Region:Africa

Author(s):Rebecca

Product Code:KRAB4662

Pages:87

Published On:October 2025

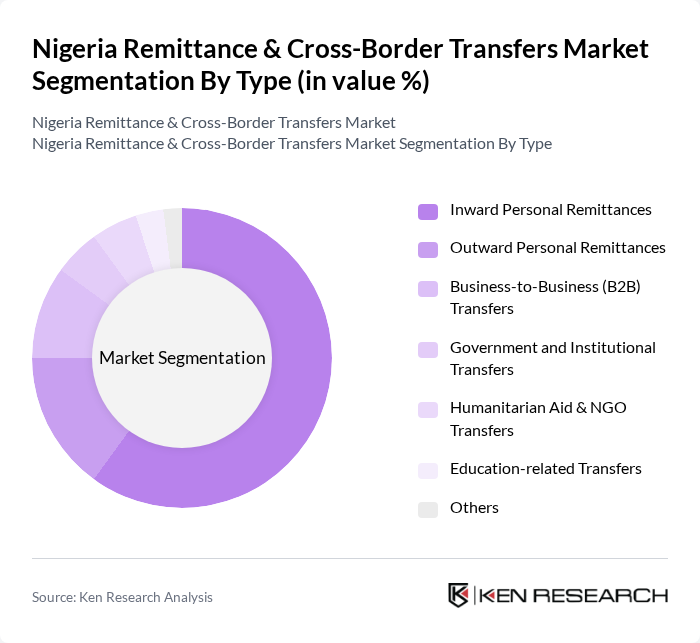

By Type:

The remittance and cross-border transfers market can be segmented into various types, including Inward Personal Remittances, Outward Personal Remittances, Business-to-Business (B2B) Transfers, Government and Institutional Transfers, Humanitarian Aid & NGO Transfers, Education-related Transfers, and Others. Among these, Inward Personal Remittances dominate the market due to the significant number of Nigerians living abroad who regularly send money back home to support their families. This segment is driven by the need for financial support in households, particularly in urban areas where living costs are higher. The ease of access to digital platforms and mobile money services has also contributed to the growth of this segment .

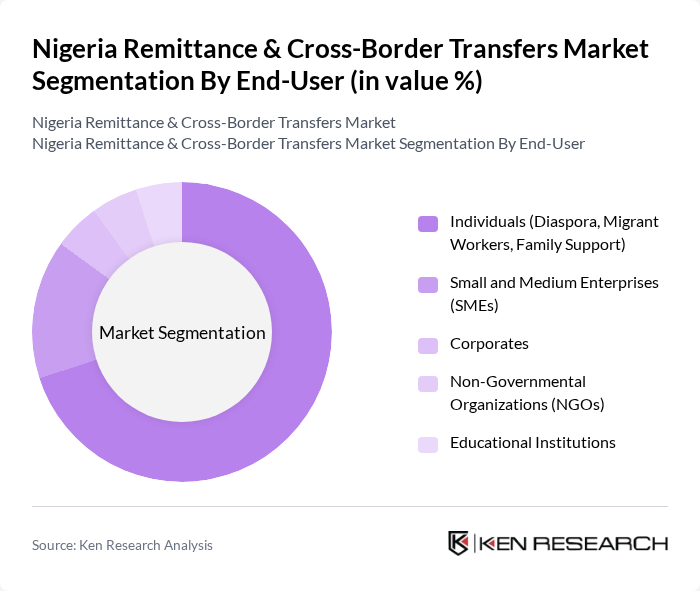

By End-User:

This market can also be segmented by end-user categories, including Individuals (Diaspora, Migrant Workers, Family Support), Small and Medium Enterprises (SMEs), Corporates, Non-Governmental Organizations (NGOs), and Educational Institutions. The Individuals segment is the most significant contributor, as many Nigerians abroad send remittances to support their families back home. This segment is characterized by frequent transactions, often driven by personal needs such as education, healthcare, and daily living expenses. The growing trend of digital remittance services and mobile platforms has made it easier for individuals to send money quickly and at lower costs .

The Nigeria Remittance & Cross-Border Transfers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, WorldRemit, Wise (formerly TransferWise), PayPal, Flutterwave, Remitly, Sendwave, Interswitch, Chipper Cash, Paga, Kuda Bank, Opay, Zenith Bank, First Bank of Nigeria, Access Bank, GTBank, Ecobank Nigeria, United Bank for Africa (UBA), Fidelity Bank, Stanbic IBTC Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's remittance and cross-border transfers market appears promising, driven by technological advancements and increasing financial inclusion efforts. The growth of digital platforms is expected to enhance user experience, while government initiatives will likely facilitate smoother transactions. Additionally, as the diaspora population continues to expand, remittance inflows are projected to rise, providing essential financial support to families. Overall, the market is poised for significant transformation, with a focus on innovation and accessibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Inward Personal Remittances Outward Personal Remittances Business-to-Business (B2B) Transfers Government and Institutional Transfers Humanitarian Aid & NGO Transfers Education-related Transfers Others |

| By End-User | Individuals (Diaspora, Migrant Workers, Family Support) Small and Medium Enterprises (SMEs) Corporates Non-Governmental Organizations (NGOs) Educational Institutions |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Others |

| By Destination | United States United Kingdom Canada United Arab Emirates South Africa Others |

| By Frequency of Transactions | Daily Weekly Monthly |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Service Provider | Banks Money Transfer Operators Fintech Companies Mobile Money Operators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nigerian Expatriates in the US | 120 | Individuals sending remittances, Financial Advisors |

| Local Recipients of Remittances | 120 | Household heads, Community Leaders |

| Money Transfer Operators | 80 | Operations Managers, Compliance Officers |

| Banking Sector Representatives | 60 | Branch Managers, Retail Banking Executives |

| Regulatory Bodies | 40 | Policy Makers, Economic Analysts |

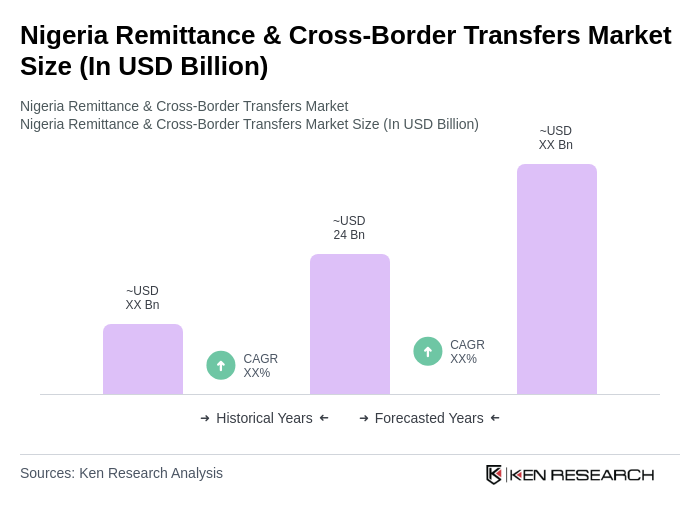

The Nigeria Remittance & Cross-Border Transfers Market is valued at approximately USD 24 billion, reflecting significant inflows from the Nigerian diaspora, particularly from countries like the United States and the United Kingdom.