Region:Global

Author(s):Rebecca

Product Code:KRAE3017

Pages:90

Published On:February 2026

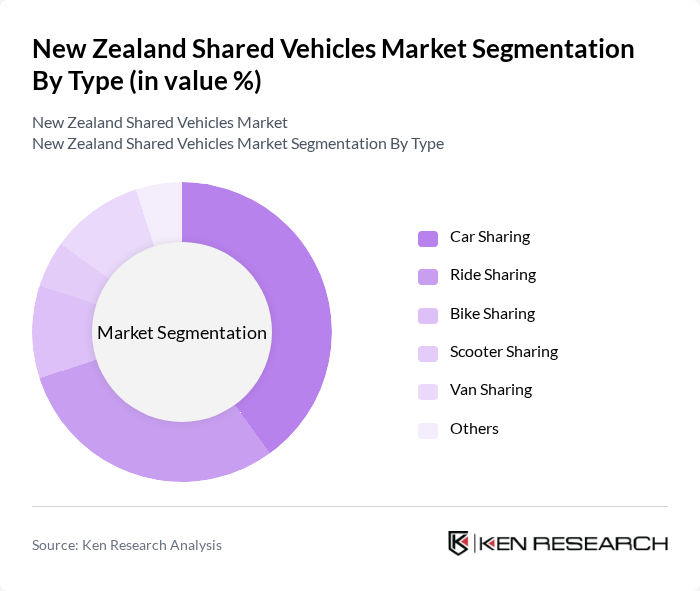

By Type:The shared vehicles market can be segmented into various types, including car sharing, ride sharing, bike sharing, scooter sharing, van sharing, and others. Among these, car sharing has emerged as the dominant segment due to its convenience and flexibility, appealing to urban dwellers who prefer not to own a vehicle. Ride sharing is also gaining traction, particularly among younger consumers who value cost-effectiveness and social interaction. The increasing availability of mobile applications has further facilitated the growth of these segments.

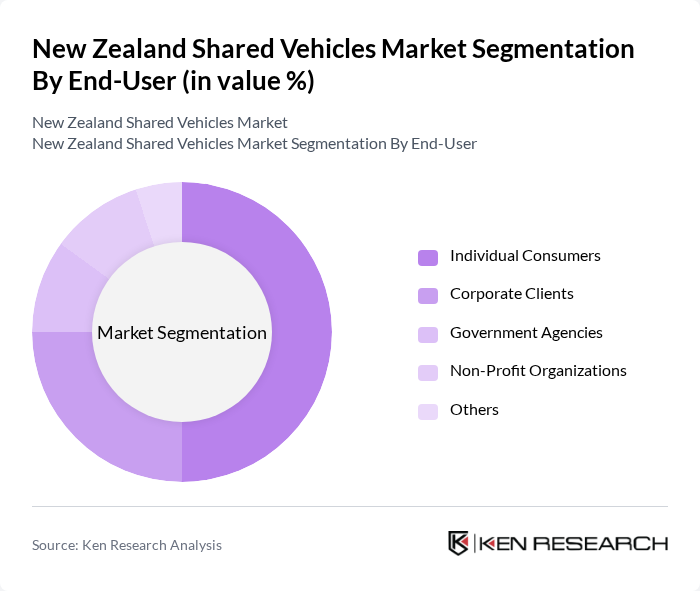

By End-User:The end-user segmentation includes individual consumers, corporate clients, government agencies, non-profit organizations, and others. Individual consumers represent the largest segment, driven by the growing trend of urbanization and the need for flexible transportation options. Corporate clients are increasingly utilizing shared vehicles for employee commuting and business travel, while government agencies and non-profits are exploring shared mobility solutions to enhance public transport accessibility.

The New Zealand Shared Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as GoGet, Cityhop, Zilch, Mevo, Flick Electric Co., Uber, Ola, Shareacar, Car Next Door, DriveMyCar, Turo, Liftango, Ofo, Lime, Bird contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand shared vehicles market is poised for significant transformation as urbanization continues to rise and environmental concerns gain prominence. In the future, the integration of electric vehicles into shared fleets is expected to accelerate, driven by government incentives and consumer demand for sustainable options. Additionally, partnerships with local governments will facilitate the development of smart mobility solutions, enhancing the overall efficiency of transport systems. These trends indicate a promising future for shared mobility, characterized by innovation and increased adoption.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Sharing Ride Sharing Bike Sharing Scooter Sharing Van Sharing Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Non-Profit Organizations Others |

| By Vehicle Type | Electric Vehicles Hybrid Vehicles Conventional Vehicles Luxury Vehicles Others |

| By Service Model | Peer-to-Peer Sharing Business-to-Consumer Sharing Business-to-Business Sharing Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Duration of Use | Short-Term Rentals Long-Term Rentals Subscription Services Others |

| By Payment Model | Pay-Per-Use Subscription-Based Membership Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shared Car Services | 150 | Users, Fleet Managers, Operations Directors |

| Bicycle Sharing Programs | 100 | City Planners, Program Coordinators, Users |

| Electric Scooter Rentals | 80 | Marketing Managers, Users, Urban Mobility Experts |

| Corporate Car Sharing Solutions | 70 | HR Managers, Sustainability Officers, Fleet Administrators |

| Peer-to-Peer Vehicle Sharing | 90 | Vehicle Owners, Users, Community Managers |

The New Zealand Shared Vehicles Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by urbanization, sustainability demands, and the rise of digital platforms facilitating shared mobility solutions.