Region:Asia

Author(s):Rebecca

Product Code:KRAE3016

Pages:81

Published On:February 2026

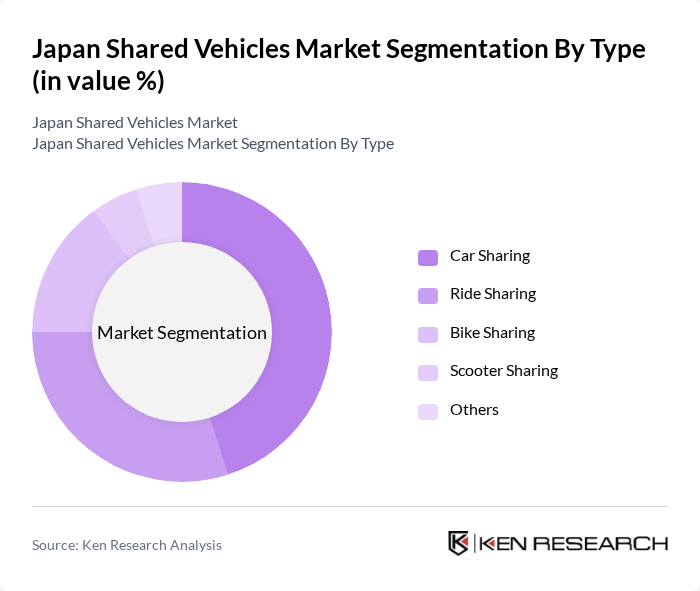

By Type:The shared vehicles market in Japan is segmented into various types, including car sharing, ride sharing, bike sharing, scooter sharing, and others. Among these, car sharing has emerged as the leading sub-segment, driven by the increasing number of urban dwellers seeking flexible transportation options without the burden of ownership. Ride sharing is also gaining traction, particularly among younger consumers who prefer on-demand services. The bike and scooter sharing segments are growing, especially in urban areas, as they offer eco-friendly alternatives for short-distance travel.

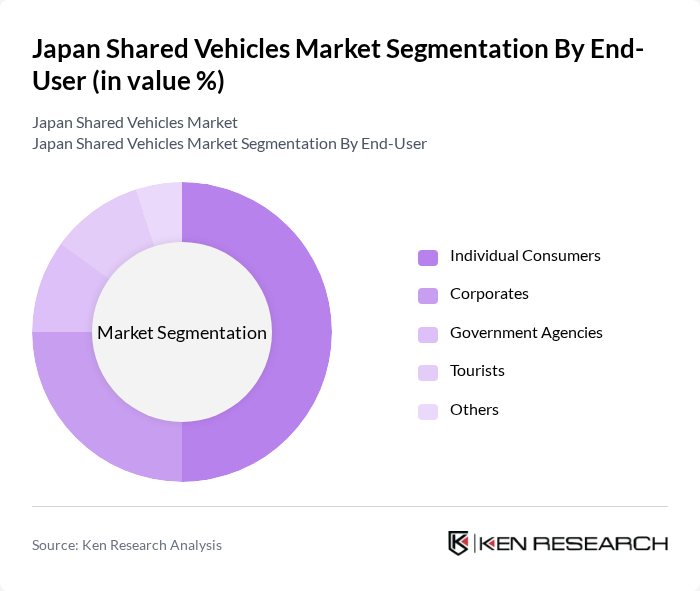

By End-User:The end-user segmentation of the shared vehicles market includes individual consumers, corporates, government agencies, tourists, and others. Individual consumers represent the largest segment, as they increasingly opt for shared mobility solutions for daily commuting and leisure activities. Corporates are also significant users, leveraging shared vehicles for employee transportation and business travel. Government agencies are promoting shared mobility as part of urban planning initiatives, while tourists utilize these services for convenience during their visits.

The Japan Shared Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Mobility Corporation, Nippon Car Share, Orix Auto Corporation, Times Car Rental, Denso Corporation, ZMP Inc., Anyca, Grab Holdings, Uber Technologies, Inc., GoGoX, Carstay, Sharely, Mobike, Lime, WeShare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan shared vehicles market appears promising, driven by increasing urbanization and a strong push towards sustainability. As the government continues to support shared mobility initiatives, the integration of smart technologies will enhance user experiences. Additionally, the growing emphasis on reducing carbon emissions will likely accelerate the adoption of electric shared vehicles. With a focus on improving infrastructure and regulatory frameworks, the market is poised for significant growth in the coming years, fostering innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Sharing Ride Sharing Bike Sharing Scooter Sharing Others |

| By End-User | Individual Consumers Corporates Government Agencies Tourists Others |

| By Vehicle Type | Electric Vehicles Hybrid Vehicles Conventional Vehicles Luxury Vehicles Others |

| By Service Model | Peer-to-Peer Sharing Business-to-Consumer Sharing Business-to-Business Sharing Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Duration of Use | Short-Term Rentals Long-Term Rentals Subscription Models Others |

| By Payment Model | Pay-Per-Use Subscription-Based Membership Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Shared Mobility Users | 150 | Regular users of car-sharing and ride-hailing services |

| Shared Vehicle Service Providers | 100 | CEOs, Operations Managers, and Marketing Directors |

| Government Transportation Officials | 80 | Policy Makers, Urban Planners, and Regulatory Authorities |

| Environmental Advocacy Groups | 60 | Leaders and Researchers focused on sustainable transportation |

| Automotive Industry Experts | 70 | Analysts, Consultants, and Academics specializing in automotive trends |

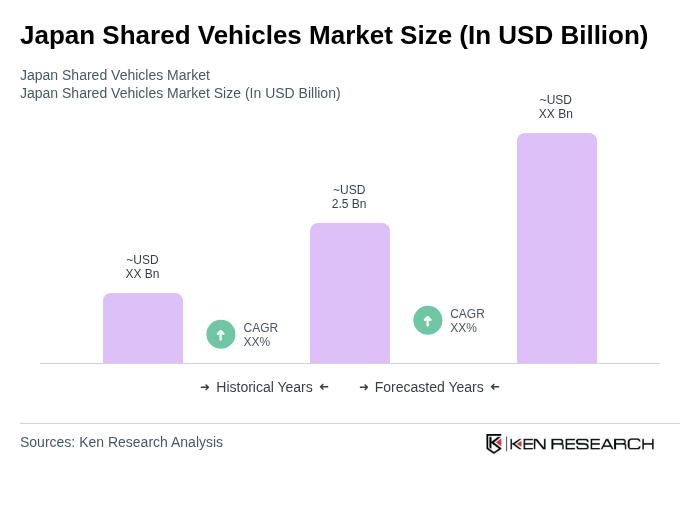

The Japan Shared Vehicles Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by urbanization, environmental awareness, and the demand for cost-effective transportation solutions.