Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1457

Pages:98

Published On:October 2025

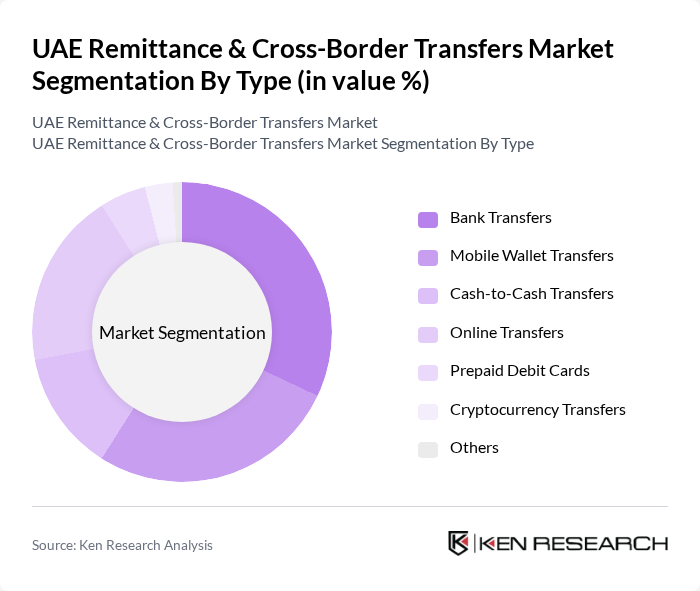

By Type:The market is segmented into various types, including Bank Transfers, Mobile Wallets, Cash-to-Cash Transfers, Online Transfers, Prepaid Debit Cards, Cryptocurrency Transfers, and Others. Each of these sub-segments caters to different consumer preferences and transaction needs. Digital solutions, such as mobile wallets and online transfers, are gaining significant traction due to their convenience, speed, and lower transaction costs, driven by the increasing adoption of fintech platforms and mobile-based remittance services .

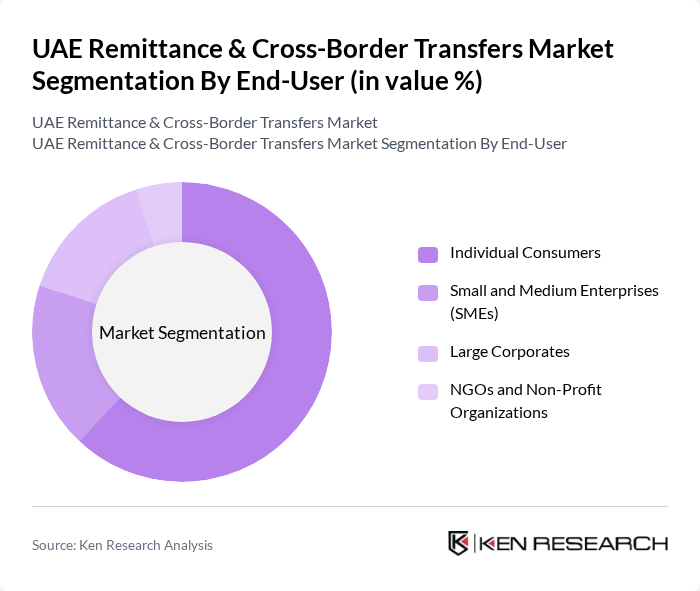

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporates, and NGOs and Non-Profit Organizations. Individual Consumers dominate the market due to the high volume of personal remittances sent by expatriates to their families back home. SMEs and corporates are increasingly utilizing digital remittance platforms for cross-border payments, while NGOs leverage remittance channels for international aid disbursement .

The UAE Remittance & Cross-Border Transfers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ansari Exchange, UAE Exchange (Finablr), Lulu Exchange, Western Union, MoneyGram, Wise (formerly TransferWise), Remitly, Ria Money Transfer, First Abu Dhabi Bank (FAB), Emirates NBD, Abu Dhabi Commercial Bank (ADCB), Mashreq Bank, Dubai Islamic Bank, RAKBANK, Xoom (PayPal) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE remittance and cross-border transfers market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence and blockchain technology is expected to enhance transaction security and efficiency. Additionally, the growing demand for instant transfers will likely lead to the emergence of new service providers, fostering competition and innovation. As the regulatory landscape continues to adapt, the market will see increased participation from fintech companies, further transforming the remittance ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Bank Transfers Mobile Wallets Cash-to-Cash Transfers Online Transfers Prepaid Debit Cards Cryptocurrency Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporates NGOs and Non-Profit Organizations |

| By Payment Method | Bank Account Transfers Cash Payments Credit/Debit Card Payments Mobile Payments Blockchain-Based Payments |

| By Destination Region | South Asia (India, Pakistan, Bangladesh, etc.) Middle East (Egypt, Jordan, Lebanon, etc.) Africa (Nigeria, Kenya, Ethiopia, etc.) Southeast Asia (Philippines, Indonesia, etc.) Other Regions |

| By Frequency of Transactions | Daily Weekly Monthly Quarterly |

| By Transaction Size | Small Transactions (up to $500) Medium Transactions ($500 - $2,000) Large Transactions (above $2,000) |

| By Service Provider Type | Banks Exchange Houses Fintech Companies Money Transfer Operators (MTOs) Telecom/Payment Service Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 120 | Expatriates from South Asia, Africa, and the Philippines |

| Fintech Adoption in Cross-Border Transfers | 60 | Product Managers, Digital Transformation Managers |

| Regulatory Impact on Remittance Services | 40 | Compliance Officers, Legal Advisors |

| Consumer Preferences for Remittance Channels | 90 | End-users, Financial Service Users |

| Market Trends in Cross-Border Payment Solutions | 50 | Industry Analysts, Market Researchers |

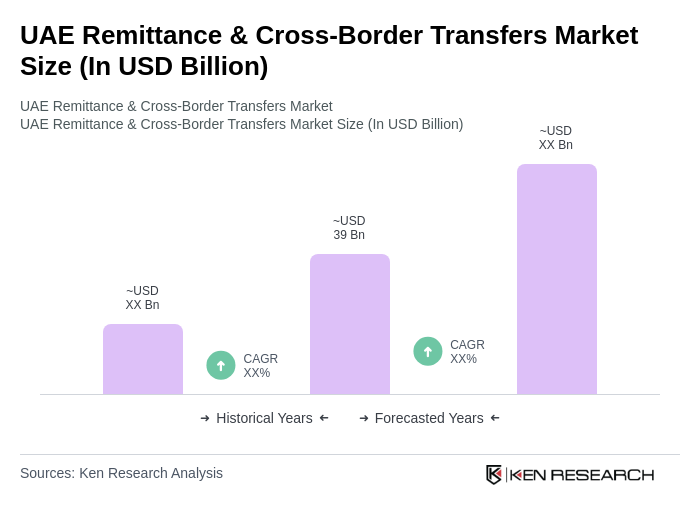

The UAE Remittance & Cross-Border Transfers Market is valued at approximately USD 39 billion, which includes private remittances, trade remittances, and other types of remittances, reflecting the significant financial flows driven by the large expatriate population.