Region:Middle East

Author(s):Rebecca

Product Code:KRAA6432

Pages:86

Published On:January 2026

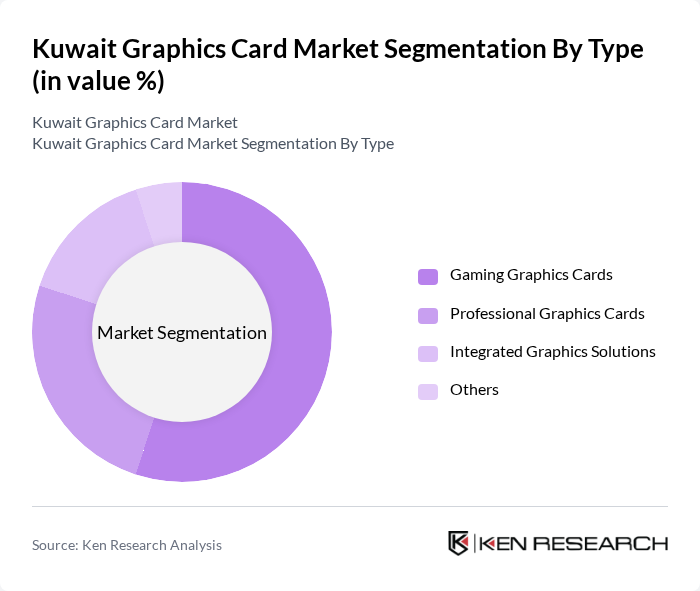

By Type:The market is segmented into various types of graphics cards, including Gaming Graphics Cards, Professional Graphics Cards, Integrated Graphics Solutions, and Others. Among these, Gaming Graphics Cards dominate the market due to the increasing popularity of gaming among the youth and the rise of competitive gaming events. The demand for high-performance gaming experiences drives consumers to invest in advanced graphics solutions, making this sub-segment the leading category.

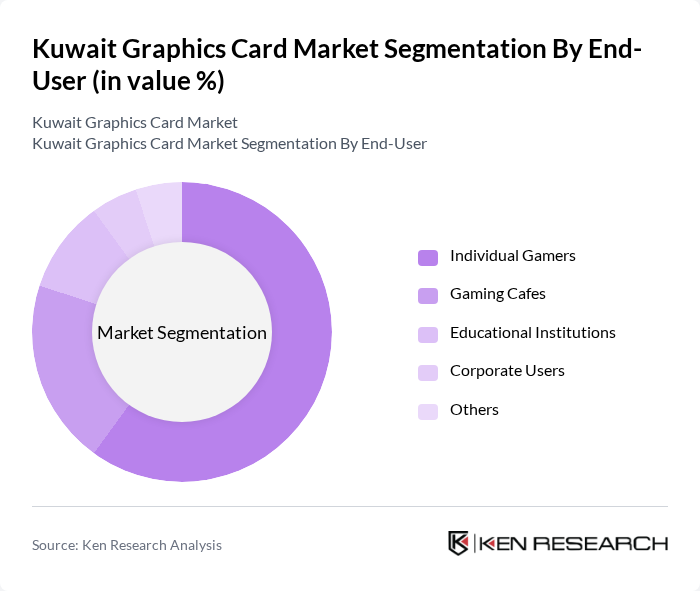

By End-User:The end-user segmentation includes Individual Gamers, Gaming Cafes, Educational Institutions, Corporate Users, and Others. Individual Gamers represent the largest segment, driven by the growing gaming community and the increasing availability of high-performance gaming titles. The trend of online gaming and streaming has further fueled the demand for advanced graphics solutions among individual users, making this sub-segment the most significant contributor to the market.

The Kuwait Graphics Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, AMD (Advanced Micro Devices), Intel Corporation, ASUS, MSI (Micro-Star International), Gigabyte Technology, EVGA Corporation, Zotac, PNY Technologies, Sapphire Technology, Palit Microsystems, XFX, Colorful Technology, Inno3D, PowerColor contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait graphics card market is poised for significant transformation as technological advancements continue to shape consumer preferences. The increasing integration of AI and machine learning in various sectors will drive demand for high-performance graphics solutions. Additionally, the rise of cloud gaming services is expected to create new avenues for growth, allowing consumers to access high-quality gaming experiences without the need for expensive hardware. As local assembly plants emerge, the market may also see a reduction in costs, enhancing accessibility for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Gaming Graphics Cards Professional Graphics Cards Integrated Graphics Solutions Others |

| By End-User | Individual Gamers Gaming Cafes Educational Institutions Corporate Users Others |

| By Application | Gaming Graphic Design Video Editing Machine Learning Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Brand | NVIDIA AMD Intel Others |

| By Price Range | Budget Graphics Cards Mid-Range Graphics Cards High-End Graphics Cards Others |

| By Customer Type | Casual Gamers Hardcore Gamers Professionals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 100 | Store Managers, Sales Representatives |

| Gaming Community Insights | 120 | Gamers, eSports Participants |

| Professional Designers and Creatives | 80 | Graphic Designers, Video Editors |

| IT Professionals and System Builders | 70 | IT Managers, System Integrators |

| Online Retail Platforms | 60 | eCommerce Managers, Product Listing Specialists |

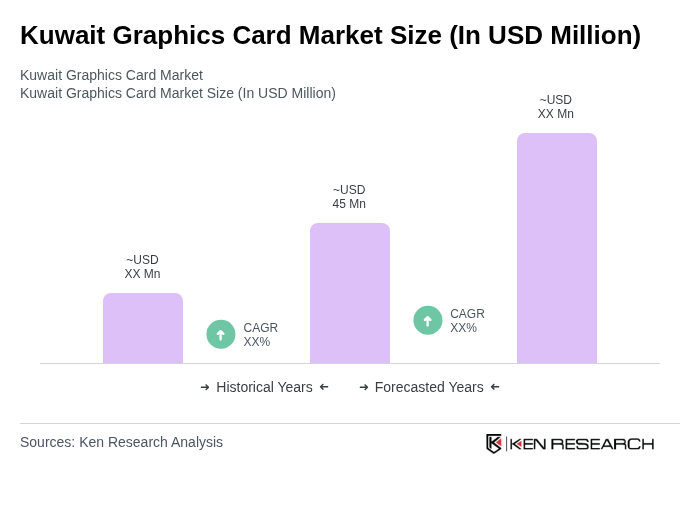

The Kuwait Graphics Card Market is valued at approximately USD 45 million, reflecting a significant growth driven by the increasing demand for high-performance computing in gaming, graphic design, and machine learning applications.