity of PC gaming and the increasing performance requirements of modern games. The rise of remote work and online gaming has also boosted the demand for high-performance desktops, while gaming consoles continue to attract a dedicated user base.

The Australia Graphics Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, Advanced Micro Devices (AMD), Intel Corporation, Micron Technology Inc, Samsung Electronics Co Ltd, Qualcomm Inc, Imagination Technologies, Huawei Technologies, ASUS, MSI (Micro-Star International) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian graphics card market appears promising, driven by technological advancements and evolving consumer preferences. As gaming and AI applications continue to expand, manufacturers are likely to focus on developing more energy-efficient and powerful graphics solutions. Additionally, the increasing integration of graphics cards in cloud gaming platforms will further enhance accessibility and user experience. The market is expected to adapt to these trends, fostering innovation and collaboration among tech companies to meet the growing demands of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Discrete Graphics Cards Integrated Graphics Cards |

| By Device | Servers/Data Centers Gaming Consoles Desktops Laptops Smartphones |

| By Application | Gaming Content Creation and Multimedia Editing AI and Machine Learning Virtual Reality (VR) and Augmented Reality (AR) Data Visualization |

| By End-User | Gaming Enthusiasts Professionals Casual Users |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gaming Community Insights | 120 | Hardcore Gamers, Casual Gamers |

| Professional Graphics Users | 100 | Graphic Designers, Video Editors |

| Retail Market Feedback | 80 | Store Managers, Sales Associates |

| IT Professionals' Preferences | 70 | System Administrators, IT Managers |

| Consumer Electronics Trends | 90 | Tech Enthusiasts, Early Adopters |

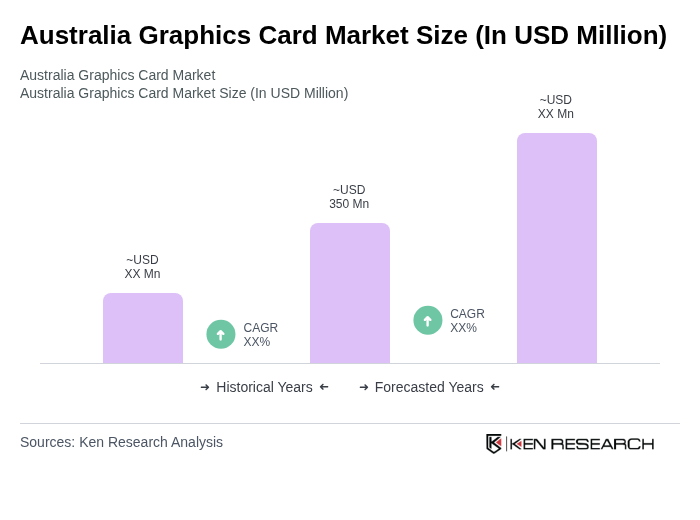

The Australia Graphics Card Market is valued at approximately USD 350 million, reflecting a robust growth trajectory driven by increasing demand for high-performance computing in gaming, content creation, and artificial intelligence applications.