Region:Middle East

Author(s):Rebecca

Product Code:KRAA6434

Pages:89

Published On:January 2026

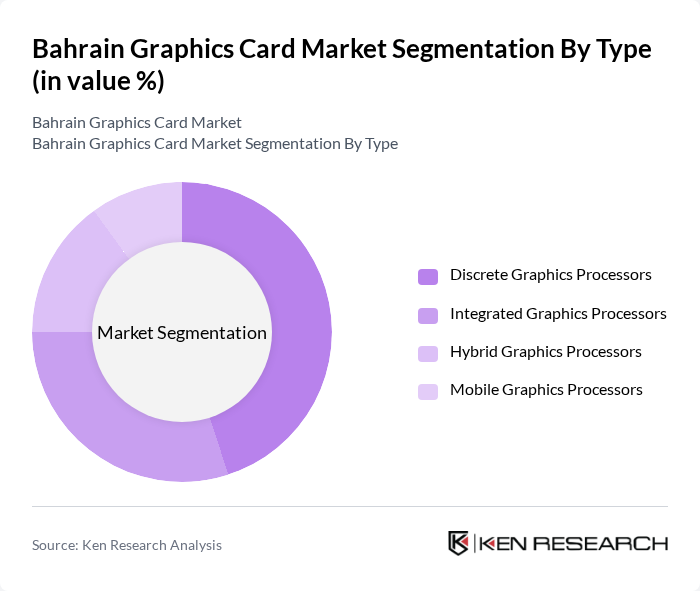

By Type:The graphics card market can be segmented into four main types: Discrete Graphics Processors, Integrated Graphics Processors, Hybrid Graphics Processors, and Mobile Graphics Processors. Discrete Graphics Processors are typically favored for high-performance tasks, while Integrated Graphics Processors are commonly used in budget-friendly devices. Hybrid Graphics Processors combine the strengths of both discrete and integrated options, and Mobile Graphics Processors cater to portable devices.

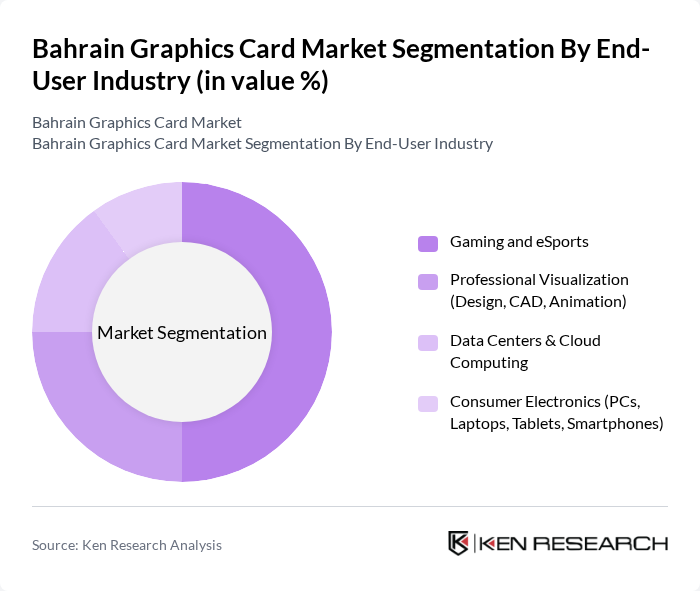

By End-User Industry:The market is also segmented by end-user industries, including Gaming and eSports, Professional Visualization (Design, CAD, Animation), Data Centers & Cloud Computing, and Consumer Electronics (PCs, Laptops, Tablets, Smartphones). The gaming sector is experiencing rapid growth, driven by the increasing popularity of eSports and online gaming, while professional visualization is essential for industries requiring high-quality graphics.

The Bahrain Graphics Card Market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Intel Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Micron Technology, Inc., ARM Holdings plc, Imagination Technologies Ltd., MediaTek Inc., Broadcom Inc., STMicroelectronics N.V., Renesas Electronics Corporation, Texas Instruments Incorporated, ON Semiconductor Corporation (onsemi), Xilinx, Inc. (now part of AMD) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain graphics card market is poised for significant transformation as technological advancements continue to shape consumer preferences. With the increasing integration of artificial intelligence and machine learning in various applications, the demand for high-performance GPUs is expected to rise. Additionally, the growth of cloud gaming services will further influence market dynamics, as consumers seek efficient and powerful graphics solutions. The focus on sustainability in production practices will also play a crucial role in shaping the future landscape of the graphics card market in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Type | Discrete Graphics Processors Integrated Graphics Processors Hybrid Graphics Processors Mobile Graphics Processors |

| By End-User Industry | Gaming and eSports Professional Visualization (Design, CAD, Animation) Data Centers & Cloud Computing Consumer Electronics (PCs, Laptops, Tablets, Smartphones) |

| By Application | Gaming Applications AI and Machine Learning Video Editing and Rendering Scientific Computing & Simulation |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Brand | NVIDIA AMD Intel Qualcomm |

| By Price Range | Budget Graphics Processors Mid-Range Graphics Processors High-End Graphics Processors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Graphics Card Sales | 120 | Store Managers, Sales Representatives |

| Gaming Community Insights | 100 | Gamers, Tech Influencers |

| Corporate Procurement for Workstations | 80 | IT Managers, Procurement Officers |

| Online Retailer Feedback | 70 | E-commerce Managers, Customer Service Representatives |

| Market Trends and Consumer Preferences | 90 | Tech Enthusiasts, Industry Analysts |

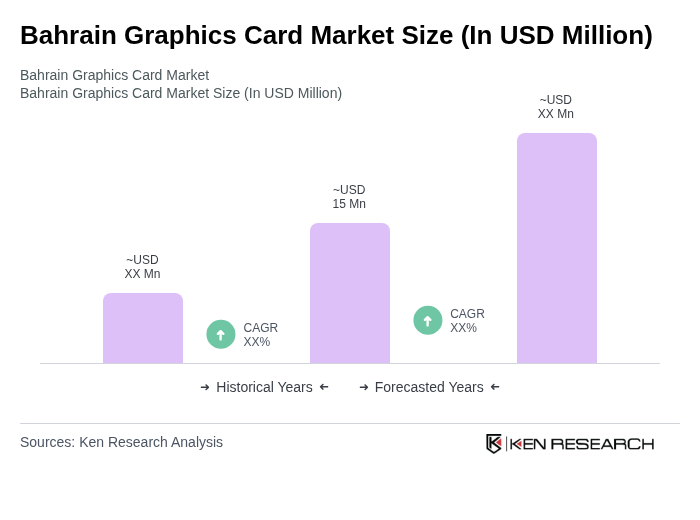

The Bahrain Graphics Card Market is valued at approximately USD 15 million, driven by increasing demand for high-performance computing in gaming, professional visualization, and data processing applications.