Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5983

Pages:81

Published On:October 2025

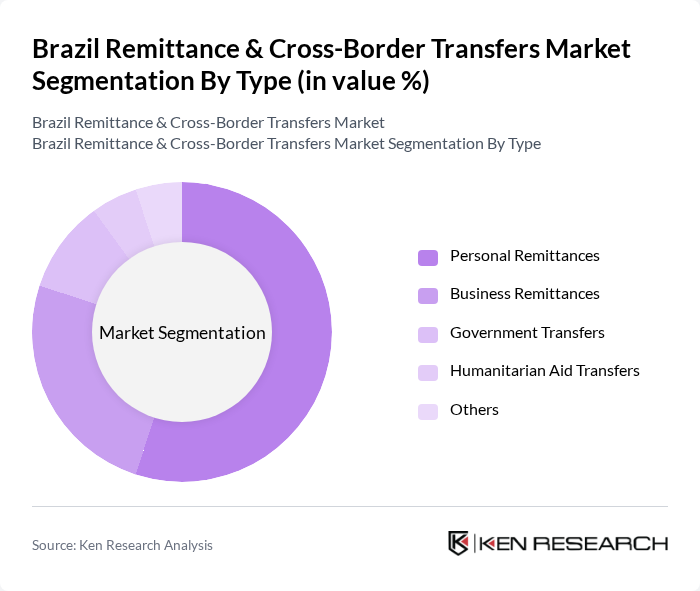

By Type:

The remittance market is segmented into various types, including Personal Remittances, Business Remittances, Government Transfers, Humanitarian Aid Transfers, and Others. Personal Remittances dominate the market, driven by the high volume of individuals sending money to family members. This segment is characterized by frequent, smaller transactions, reflecting the needs of families relying on these funds for daily expenses. Business Remittances follow, as companies engage in cross-border transactions for trade and investment purposes, contributing significantly to the overall market size.

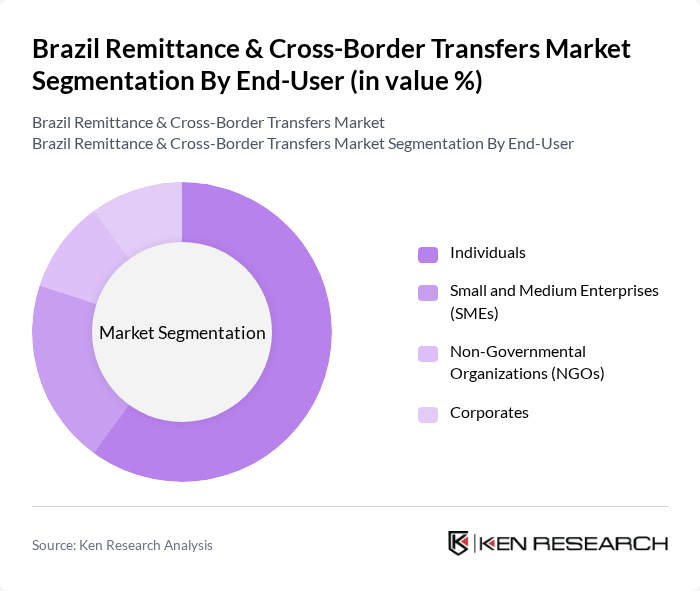

By End-User:

The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Non-Governmental Organizations (NGOs), and Corporates. Individuals represent the largest segment, as they frequently send remittances to support family members. SMEs also play a crucial role, particularly in facilitating cross-border trade and payments. NGOs utilize remittance services for funding projects, while Corporates engage in larger transactions for business operations, contributing to the overall market dynamics.

The Brazil Remittance & Cross-Border Transfers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal, Remitly, TransferWise, Xoom, WorldRemit, Ria Money Transfer, Azimo, PagSeguro, PicPay, Banco do Brasil, Caixa Econômica Federal, Bradesco, and Itaú Unibanco contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil remittance and cross-border transfers market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital payment solutions gain traction, the market is likely to see increased participation from fintech companies, enhancing service accessibility. Additionally, the government's ongoing efforts to streamline regulations will likely foster a more competitive environment, encouraging innovation. These trends suggest a robust future for remittance services, with a focus on efficiency, cost reduction, and improved customer experiences shaping the landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Remittances Business Remittances Government Transfers Humanitarian Aid Transfers Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Non-Governmental Organizations (NGOs) Corporates |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Prepaid Cards |

| By Destination | North America Europe Asia-Pacific Latin America |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | One-time Transfers Regular Transfers Occasional Transfers |

| By Customer Segment | Low-Income Customers Middle-Income Customers High-Income Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Senders | 150 | Individuals aged 18-65, regular remittance senders |

| Remittance Service Providers | 100 | Executives and managers from remittance companies |

| Financial Institutions | 80 | Banking professionals, financial analysts |

| Regulatory Bodies | 50 | Policy makers, regulatory compliance officers |

| Consumer Advocacy Groups | 40 | Representatives from NGOs focused on financial inclusion |

The Brazil Remittance & Cross-Border Transfers Market is valued at approximately USD 25 billion, reflecting significant growth driven by the increasing number of Brazilians living abroad and the rise of digital payment platforms facilitating cross-border transactions.