Region:Global

Author(s):Shubham

Product Code:KRAA0698

Pages:96

Published On:August 2025

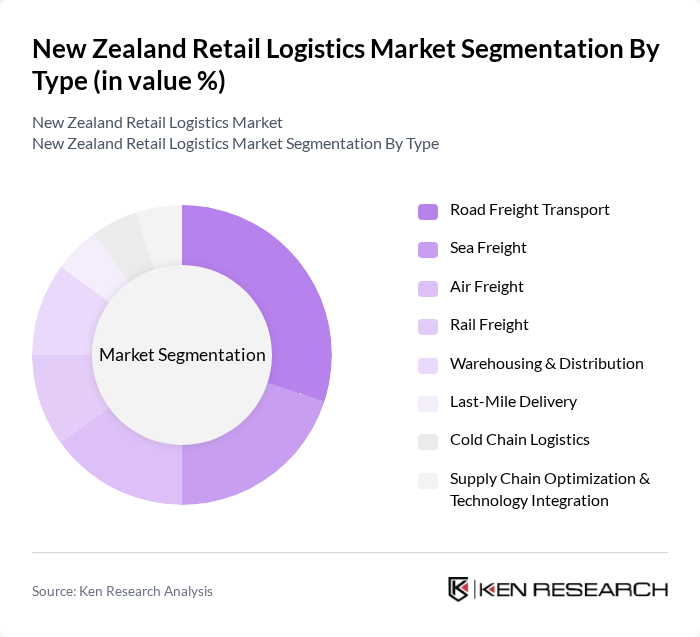

By Type:The retail logistics market can be segmented into Road Freight Transport, Sea Freight, Air Freight, Rail Freight, Warehousing & Distribution, Last-Mile Delivery, Cold Chain Logistics, and Supply Chain Optimization & Technology Integration. Each of these segments plays a crucial role in ensuring the efficient movement of goods from suppliers to consumers. Road freight is the most widely used mode, supporting domestic distribution, while sea and air freight are essential for international trade. Warehousing and last-mile delivery are increasingly critical due to the surge in e-commerce and consumer expectations for fast, reliable delivery. Cold chain logistics supports the growing demand for fresh and perishable goods, and technology integration is enhancing visibility and efficiency across the supply chain .

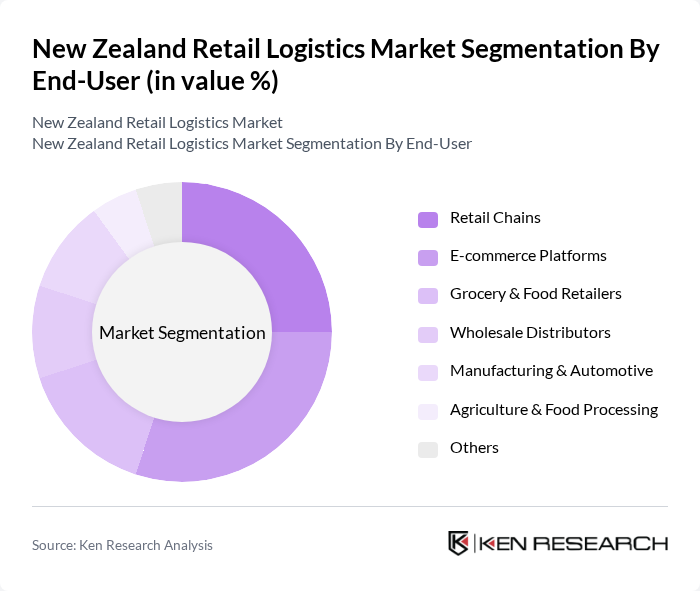

By End-User:The end-user segmentation includes Retail Chains, E-commerce Platforms, Grocery & Food Retailers, Wholesale Distributors, Manufacturing & Automotive, Agriculture & Food Processing, and Others. Each segment has unique logistics requirements that influence the overall market dynamics. E-commerce platforms are driving demand for rapid fulfillment and last-mile delivery, while grocery and food retailers require robust cold chain and inventory management. Manufacturing and automotive sectors depend on reliable freight and warehousing, and agriculture and food processing need specialized logistics for perishables .

The New Zealand Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight Limited, Freightways Limited, New Zealand Post (NZ Post), Toll Group, Fliway Group, PBT Transport, Linfox, Kuehne + Nagel, DHL Supply Chain (New Zealand), DB Schenker, Mainstream Group, C.H. Robinson, CEVA Logistics, Agility Logistics, and C3S Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The New Zealand retail logistics market is poised for significant transformation, driven by technological innovations and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly focus on enhancing last-mile delivery capabilities and integrating automation technologies. Additionally, sustainability initiatives will gain traction, with companies investing in eco-friendly practices to meet consumer demand for responsible logistics solutions. This dynamic environment presents opportunities for growth and adaptation in the retail logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Transport Sea Freight Air Freight Rail Freight Warehousing & Distribution Last-Mile Delivery Cold Chain Logistics Supply Chain Optimization & Technology Integration |

| By End-User | Retail Chains E-commerce Platforms Grocery & Food Retailers Wholesale Distributors Manufacturing & Automotive Agriculture & Food Processing Others |

| By Distribution Mode | Road Transport Rail Transport Air Freight Sea Freight Intermodal Transport Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Service Type | Standard Logistics Services Value-Added Services Customized Logistics Solutions Others |

| By Pricing Strategy | Competitive Pricing Premium Pricing Discount Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Logistics | 60 | Logistics Coordinators, Supply Chain Managers |

| Apparel Supply Chain Management | 45 | Operations Managers, Inventory Managers |

| Electronics Distribution Logistics | 40 | Warehouse Supervisors, Logistics Analysts |

| Online Retail Fulfillment | 50 | eCommerce Operations Managers, Customer Experience Leads |

| Third-Party Logistics Providers | 40 | Business Development Managers, Account Managers |

The New Zealand Retail Logistics Market is valued at approximately USD 16.8 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, the rise of e-commerce, and advancements in logistics technology.