Region:Asia

Author(s):Rebecca

Product Code:KRAE3015

Pages:97

Published On:February 2026

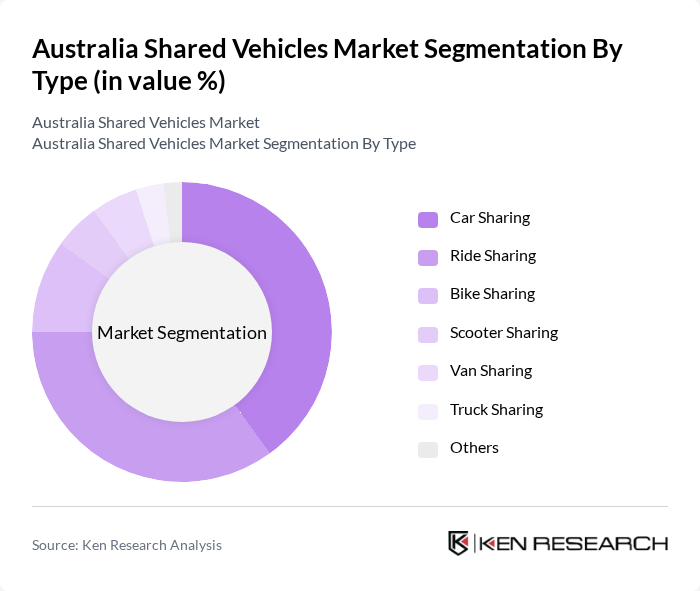

By Type:The shared vehicles market can be segmented into various types, including car sharing, ride sharing, bike sharing, scooter sharing, van sharing, truck sharing, and others. Among these, car sharing and ride sharing are the most prominent segments, driven by consumer preferences for convenience and cost-effectiveness. The increasing availability of mobile applications has also facilitated the growth of these segments, making them more accessible to users.

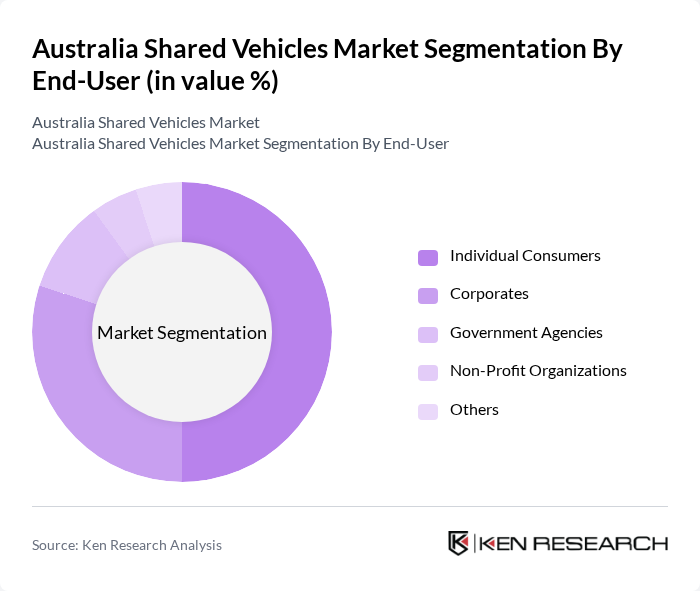

By End-User:The end-user segmentation includes individual consumers, corporates, government agencies, non-profit organizations, and others. Individual consumers and corporates are the leading segments, as they represent the majority of users seeking flexible and cost-effective transportation solutions. The growing trend of remote work and urban commuting has further fueled the demand for shared vehicles among these user groups.

The Australia Shared Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as GoGet, Car Next Door, Uber, Ofo, Lime, Zipcar, DriveMyCar, Flexicar, Dott, Share Now, Blablacar, Scoot, Rideshare, Car2Go, Turo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the shared vehicles market in Australia appears promising, driven by ongoing urbanization and technological advancements. As cities continue to grow, the demand for efficient and sustainable transportation solutions will likely increase. Furthermore, the integration of electric vehicles and autonomous technologies is expected to reshape the landscape, enhancing user experience and operational efficiency. Collaborative efforts between government and private sectors will be crucial in addressing regulatory challenges and fostering a supportive environment for shared mobility innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Sharing Ride Sharing Bike Sharing Scooter Sharing Van Sharing Truck Sharing Others |

| By End-User | Individual Consumers Corporates Government Agencies Non-Profit Organizations Others |

| By Vehicle Ownership Model | Peer-to-Peer Sharing Fleet-Based Sharing Hybrid Models Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| By Payment Model | Pay-Per-Use Subscription-Based Membership Models Others |

| By Vehicle Type | Electric Vehicles Hybrid Vehicles Conventional Vehicles Others |

| By Service Type | On-Demand Services Scheduled Services Corporate Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Shared Vehicle Users | 150 | Regular users, occasional users, and non-users of shared vehicles |

| Shared Vehicle Operators | 100 | Fleet Managers, Business Development Executives |

| Policy Makers and Urban Planners | 80 | City Council Members, Transportation Policy Analysts |

| Environmental Impact Analysts | 60 | Sustainability Consultants, Environmental Researchers |

| Technology Providers for Shared Mobility | 70 | Product Managers, Technology Developers |

The Australia Shared Vehicles Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by urbanization, rising fuel prices, and a preference for sustainable transportation options among consumers.