Region:Africa

Author(s):Shubham

Product Code:KRAB1092

Pages:94

Published On:October 2025

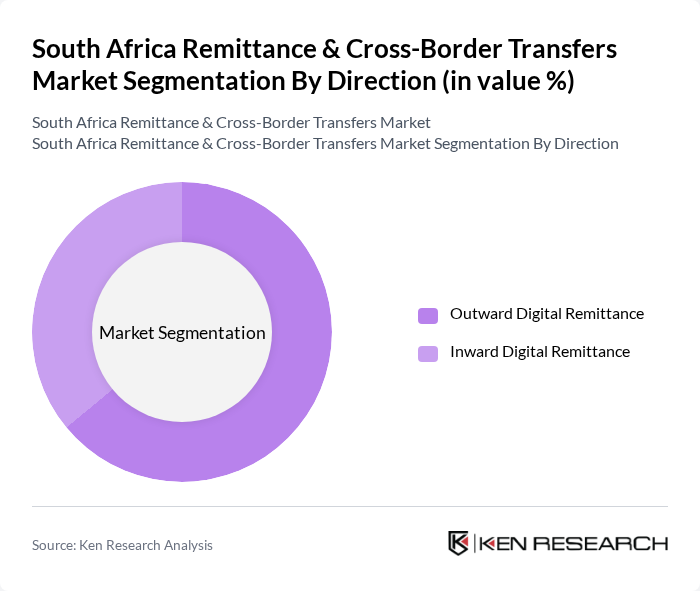

By Direction:

The direction of remittances in South Africa is categorized into two primary subsegments: Inward Digital Remittance and Outward Digital Remittance. Outward digital remittance was the largest segment by revenue share in 2024, accounting for approximately 64 percent, driven by South Africans sending funds to family and friends abroad, particularly within the Southern African Development Community (SADC) region. Inward digital remittance, while smaller in absolute terms, is the fastest-growing segment, fueled by funds from South Africans living overseas, especially in Europe and North America, and supported by the increasing use of digital platforms for quick, low-cost transfers.

By Application:

The application of remittances in South Africa is segmented into Personal Remittances, Business Remittances, and Public Services. Personal Remittances dominate the market, as they account for the majority of cross-border transfers, primarily for family support and living expenses. Business Remittances are also significant, driven by the need for South African businesses to pay for goods and services internationally. Public Services, while a smaller segment, are growing as government initiatives encourage remittances for development projects and social programs. The segmentation by application remains consistent with industry practice, though specific, verified percentage breakdowns for 2024 are not available in the latest sources.

The South Africa Remittance & Cross-Border Transfers Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Western Union Company, MoneyGram International Inc., Wise PLC (formerly TransferWise), PayPal Holdings Inc., WorldRemit Group Limited, Remitly Inc., Ria Money Transfer, Standard Bank Group Limited, First National Bank (FNB), Nedbank Group Limited, ABSA Group Limited, Capitec Bank Holdings Limited, Mukuru Financial Services, Hello Paisa, Mama Money contribute to innovation, geographic expansion, and service delivery in this space.

The South African remittance and cross-border transfers market is poised for significant transformation, driven by technological advancements and regulatory reforms. As digital platforms gain traction, the market is expected to see increased participation from fintech companies, enhancing competition and service offerings. Additionally, the government's commitment to financial inclusion will likely foster a more conducive environment for remittance services, ultimately benefiting consumers and stimulating economic growth in the region.

| Segment | Sub-Segments |

|---|---|

| By Direction | Inward Digital Remittance Outward Digital Remittance |

| By Application | Personal Remittances Business Remittances Public Services |

| By Channel | Banks Money Transfer Operators Online Platforms Mobile Wallets |

| By Transaction Type | Domestic Money Transfer International Money Transfer |

| By End-User | Individual Senders Small and Medium Enterprises Corporates Non-Governmental Organizations |

| By Payment Method | Bank Transfers Cash Pickup Mobile Money Prepaid Cards |

| By Destination Region | Africa Europe North America Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Remittance Users | 120 | Migrant Workers, Family Members of Migrants |

| Cross-Border Transfer Service Providers | 50 | Business Development Managers, Compliance Officers |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

| Financial Institutions Offering Remittance Services | 60 | Product Managers, Marketing Directors |

| Community Organizations Supporting Migrants | 45 | Community Leaders, Social Workers |

The South Africa Remittance & Cross-Border Transfers Market is valued at approximately USD 330 million, reflecting a significant growth trend driven by the increasing number of South Africans working abroad and the rising demand for efficient remittance services.