Region:Global

Author(s):Shubham

Product Code:KRAA7135

Pages:81

Published On:January 2026

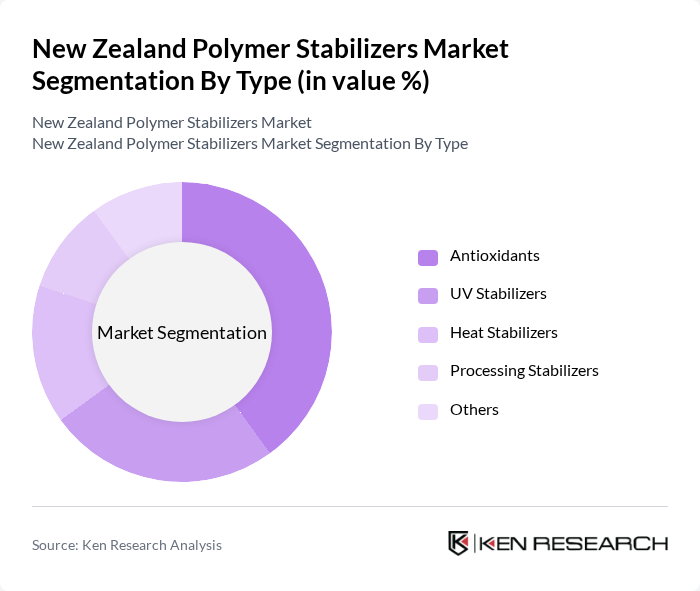

By Type:The market is segmented into various types of polymer stabilizers, including antioxidants, UV stabilizers, heat stabilizers, processing stabilizers, and others. Among these, antioxidants are the leading subsegment due to their critical role in enhancing the durability and performance of polymers, particularly in applications exposed to harsh environmental conditions. The increasing demand for high-quality, long-lasting materials in industries such as automotive and construction drives the growth of this subsegment.

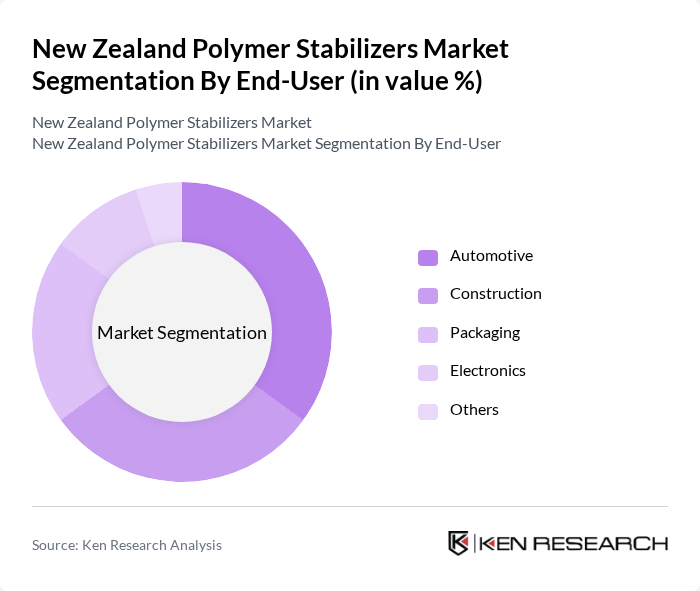

By End-User:The polymer stabilizers market is segmented by end-user industries, including automotive, construction, packaging, electronics, and others. The automotive sector is the dominant end-user, driven by the increasing demand for lightweight and durable materials that enhance vehicle performance and fuel efficiency. As automotive manufacturers focus on sustainability and innovation, the need for advanced polymer stabilizers continues to grow, solidifying this segment's leadership in the market.

The New Zealand Polymer Stabilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF New Zealand, Dow Chemical Company, Evonik Industries AG, Clariant AG, Solvay S.A., Eastman Chemical Company, Huntsman Corporation, Lanxess AG, Croda International Plc, A. Schulman, Inc., PolyOne Corporation, SABIC, Mitsubishi Chemical Corporation, INEOS Group, LyondellBasell Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the New Zealand polymer stabilizers market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly materials, the demand for innovative polymer stabilizers is expected to rise. Additionally, the integration of advanced manufacturing technologies will enhance production efficiency and product quality. Companies that invest in research and development will likely lead the market, capitalizing on emerging trends and consumer preferences for high-performance, sustainable solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Antioxidants UV Stabilizers Heat Stabilizers Processing Stabilizers Others |

| By End-User | Automotive Construction Packaging Electronics Others |

| By Application | Coatings Adhesives Films Fibers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North Island South Island |

| By Product Form | Granules Powders Liquids Others |

| By Customer Type | OEMs End-users Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Polymer Applications | 45 | Product Development Managers, Quality Assurance Engineers |

| Construction Material Stabilizers | 38 | Construction Project Managers, Material Suppliers |

| Consumer Goods Packaging | 42 | Packaging Engineers, Brand Managers |

| Industrial Polymer Usage | 35 | Operations Managers, Procurement Specialists |

| Research & Development Insights | 40 | R&D Directors, Innovation Managers |

The New Zealand Polymer Stabilizers Market is valued at approximately USD 285 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for high-performance polymers across various industries, including automotive, construction, and packaging.