Region:Global

Author(s):Dev

Product Code:KRAC0380

Pages:91

Published On:August 2025

By Type:The used car market in New Zealand is segmented by vehicle type, which includes various categories such as hatchbacks, sedans, SUVs, utes/pickups, vans/people movers, coupes/convertibles, MPVs/crossovers, and others. Among these, SUVs have gained significant popularity due to their versatility and spaciousness, appealing to families and outdoor enthusiasts. Hatchbacks and sedans also maintain a strong presence, particularly among urban dwellers seeking compact and fuel-efficient options. The demand for utes/pickups is driven by the agricultural sector and tradespeople, while vans/people movers cater to larger families and groups.

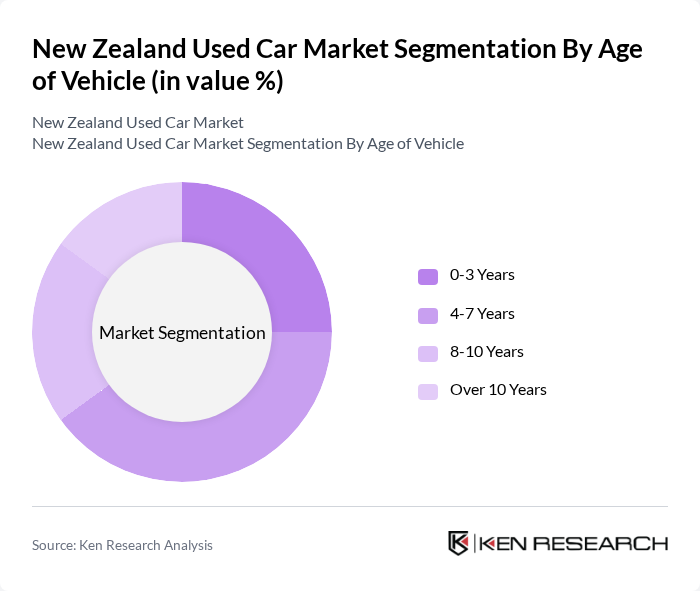

By Age of Vehicle:The segmentation by age of vehicle includes categories such as 0-3 years, 4-7 years, 8-10 years, and over 10 years. The 4-7 years category dominates the market, as these vehicles offer a balance of affordability and reliability, appealing to budget-conscious consumers. Vehicles aged 0-3 years are also popular, particularly among first-time buyers and those looking for nearly new options. Older vehicles, while less popular, still attract buyers seeking lower prices and specific models.

The New Zealand Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Turners Automotive Group, Trade Me Motors, 2 Cheap Cars, AutoTrader New Zealand, Autoport, NZC — New Zealand Car, Paul Kelly Motor Company, Enterprise Motor Group, AA Motoring (AA Vehicle Inspections & AA Preferred Dealer Network), VINZ — Vehicle Inspection New Zealand, VTNZ — Vehicle Testing New Zealand, Autoshop/Dealer Finance: UDC Finance, Driveline Fleet, Armstrong’s (Armstrong’s Auto), Eagers Automotive NZ (formerly AHG NZ) contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand used car market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As digital platforms become more prevalent, the purchasing process will likely become increasingly streamlined, enhancing customer experiences. Additionally, the growing interest in electric and hybrid vehicles will create new segments within the market, catering to environmentally conscious consumers. Overall, the market is expected to adapt to these trends, fostering innovation and competition among dealers.

| Segment | Sub-Segments |

|---|---|

| By Type | Hatchbacks Sedans SUVs Utes/Pickups Vans/People Movers Coupes/Convertibles MPVs/Crossovers Others |

| By Age of Vehicle | 3 Years 7 Years 10 Years Over 10 Years |

| By Price Range | Under NZD 10,000 NZD 10,000 - NZD 20,000 NZD 20,000 - NZD 30,000 NZD 30,000 - NZD 50,000 Over NZD 50,000 |

| By Fuel Type | Petrol Diesel Hybrid (HEV/PHEV) Electric (BEV) LPG/Other |

| By Sales Channel | Organized Dealerships Online Marketplaces Auctions (incl. wholesale) Private Sales |

| By Financing Options | Cash Purchases Bank/Non-bank Loans Dealer Financing Leasing/Subscription |

| By Vendor Type | Organized (Franchise & Large Independents) Unorganized (Small Yards & Private Sellers) |

| By Condition | Certified Pre-Owned Non-Certified Used Damaged/Repairable Japanese Used Imports Ex-lease/Fleet Returns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 100 | Dealership Owners, Sales Managers |

| Private Used Car Buyers | 140 | Recent Buyers, First-time Buyers |

| Automotive Financing Institutions | 80 | Loan Officers, Financial Advisors |

| Automotive Industry Experts | 50 | Market Analysts, Automotive Consultants |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Research Analysts |

The New Zealand used car market is valued at approximately NZD 470 million, reflecting a significant increase in consumer demand for affordable and sustainable transportation options over the past five years.