Region:Middle East

Author(s):Rebecca

Product Code:KRAE3012

Pages:87

Published On:February 2026

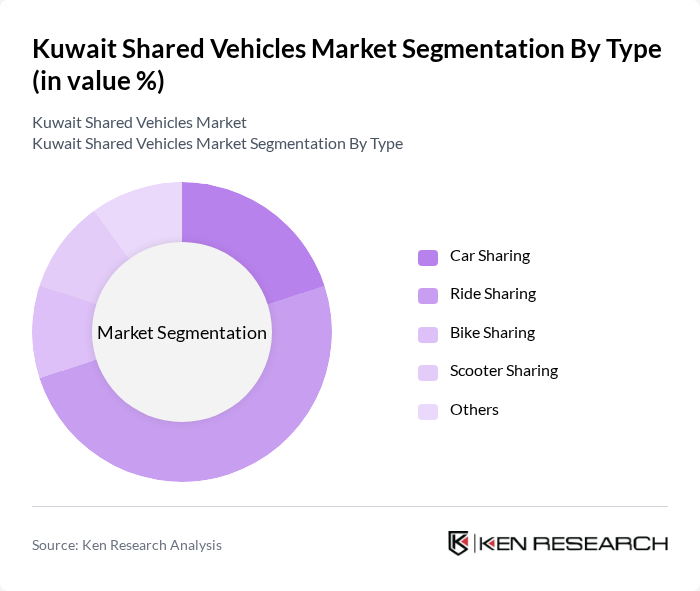

By Type:The shared vehicles market can be segmented into various types, including car sharing, ride sharing, bike sharing, scooter sharing, and others. Among these, ride sharing has emerged as the leading segment due to its convenience and affordability, appealing to a wide range of consumers. The increasing penetration of smartphones and mobile applications has further facilitated the growth of ride-sharing services, making them a preferred choice for urban commuters.

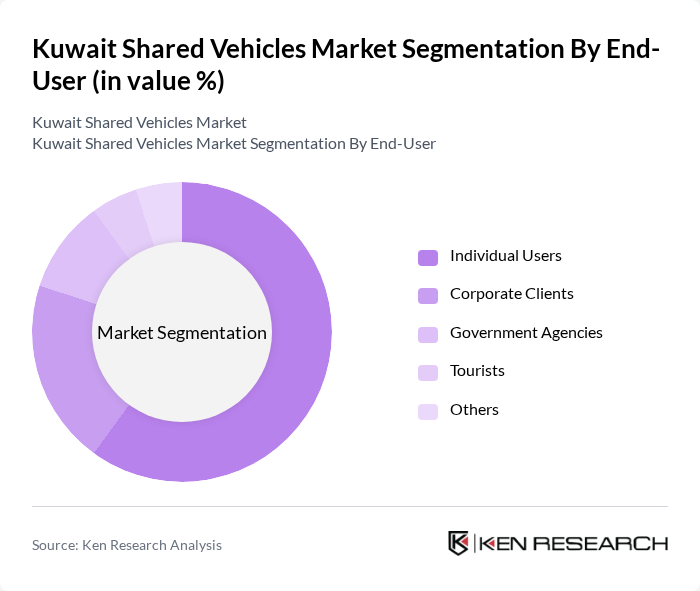

By End-User:The end-user segmentation includes individual users, corporate clients, government agencies, tourists, and others. Individual users dominate the market, driven by the increasing trend of urban mobility and the need for cost-effective transportation solutions. The rise in the gig economy and flexible work arrangements has also contributed to the growing preference for shared vehicles among individuals.

The Kuwait Shared Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem, Uber, Kiwitaxi, OTaxi, Q8 Car Rental, Al-Mutawa Group, Al-Futtaim Group, Al-Jazeera Car Rental, Budget Rent a Car, Sixt Rent a Car, Thrifty Car Rental, Hertz, National Car Rental, Europcar, and Local Car Sharing Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the shared vehicles market in Kuwait appears promising, driven by increasing urbanization and a growing emphasis on sustainable transportation. As the government continues to invest in infrastructure and promote shared mobility, the market is likely to see enhanced service offerings and technological advancements. Additionally, consumer preferences are shifting towards more flexible transportation options, indicating a potential rise in demand for innovative shared vehicle solutions that cater to evolving urban mobility needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Sharing Ride Sharing Bike Sharing Scooter Sharing Others |

| By End-User | Individual Users Corporate Clients Government Agencies Tourists Others |

| By Vehicle Type | Sedans SUVs Electric Vehicles Luxury Vehicles Others |

| By Service Model | Peer-to-Peer Sharing Fleet Management Services Subscription Services Others |

| By Payment Model | Pay-per-use Subscription-based Membership-based Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| By Customer Demographics | Age Group Income Level Occupation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shared Vehicle Users | 150 | Regular users of ride-sharing and car-sharing services |

| Fleet Operators | 100 | Managers and owners of shared vehicle fleets |

| Government Officials | 50 | Policy makers and transportation regulators |

| Urban Planners | 40 | Professionals involved in city transportation planning |

| Technology Providers | 30 | Suppliers of software and hardware for shared mobility solutions |

The Kuwait Shared Vehicles Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a preference for shared mobility solutions among consumers.